Urban Customized Commercial Medical Insurance: Part 1

Insights into the development and stages of “Medicare” in China November 2022This two-part article series explores urban customized commercial medical insurance in China. This article, Part 1 of the series, mainly introduces the starting point of urban customized commercial medical insurance, ordinarily known as “Medicare.” It will cover:

- The origin of urban customized commercial medical insurance

- The three stages of urban customized commercial medical insurance development

- The first stage, which started in 2015

The program began in 2015, providing critical illness supplement insurance in Shenzhen. Shenzhen Medical Insurance Bureau sponsored this business, and the underwriting company, Ping An Pension, was selected through bidding.

Critical Illness Supplemental Insurance in Shenzhen: The Business Plan

The program includes two coverage responsibilities: First, for medical expenses incurred in the hospital within the scope of the basic medical insurance catalog for personal payment, the deductible is 10,000 yuan; 70% is paid for expenses exceeding the deductible. Second, for those insured who suffer from serious and exceptionally serious diseases, 70% of the expenses incurred by the insured to use the drugs in the Shenzhen Supplementary Medical Insurance Catalogue of the Major and Exceptionally Serious Diseases are paid; the annual payment limit is 150,000 yuan.

From the perspective of those insured, it protects those who participate in basic medical insurance in Shenzhen and pays without interruption, regardless of age and occupation, and whether it is insurable or compensable in the past, and adopts a uniform rate.

From the perspective of group insurance payment methods, there are three:

- One-stop account full deductions

- Individual self-payments

- For special hardship and low-income insurance, low-income family members, orphans, preferential care targets, severely disabled residents and so on, the appropriate departments handle it uniformly; the premium is allocated by municipal finance

Regarding the underwriting model, bids are invited every three years and undertaken by an exclusive insurance company. The contract period is divided into a period of making an appointment for insurance and the effective period of coverage, and the appointment insurance is divided into batches and classifications. The appointment is made in May each year for those whose employer and individual account balances meet the conditions. The employer insures its active employees and their families through a group approach, and those whose account balances are greater than a certain amount and have not applied for nonparticipation will insure themselves. The person who does not meet the criteria for these two categories makes an appointment in June of each year.

The Operation Situation of Critical Illness Supplemental Insurance in Shenzhen

Shenzhen Major Illness Supplementary Insurance has been in operation for seven years—from July 1, 2015–June 30, 2022—with insurance liability remaining stable, premiums adjusted every two years and per capita premiums growing from $20 in 2015 to $39 in 2021, with an annual compound growth rate of 10% and the largest growth rate of 30% in 2020–2021. The number of insured people has grown yearly, with the fastest growth from 2016–2018. The business is generally losing money, with losses narrowing from 2020–2022. Looking only at claims, the cumulative loss from 2015–2022 was $87 million.

Figure 1: Critical Illness Supplemental Insurance in Shenzhen: July 1, 2015–June 30, 2022

| Period of Coverage: July 1–June 30 | Number of Policyholders

(million people) |

Premium per Capita(yuan) | Accumulated Premium

(100 million yuan) |

Claim Amount

(100 million yuan) |

Claim Amount-Accumulated Premium

(100 million yuan) |

| 2015–2016 | 486 | 20 | 3.79 | 4.1 | 0.31 |

| 2016–2017 | 504 | 20 | |||

| 2017–2018 | 625 | 29 | |||

| 2018–2019 | 705 | 29 | 4.3 | 4.7 | 0.4 |

| 2019–2020 | 750 | 30 | |||

| 2020–2021 | 780 | 30 | 5.4 | 5.6 | 0.2 |

| 2021–2022 | 796 | 39 | |||

| Overall | 13.53 | 14.4 | 0.87 | ||

| 2022–2023 | – | 39 | |||

Considerations From Shenzhen Critical Illness Supplemental Insurance

Is there room for change in the impact of the business model on operating results? The order of business development and the use of deductions are conducive to expanding the number of policyholders and risk control. It is the only business expanded by stratification and classification in China. It does not offer to participate and automatically deducts the personal account balance.

