Manufacturer Coupons and Patient Assistance Programs

Actuaries should account for the impact of coupons and PAPs on the health care system May 2020Photo: iStock.com/alexsl

In recent years, coupons and patient assistance programs (PAPs) have become more popular to help make prescription drugs more affordable. While this may be beneficial to an individual consumer at a specific point in time, it may interfere with health plan design—therefore actuaries must be aware of and account for the impact of both coupons and PAPs on the health care system. Actuaries can help align incentives and develop strategies to ensure all patients can receive necessary care while not distorting benefit structures. The resultant improvement in care also should help mitigate growth in total cost of care, thereby addressing the core issues identified in the Society of Actuaries’ (SOA’s) 18|11 Initiative report.

Like rebates, coupons and some PAPs are payments or discounts directly from the pharmaceutical manufacturer and usually apply to specific brand-name drugs. Unlike rebates, coupons and PAPs directly benefit the member, rather than the insurance plan.

Coupons are sometimes referred to as manufacturer coupons, copay coupons or copay assistance cards. They can easily be found online and are sometimes provided to patients by a doctor. Some basic information may be collected by the manufacturer, and coupons generally are available to all for the drug for which they are offered.

The use of manufacturer coupons has grown dramatically in recent years. From 2009 to 2015, the number of brand-name drugs with coupons available increased from fewer than 100 to more than 700.1 Drug coupon discounts for commercially insured patients have reached an all-time high of $13 billion in 2018, which is more than double the $6 billion coupon offset in 2014.2 From 2012 to 2015, the share of commercial health plans with a drug deductible increased from 23 percent to 46 percent,3 which has been driving consumers to seek coupons.

PAPs are offered by drug manufacturers, nonprofit groups or state governments,4 and are charitable in nature. Unlike coupons, PAPs typically require an application process,5 although coupons and PAPs can sometimes to be difficult to distinguish. These programs usually are based on a consumer’s financial needs.

For example, a PAP may require an applicant to:

- Be below 200 percent of the federal poverty level as shown on a provided W-2.

- Not have health insurance or an applicable drug benefit from their health plan.

- Have their doctor complete part of the application as evidence of need for the drug.

Regulation

Coupons are banned from use on drugs purchased with federal health care insurance, including Medicare and Medicaid, because they may violate federal anti-kickback statutes (specifically 42 U.S.C. § 1320a-7b(b)).6 Coupons generally are allowed to be used with commercial health plans, but some states have moved to ban or reduce their usage. Massachusetts and California have laws that only allow coupons to be used when a generic alternative is not available.7

The 2020 Notice of Benefit Payment and Parameters (NBPP) Rule stated that health plans would have the option to exclude the value of coupons from the satisfaction of cost-sharing limits if there is a generic equivalent for the prescribed drug. However, it was later realized there are potential conflicts with other agency guidance, and this rule is being put on hold pending further clarification.8

PAPs may be used with Medicare, but they must operate “outside the Part D benefit.” This means that the drug associated with the PAP is not counted as an incurred cost under Part D and would not be applied to the beneficiary’s true out-of-pocket (TrOOP).9

Pros and Cons for the Consumer

For consumers, there are a number of benefits to using coupons and PAPs:

- The consumer using the coupon gets their prescribed treatment with a lower out-of-pocket expense.

- PAPs help lower-income consumers who may otherwise struggle to afford treatment. Because PAPs typically do not interfere with insurance benefits, there is little controversy regarding these programs.

- Improved patient affordability as a result of coupons or PAP programs may improve adherence to prescribed treatment regimens, helping to avoid downstream adverse health events and associated medical claim costs.

On the flip side, there are also some cons associated with using PAPs and coupons:

- Coupons may lower the out-of-pocket expense for the consumer, but they could increase expenses for the health plan and therefore increase premiums for all members. For example, a member may have the choice of a $200 brand-name drug with a $30 copay or $20 generic drug with a $5 copay. If the member is using a coupon that will eliminate the $30 copay for the brand-name drug, the best choice for the member, at least in the short term, is to choose the brand-name drug and pay $0 out-of-pocket. However, if the brand-name drug is purchased instead of the generic alternative, the health plan would be liable to pay an additional $155 (($200 – $30) – ($20 – $5)).

