Small Details, Big Impact

Design elements of lifetime pension pools

October 2025Photo: Adobe

Canada’s occupational pension system is at a critical juncture: more Canadians than ever before are managing their own pension savings via registered retirement savings plans and defined contribution pension plans, now holding more than $1.5 trillion nationwide. Many retirees are faced with the consequences of a laissez-faire approach to retirement savings—a by-product of the general decline in workplace-based defined benefit pension plans over the past three decades—and thus need to make difficult decisions about how best to deploy these savings.

The two most common options for converting retirement assets to income are traditional life annuities offered by insurance companies and individually managed drawdowns of retirement accounts. Historically, traditional life annuities have lacked popularity and continue to do so today. Most Canadians opt for the latter alternative, decumulating their accounts throughout retirement and bearing the risk of running out of money. Supported by legislative changes like the Budget Implementation Act of 2021, lifetime pension pools are now emerging as a third viable option for Canadian retirees.

What’s next?

Lifetime pension pools—also known as variable payment life annuities, dynamic pension pools and retirement tontines in Canada—allow retiring individuals to convert a lump sum into income for life. An individual can bring a pot of money to the pool and, in exchange, the pool will make regular payments to them as long as they live. This way, individuals do not have to worry about outliving their money—a significant risk for someone trying to manage their retirement assets in an income drawdown fund.

The word “pool” in the name refers to the fact that this is a risk-pooling arrangement between the members—not a risk transfer to a third party. No entity assumes the risk of how long a member lives; instead, this risk is shared among the pool members. As a result, the pool cannot guarantee a specific income level, and benefit payouts need to be adjusted from time to time to reflect the group’s investment and mortality experience. For example, if more members than expected die during a given year, then surviving members will see their benefits increase because the money left in the pool by those who passed away is shared among the survivors. On the other hand, if more members survive than expected, benefits will need to be cut to ensure enough is left to provide lifetime income. The pool cannot guarantee a specific income level, and benefit payouts need to be adjusted from time to time to reflect the group’s investment and mortality experience.

The lack of a guaranteed level of income in lifetime pension pools is a key point of contrast to traditional life annuities. This difference is also reflected in the pricing: annuities are often costly due to the need to hold risk capital to support the benefit guarantee, while lifetime pension pools tend to be more cost-effective since they do not need to hold as much risk capital.

Lifetime pension pools are similar to individually managed income drawdown in that they allow members to benefit from investing in riskier, return-seeking assets even after retirement. However, a key distinction with income drawdown is that the assets contributed to the pool are not freely accessible; there is limited flexibility to withdraw funds if the need arises.

Currently, in Canada, lifetime pension pools can be implemented under two different regulatory regimes: those applicable to pension plans or to securities. Operated since the late 1960s, the variable payment life annuities (VPLAs) offered by the University of British Columbia Faculty Pension Plan are often-cited examples of the pension-type arrangement. The UBC Faculty Pension Plan’s VPLAs were grandfathered in 1988 when federal tax authorities decided not to permit such uninsured annuities anymore. Note that these pools have been allowed again in 2021, thanks to the Budget Implementation Act of 2021.

More recently, a Canadian financial services firm, Purpose Investments, released the Longevity Pension Fund in 2021, a securities-based implementation of lifetime pension pools.

Understanding benefit update rules and common design features

There are many different ways to set up a lifetime pension pool and to update the benefits from year to year. In this article, we focus on a plan design similar to the VPLAs offered by UBC’s Faculty Pension Plan. For illustration, we presume that benefits are revised once a year with no lag between the end of the year and the payment of the adjusted benefit.

Suppose a new member joins a lifetime pension pool at the beginning of a year, making a lump sum contribution from their retirement savings to the pool. This lump sum is converted into an annual benefit using a pricing basis that includes a fixed hurdle rate (i.e., an assumed rate of return) and a mortality assumption, typically a life table representing the pool’s systematic mortality. Specifically, the member’s initial annual benefit is obtained by dividing the amount brought to the pool by an annuity factor computed using the assumed hurdle rate and life table. (Note: It’s also possible to consider a variable hurdle rate that changes in response to evolving economic conditions, as detailed in Section 5 of the 2023 SOA Research Institute report “Exploration of Lifetime Pension Pool Design Elements.”)