When we look at the relationship between the growth of the number of insured people, premiums and claims, the number of insured people increases every year along with the premiums. So, why is there an overall loss? The main reason is the increase in medical costs. The change in medical behavior is much faster than the increase in the number of insured persons and premiums.

How does it achieve profitability? Does it rely on its own business to make a profit, or on the ecological effects it generates as a whole to make a profit? How can the business achieve sustainable development when the overall operating results for seven years are loss-making in claim results?

In 2020, initiated and coordinated by Shenzhen Medical Insurance Bureau, 14 insurance companies jointly underwrote and developed exclusive medical insurance and critical illness insurance, of which exclusive medical insurance is divided into three-year guaranteed renewal and six-year long-term medical insurance. These products are aimed at healthy groups, and Ping An Pension relies on the accumulation of customers from the original Shenzhen critical illness supplemental insurance, with sales accounting for nearly 80% of the total. The products launched currently are operating well—overlaying the universal products and moving toward overall profitability may be the way forward.

Second Stage: The Trial Period of 2018–2019

Represented by Nanjing customized commercial medical insurance, from which the name Medicare was derived, the business is the culmination of the research project on hospitalization medical expenses for Nanjing citizens, and its business model provides a model for the design of urban customized commercial medical insurance in the future.

Nanjing Customized Commercial Medical Insurance Business Plan

Nanjing customized commercial medical insurance, jointly launched by Nanjing Development and Reform Commission, Human Resources and Social Security Bureau, Health Commission and other departments, is connected to basic medical insurance, and its responsibility is limited to the out-of-pocket expenses of individuals and special particulars within the scope of basic medical insurance.

The insurance is set up for an appointment period and coverage period, with one rate for all age groups. The liability of those who have suffered from 12 major diseases is determined according to whether the number of insured people reaches 2.6 million. Suppose the total number of policyholders is 395,000 after the end of the appointment period, and the agreed 2.6 million is not reached. In that case, the first year of anamneses can be insured without compensation.