- Coupons may influence consumers to use brand-name drugs rather than lower-cost generic drugs. Analyses from 201310 and 201411 found that about half of available coupons were for brand-name drugs that had generic alternatives. A study found that coupons for brand-name drugs significantly slow the adoption of a new generic, and in the years following generic entry to the market, branded utilization was 60 percent higher when a coupon for a brand-name drug was available.12

- Coupons nearly always have some kind of limit, and therefore may not be a long-term solution for the consumer. Some coupons allow multiple uses, but very few offer a savings for more than a year.13 After the coupon limit has been reached, the consumer will need to either seek a different treatment or continue to purchase the drug without the savings the coupon provided.

- The consumer may be reluctant to change treatment if the current drug is viewed as effective.

The Future of Coupons and PAPs

The use of PAPs has been increasing in recent years,14 and it seems likely that these programs will continue with little change. However, as previously stated, there are several issues with coupons, and states and health plans have been developing solutions to mitigate the adverse effects. Likewise, manufacturers also are adapting with countermeasures.

Banning coupons on drugs where generic alternatives are available, as has been done in Massachusetts and California, may help reduce some overspending in the health care system by not incentivizing the use of brand-name drugs over generics. Also, coupons would still be available to help consumers afford drugs with no lower-cost alternatives. Some methods that health plans may employ to attempt to steer members away from brands with coupons include formulary exclusions, increased tier differential for nonpreferred drugs and step therapy.

A fairly new addition to the health plan is an “accumulator” program, which doesn’t allow the savings from the coupon to count toward the member’s deductible or maximum out-of-pocket.15 While on the surface this appears to be negative for the consumer, one could argue that a reimbursement from the manufacturer never should have applied to out-of-pocket accumulators because the money isn’t coming from the member’s pocket. A barrier to accumulators becoming more commonplace is that it’s only practical where it’s ensured that the pharmacy will report and process the coupon—for instance, contractually requiring the health plan’s specialty pharmacy to help employ the accumulator program.

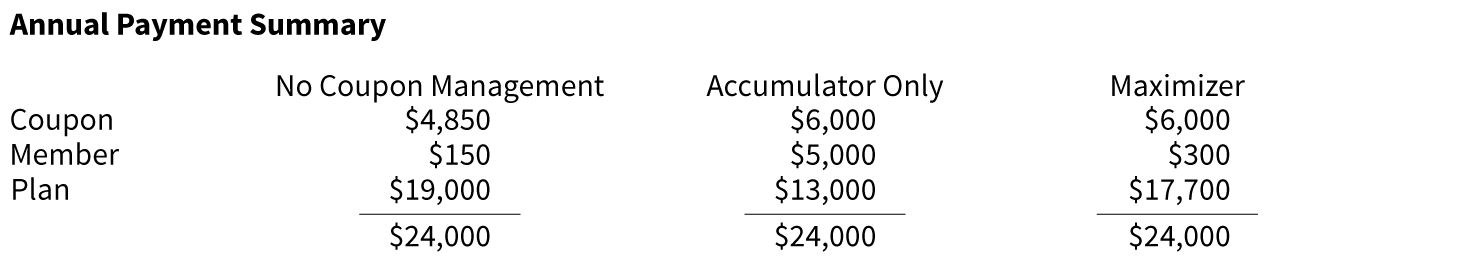

Another new program is a “maximizer” or “variable copay,” which works alongside the accumulator. The purpose is to adjust the member copay to collect the maximum amount of savings from the coupon as allowed by the terms of the coupon and spread the savings over a longer period.16 See Figures 1, 2, 3 and 4 for an illustration of accumulators and maximizers. Please note that the following assumptions were made in the design of these illustrations:

- Drug cost (per month): $2,000

- Deductible: $3,000

- Tier 5 coinsurance: 25%

- Maximum out-of-pocket costs: $5,000

- Coupon annual maximum: $6,000

- Coupon member target pay (assuming coupon has an annual maximum, but no per claim maximum): $25

Figure 1: Coupon Accumulator and Maximizer Illustration—Annual Payment Summary

Figure 2: Coupon Accumulator and Maximizer Illustration—No Coupon Management

Hover Over Image for Specific Data

Figure 3: Coupon Accumulator and Maximizer Illustration—Accumulator Program Only

Hover Over Image for Specific Data

Figure 4: Coupon Accumulator and Maximizer Illustration—Maximizer Program

Hover Over Image for Specific Data

Accumulators and maximizers are rare. One estimate ventures that only 9.5 percent of brand coupon transactions occur with health plans that use an accumulator or maximizer design.17 Virginia, West Virginia and Arizona have passed laws that restrict the use of accumulators.18 While lawmakers undoubtedly passed these laws to protect the consumer—and it will certainly benefit some individuals—it’s not clear if this is the most beneficial course for all consumers in the long run, as it may drive utilization of brand-name drugs when generic alternatives are available. Therefore, it may contribute to increases in drug benefit premium rates in those populations.