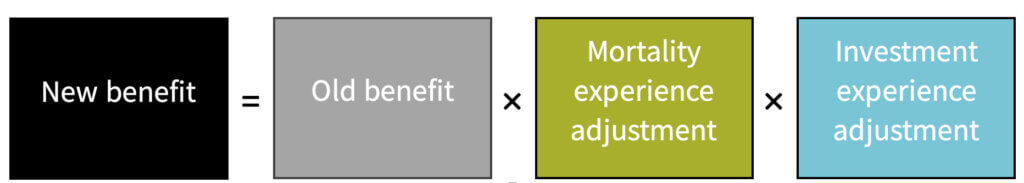

At the end of each year, the benefit is updated to account for the pool’s experience. It is adjusted by multiplying the old benefit by two experience adjustment factors: the mortality experience adjustment factor and the investment experience adjustment factor (see Figure 1).

The mortality experience adjustment factor (green box in Figure 1) accounts for the pool’s actual survivors and decedents relative to the mortality assumptions built into the pricing basis. Roughly speaking, this adjustment factor will be larger than one—implying increases in the benefit level—if there are fewer survivors than expected by the mortality table. By contrast, if members experience a lower mortality rate than expected, the adjustment factor will be lower than one, implying benefit cuts for all survivors to maintain lifetime benefits.

Figure 1: Typical benefit update rule

The investment experience adjustment factor (blue box in Figure 1) accounts for deviations in the investment returns when compared to the hurdle rate used in the pricing basis. In particular, the adjustment factor will exceed one if the actual investment return for the year surpasses the hurdle rate, and it will be less than one if the investment return falls below the hurdle rate.

The specific rules used to calculate the mortality and investment experience adjustment factors depend on the design choices made by the pool operator. For instance, different rules could apply in a closed pool—where the pool accepts members only at inception so that no new members are permitted to join, leading to a decrease in the total number of members as time passes—when compared to an open pool—where the pool continues to accept new members after inception.

In addition, the pool operator could choose to reflect emerging experience in the annual adjustments more slowly, leading to smoother benefits or decide to split the gains and losses unevenly across generations. (An alternative rule based on the death probability is considered in Richard Fullmer’s 2019 CFA Institute Research Foundation brief.) Finally, the choice of the hurdle rate can have a significant impact on two fundamental aspects of the benefit stream: the initial benefit and the future evolution of the benefits.

The rest of this article focuses on the hurdle rate assumption, which we consider one of the most important design choices in lifetime pension pools.

The hurdle rate as a means of controlling future benefit streams

For a given amount of pension savings, the initial benefit paid to a new member is positively related to the hurdle rate. If the hurdle rate is low, then the annuity factor used in the initial pricing should be high, leading to a smaller initial benefit level. On the other hand, if the hurdle rate is high, then the annuity factor used for converting the lump sum contribution into benefits when the member joins is lower, leading to a more substantial initial benefit.

A low hurdle rate boosts the likelihood of having an adjustment factor greater than one, yielding rising benefit streams on average. A high hurdle rate, on the other hand, is more difficult to exceed and makes reductions in future benefits more likely.