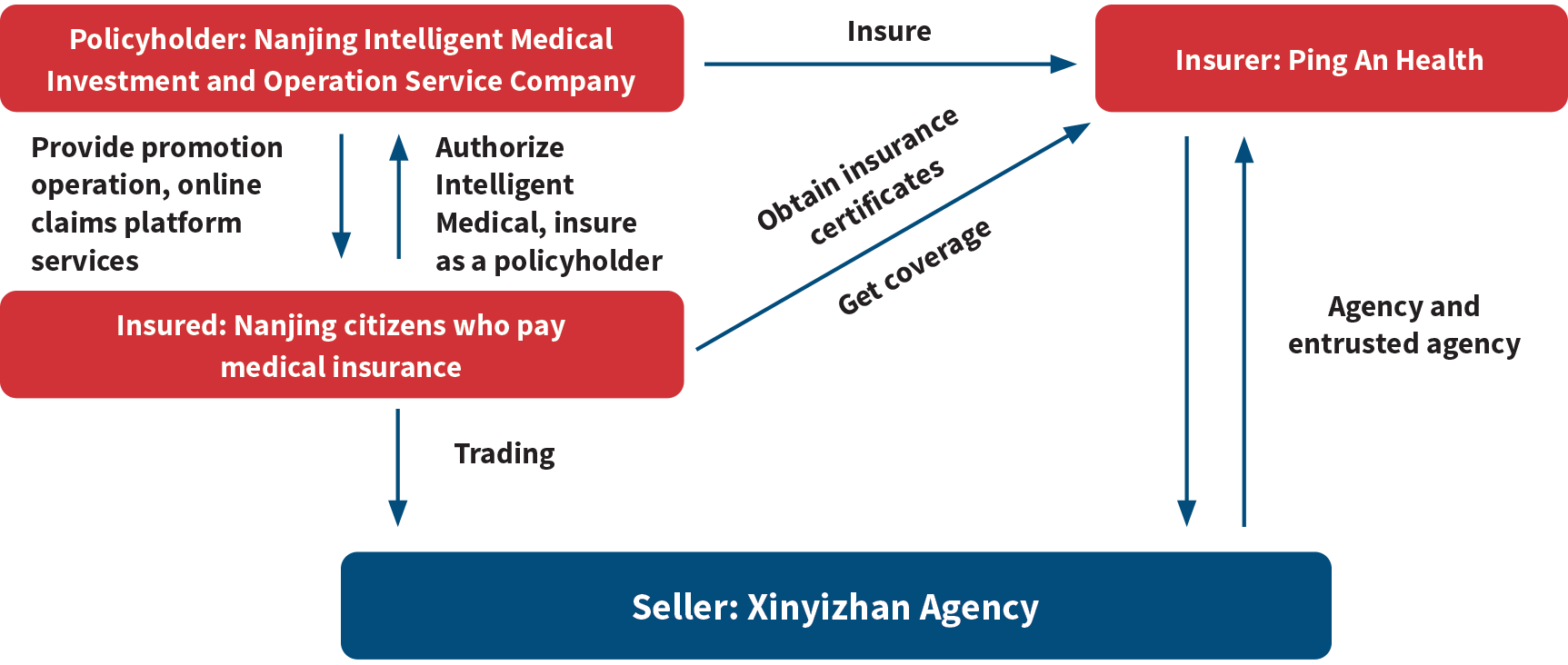

As shown in the example in Figure 2, the insured was covered through a group approach. The group product was undertaken but purchased voluntarily by individuals and sold through Xinyizhan Agency, unified insured to Ping An Health Company. At that time, Nanjing Intelligent Medical Investment and Operation Service Company was the policyholder of the group insurance, and the insured resolved the issue of insurable interests of the policyholder and the insured by authorizing the policyholder to purchase the insurance.

Figure 2: Nanjing Customized Commercial Medical Insurance Expansion Model

The Operation Situation of Nanjing Customized Commercial Medical Insurance

In 2019, a total of 17.591 million yuan was collected in premiums, and 14.2 million yuan was paid out without considering the incurred-but-not-reported (IBNR) claims, resulting in a small overall profit. In 2020, Nanjing customized commercial medical insurance continued to use a 49-yuan premium, but it stipulated that no liability for anamnesis would be taken. In 2021, the original plan was adjusted to extend the out-of-pocket liability and raise the premium to 99 yuan. At the same time, the optional plan of proton therapy liability was provided. If you pay 5 yuan more, you can get the guarantee of proton therapy liability.

Figure 3: Evolution of Nanjing Customized Commercial Medical Insurance

| 2019 | 2020 | 2021 | |

| Plan name | Nanjing customized commercial medical insurance | Nanjing customized commercial medical insurance | Nanjing customized commercial medical insurance |

| Underwriting company | Ping An Health | Taikang online | People’s Insurance Company of China |

| Premium | 49 yuan | 49 yuan | 99 yuan |

| Coverage responsibility |

|

|

|

| Anamnesis | Uninsurable risk | Insurable risk | |

The pilot period of Nanjing’s customized commercial medical insurance plan and business model provided a model for the subsequent explosive development of urban customized commercial medical insurance.

Third Stage: The Blooming Period of 2020–2021

In April 2020, Suzhou customized commercial medical insurance’s 49-yuan-premium plan was listed, mainly covering outpatient and inpatient responsibilities; connecting with major medical insurance; covering individual out-of-pocket compliance costs after the major medical compensation of the basic medical insurance; and providing 15 kinds of special drug liability coverages, regardless of age and occupation. It does not cover policyholders who have already suffered from eight kinds of serious diseases.