Manufacturers also are offering debit cards as coupons and self-filing, which is when the consumer may redeem the coupon after the sale has occurred. These offerings make it more difficult for the health plan to detect the reimbursement and apply it back through accumulator and/or maximizer programs.

Short of a ban on all coupons, health plans, manufacturers and legislatures will continue to develop measures and countermeasures to either control or promote coupons. The consumer will be left to assess their individual situation and weigh the various costs and benefits, such as out-of-pocket savings vs. increased premiums, point-of-sale coupons vs. self-filing coupons, and coupons contributing to an out-of-pocket accumulator vs. health plan measures that disallow this from happening.

From the viewpoint of lowering overall drug costs for the consumer while still receiving the necessary medical treatment, state legislatures might follow the lead of Massachusetts and California and ban coupons for which there is a generic alternative. Health plans should seek to educate consumers on how their plan designs ultimately benefit the member and provide incentives for cost reducing behavior. A forum could be held in which all stakeholders, such as manufacturers, health plans, pharmacy benefit managers and policymakers, can discuss their goals and challenges and perhaps initiate movement toward solution that can benefit all parties and increase transparency in the health care system.

With experience in benefit design and cost modeling, and having a skill set that intersects financial and health considerations, actuaries are in a strong position to drive these solutions.

References:

- 1. Van Nuys, Karen, Geoffrey Joyce, and Rocio Ribero. Prescription Drug Coupons: A One-Size-Fits-All Policy Approach Doesn’t Fit the Evidence. Health Affairs, February 16, 2018 (accessed October 9, 2019). ↩

- 2. IQVIA Institute. May 2019. Medicine Use and Spending in the U.S.—A Review of 2018 and Outlook to 2023. ↩

- 3. Prescription Drug Discount Coupons and Patient Assistance Programs (PAPs). Congressional Research Service, June 15, 2017 (accessed October 9, 2019). ↩

- 4. Goodell, Sarah. Patient Assistance Programs for Prescription Drugs. WebMD, August 19, 2019, (accessed October 9, 2019). ↩

- 5. Ibid. ↩

- 6. Van Nuys, Karen, Geoffrey Joyce, Rocio Ribero, and Dana Goldman. A Perspective on Prescription Drug Copayment Coupons. USC Schaeffer, February 20, 2018 (accessed October 9, 2019). ↩

- 7. Linehan, John S. State Legislatures Spring Ahead With Restrictions on Drug Copay Accumulators. Managed Care, April 16, 2019 (accessed October 9, 2019). ↩

- 8. Plans May Exclude Drug Coupons from Annual Cost Sharing Limits. NFP, September 4, 2019, (accessed October 9, 2019). ↩

- 9. Pharmaceutical Manufacturer Patient Assistance Program Information. CMS.gov, July 23, 2018 (accessed October 9, 2019). ↩

- 10. Ross, Joseph S., and Aaron S. Kesselheim. 2013. Prescription-Drug Coupons—No Such Thing as a Free Lunch. New England Journal of Medicine, 369:1,188–1,189. ↩

- 11. Supra note 6. ↩

- 12. Dafny, Leemore, Christopher Ody, and Matthew Schmitt. When Discounts Raise Costs: The Effect of Copay Coupons on Generic Utilization. National Bureau of Economic Research, October 2016 (accessed October 9, 2019). ↩

- 13. Supra note 10. ↩

- 14. Supra note 3. ↩

- 15. Supra note 2. ↩

- 16. Linehan, John S. Assessing the Legal and Practical Implications of Copay Accumulator and Maximizer Programs. Managed Care, February 13, 2019 (accessed October 9, 2019). ↩

- 17. Supra note 2. ↩

- 18. Supra note 7. ↩

Copyright © 2020 by the Society of Actuaries, Schaumburg, Illinois.