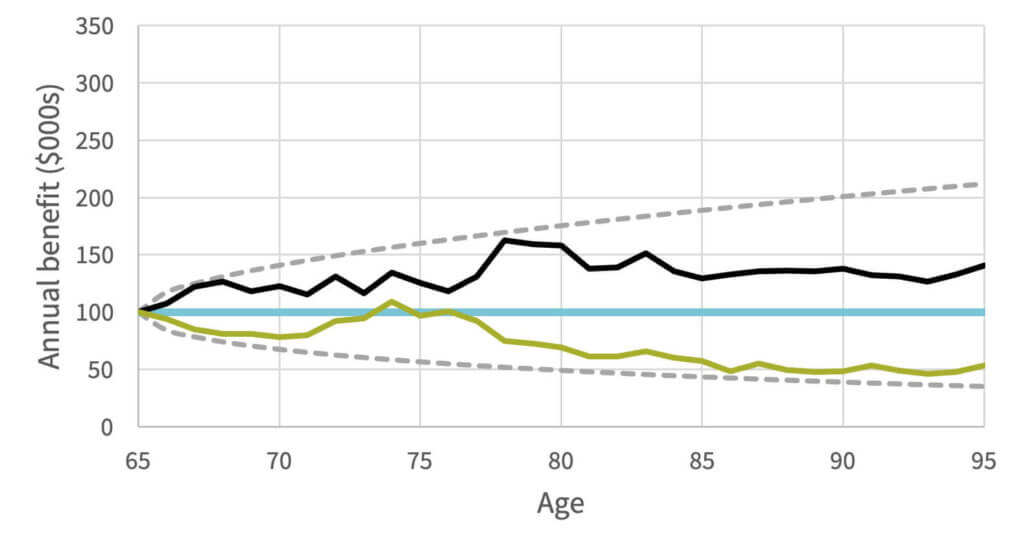

To illustrate this fact, we first consider a 65-year-old female receiving an initial benefit of $100,000 when the hurdle rate is set to the average return on the pool’s assets. The actual benefits received by this member in future years vary with the mortality and investment experience of the pool. Figure 2 illustrates two of many possible benefit paths (black and green solid lines), as well as the average future benefit stream (blue solid line) and the 5th and 95th percentiles of the future benefit distribution (gray dotted lines). A key feature to note is that, when the hurdle rate is set to the average return on the pool’s assets, the resulting average benefit is level, with some possible variations around the mean benefit due to mortality and investment experience—remember that these benefit payouts are not guaranteed.1

Figure 2: Annual benefit as a function of the member’s age, with a hurdle rate comparable to the average return on the pool’s assets

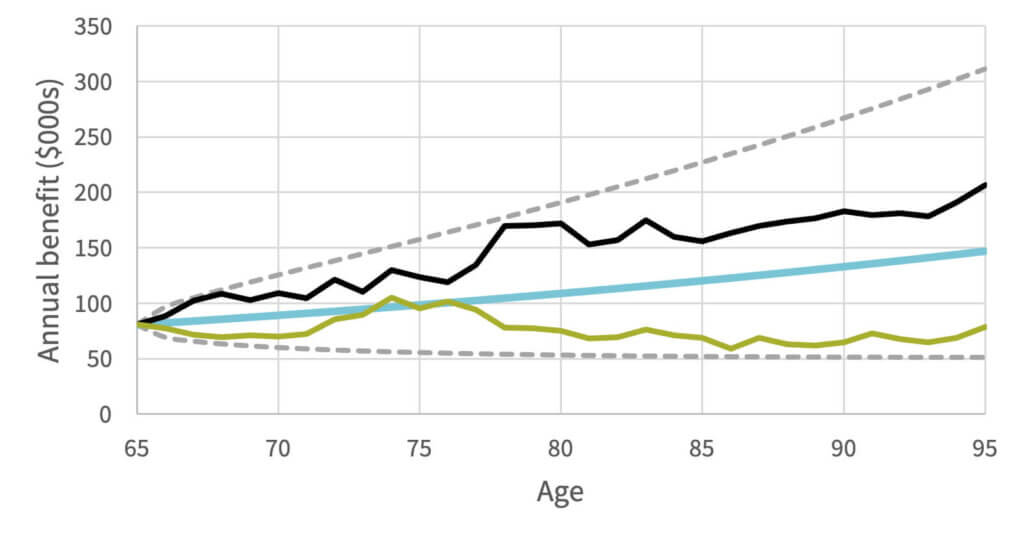

Figure 3 shows an alternative design where the hurdle rate is set lower than the average return on the pool’s assets. Notably, the initial benefit is lower than in Figure 2—about $80,000 instead of $100,000 in this case—but benefits tend to grow over time, like an indexed pension.

Figure 3: Annual benefit as a function of the member’s age, with a hurdle rate set lower than the average return on the pool’s assets