In May 2020, Huirong Insurance’s 59-RMB plan was listed with no age, occupation nor preexisting conditions limits. The plan provides coverage for personal out-of-pocket medical expenses within the scope of basic medical insurance and 20 types of specialty drugs. Suzhou customized commercial medical insurance is jointly directed by Suzhou Medical Insurance Bureau, Suzhou Human Resources and Social Security Bureau, Suzhou Civil Affairs Bureau, Suzhou Health Commission and Suzhou Social Insurance Fund Management Center, and is counderwritten by Soochow Life and Suzhou Citizen Card Company, with support from Shanghai MediTrust Health Technology Company.

Also in May 2020, Chengdu customized commercial medical insurance’s 59-yuan-premium plan was listed, with no age, occupation nor anamnesis conditions limits, providing individual out-of-pocket medical expense responsibility within the scope of basic medical insurance, as well as liability coverage for 20 types of specialty drugs. Chengdu customized commercial medical insurance is underwritten by 10 companies that are members of the Chengdu Medical Insurance Alliance under the guidance of Sichuan Medical Insurance Bureau and Chengdu Medical Insurance Bureau, with Medbanks Health providing the service platform.

In April 2021, Shanghai customized commercial medical insurance’s 115-yuan-premium plan was launched, with no age, occupation nor anamnesis conditions limits, focusing on coverage of inpatient out-of-pocket expenses.

According to incomplete statistics, by the end of 2020, more than 110 urban customized commercial medical insurance plans were listed in nearly 80 cities in 23 provinces nationwide. From 2020 to 2021, urban customized commercial medical insurance entered a prosperous period in China. The next section of the article focuses on the analysis of Shanghai’s customized commercial medical insurance business plan.

Shanghai Customized Commercial Medical Insurance Business Plan: 2021 Version

The 2021 version of Shanghai customized commercial medical insurance is available to two categories of people:

- Those who participate in Shanghai’s basic medical insurance

- Those who participate in the Shanghai community medical care mutual help plan—the Love Edition

Insured who participate in Shanghai customized commercial medical insurance can use the balance of individual medical insurance card accounts to buy for themselves and their families and achieve mutual aid. Anamnesis conditions are labeled as those who registered and enjoy the treatment of major illnesses for outpatient and emergency care for urban and rural residents in Shanghai two years before the insured date. For the Love Edition, participants whose out-of-pocket expenses reached 10,000 yuan or more in the previous two years are labeled as anamnesis.

The insurance liability of Shanghai customized commercial medical insurance focuses on drug costs, surgical material costs and examination and inspection fees in the out-of-pocket hospitalization costs—to complement the basic medical insurance payment scope and not overlap. Specialty drug responsibility focuses on specialty drugs for specific diseases with high incidence and rare occurrences. Meanwhile, proton therapy also is included in the coverage, reflecting the characteristics of Shanghai.

Multiparty Participation and Collaboration

The number of policyholders reached 7.39 million in the first year, with a participation rate of 38.5%. The Shanghai Medical Insurance Bureau provides guidance on insurance plans and policies; the Shanghai Banking and Insurance Regulatory Bureau provides supervision; the Shanghai Big Data Center and China Bank Insurance Information Technology Management Co. jointly provide technical support; the Shanghai Trade Union provides coordination; and Shanghai Pharmaceutical Co. Ltd, MediTrust Health, Sinopharm Group and Chenxi Health provide pharmaceutical services. The commercial insurance company adopts the coinsurance model of chief underwriting, and nine insurance companies set up a joint office of coinsurance to unify the release of data and promotion to the public.

2021 Version of Shanghai Customized Commercial Medical Insurance Operation Situation

The 2021 version of Shanghai customized commercial medical insurance achieved a premium income of 850 million yuan, with a claim amount of 613 million yuan in 10 months. Hospitalization liability accounted for 88% of the claim amount, with the top three hospitalization liability claims being lumbar disc herniation, malignant tumors of the bronchus or lung and knee disorders. The proportion of compensation for specialty drugs is about 9%.

The Thinking Brought by the 2021 Version of Shanghai Customized Commercial Medical Insurance: Scheme Design and Risk Control

Commercial insurance companies operate medical expense insurance, and the risk control means mainly comes from underwriting. In contrast, the risk control of the customized commercial medical insurance primarily relies on the number of underwriters and the basic medical insurance system, and the control of this medical insurance system on out-of-pocket expenses is relatively weak. Therefore, when designing the plan, we consider the coverage and combine it with the control means of basic medical insurance as much as possible, set the deductible and set different payout rules for various groups of people.

How is the risk of out-of-pocket liability outside the scope of basic medical insurance controlled? By setting up a positive list of out-of-pocket responsibilities to design coverage plans and risk management.

The mode of operation can be used as a reference. Adopting a coinsurance model can save costs, curb competition and work to improve the participation rate.

Development of Supply, Demand and Linking Platforms

Urban customized commercial health insurance saw explosive growth in 2020, facilitated by a combination of four main factors.

1. Policy Level—Top-level Design for Deepening the Reform of the Medical Insurance System Introduced to Provide Policy Guidance and Support

In 2009, the basic medical insurance fund’s income was 367.19 billion yuan, and its expenditure was 279.74 billion yuan, with a cumulative balance of 427.59 billion yuan. In 2020, maternity insurance was merged with the basic medical insurance fund. Its income was 2,484.6 billion yuan, and its expenditure was 2,103.2 billion yuan. From 2009 to 2020, the income of the basic medical insurance fund increased by 5.77 times and the expenditure of the basic medical insurance fund increased by 6.5 times—the growth rate of expenditure of the basic medical insurance fund is much faster than the growth rate of income of the basic medical insurance fund. With the development of aging and chronic diseases, the payment of basic medical insurance funds is under pressure, and it is imperative to encourage the protection beyond basic medical insurance.