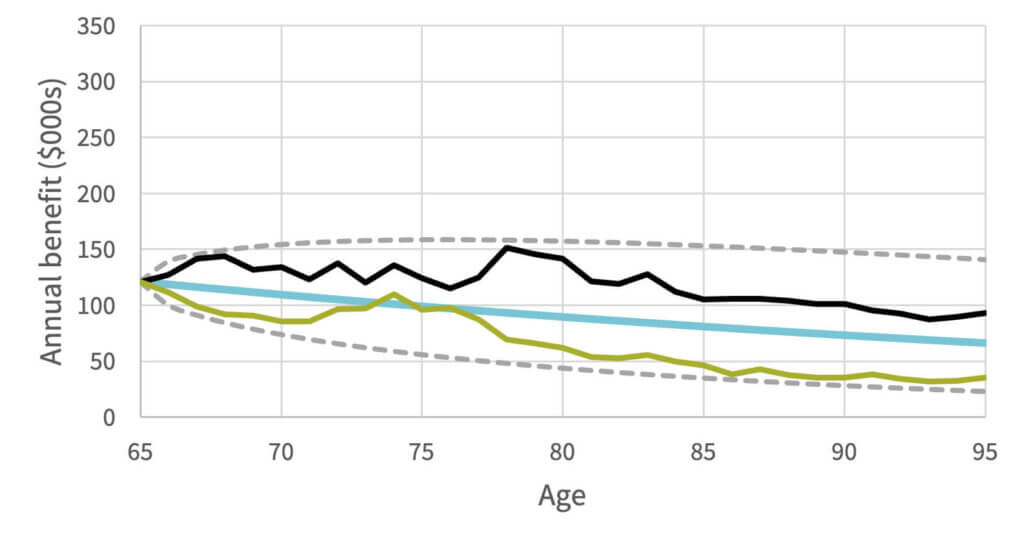

The opposite case—a hurdle rate higher than the average return—is reported in Figure 4, with a higher initial benefit (about $120,000) that is generally decreasing over time.

Figure 4: Annual benefit as a function of the member’s age, with a hurdle rate set higher than the average return on the pool’s assets

Comparing options

The pool operator’s responsibility is to select one of these three options—a hurdle rate that is lower, higher, or equal to the average rate of return on the pool’s assets. Which alternative should be chosen?

The answer to this question depends on the pool operator and member preferences. A low hurdle rate builds in conservatism (and potentially some inflation protection). Yet, members have to pay upfront for this by collecting reduced benefits early in retirement, on average. A high hurdle rate yields higher benefits at first, but the prospects in the longer term are dismal—a one-two punch if you consider inflation. A hurdle rate that matches the average asset return yields a level average pattern—a neutral, middle-ground solution.

So, the process of selecting the hurdle rate entails a trade-off—getting higher benefits earlier or later—and the optimal decision might differ from one pool to another. Each option has advantages and disadvantages, and the final decision should hinge on the members’ preferences and the pool’s profile.

Conclusion

FOR MORE

Read The Actuary Canada article “Navigating Retirement.”

Read The Actuary Canada article “From Pension Valuation to Product Innovation.”

The SOA Research Institute’s Aging and Retirement Strategic Research Program and Canadian Institute of Actuaries offer two reports, “Benefit at Risk in Lifetime Pension Pools” and “Exploration of Lifetime Pension Pool Design Elements.”

This article only considered one design choice—the hurdle rate—but many more exist. For instance, these pools could be open or closed to new members, which could impact the volatility of future benefits, especially for older members in closed pools. Or these pools could delay the recognition of emerging experience, making benefit streams more stable and allowing members more time to adjust their spending. If done poorly, this delay could result in significant value transfers between generations, leading to undesirable levels of intergenerational risk-sharing. These additional design features were investigated in a report commissioned by the SOA Research Institute and the Canadian Institute of Actuaries.

Yet, design is not the only hurdle facing lifetime pension pools (pun intended). In addition to evolving regulations, the second most important obstacle is communication. The income provided through a lifetime pension pool is expected to vary in response to investment and mortality experience, and these changes need to be communicated to members. One thing to remember when communicating to members is that they are not actuaries, so pool operators need to ensure that members understand the words they are using and the numbers they are reporting—a very difficult task as members tend to lack financial literacy. The interested reader can find additional details about communication in the context of lifetime pension pools in another 2023 report.

Despite these challenges, interest in lifetime pension pools continues to grow. Several large pension organizations and service providers are working with pension policymakers and regulators to bring more such pools to market, hoping to fill the decumulation gap facing millions of Canadian retirees. We believe actuaries, with their expertise in building and managing sustainable risk-pooling arrangements, have much to contribute to this effort.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

References:

- 1. These numbers are obtained using a very large open pool where mortality follows the Canadian Pensioners’ Mortality (CPM) table with generational improvements. The log-returns on the pool’s assets are normally distributed with an average return of 5% and a standard deviation of 10%, consistent with a pool investing half of its assets in a stock index and half in risk-free bonds. ↩

Copyright © 2025 by the Society of Actuaries, Chicago, Illinois.