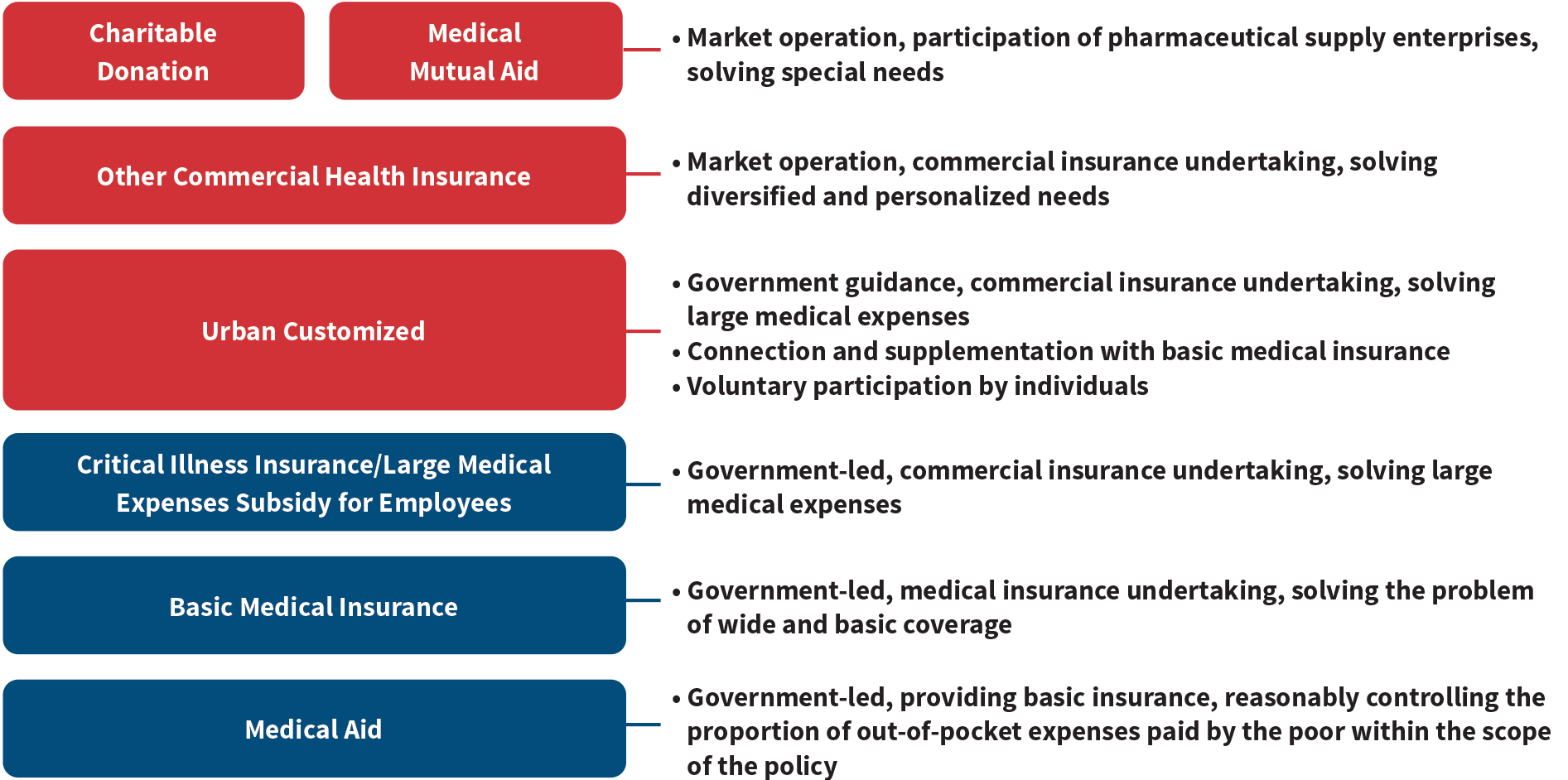

Therefore, in 2020, the State Council issued an opinion on deepening the reform of the medical insurance system, proposing that by 2030, a medical insurance system should be fully established with basic medical insurance as the main body, medical assistance as the base, supplementary medical insurance, commercial insurance, charitable donations and medical mutual aid for common development. At the same time, we need to strengthen and promote the complementarity and connection of all kinds of medical insurance and improve the action against major diseases and multiple medical needs. The top-level design of the medical security system provides policy support for developing commercial insurance and the cooperation mode of multiparty cooperation of urban customized commercial medical insurance. Also, it gives a foundation for the future explosive growth of this kind of business.

Figure 4: Multitiered Medical Insurance System

In terms of the level of coverage provided, urban customized commercial medical insurance, between basic medical insurance and medium and high-end commercial medical insurance, provides coverage with a certain deductible and loss ratio and a high insurance amount while connecting with basic medical insurance, mainly solving the problem of large medical expenses. According to the degree of government involvement, this kind of business belongs to the government guiding commercial companies to undertake, different from both basic medical insurance and pure commercial health insurance.

2. Demand Level

With the development of commercial insurance, especially the development of health insurance such as critical illness insurance and medical expense insurance, people’s insurance awareness has increased, which has driven the demand for medical expense insurance products in society.

3. Supply Level

With the development of commercial insurance, the original business model and business areas are facing the challenge of transformation and upgrading, which provides opportunities for urban customized commercial medical insurance. With the deepening of pharmaceutical reform and the implementation of drug price limits, collective procurement access and other measures, breakthroughs are needed in the future development of the main pharmaceutical institutions in the health industry.

4. Technology Development Level

The rapid development of mobile internet communication technology and the optimization and upgrading of information dissemination platforms provide technical support and convenience for urban customized commercial medical insurance to better reach policyholders.

The organic combination of these four levels will help promote urban customized commercial medical insurance business development.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Copyright © 2022 by the Society of Actuaries, Schaumburg, Illinois.