Cryptocurrency and DeFi

What’s next for the actuarial profession?

January 2023Cryptocurrency has had high volatility. However, the recent bankruptcy filing of the cryptocurrency exchange FTX and the criminal charges against its founder, Samuel Bankman-Fried, have created a new wave of reverberations across the world of finance. This is a developing story, and so far, the results include the apparent loss of funds by FTX users. In fact, the overall cryptocurrency market, including decentralized finance (DeFi), has been affected.1 For example, within the retirement industry, investment professionals are indicating they have second thoughts about including cryptocurrency funds in defined contribution (DC) retirement plans.2

Additionally, at the time of FTX’s bankruptcy announcement, legislation was pending in the U.S. Congress that might have bolstered exchanges while potentially harming DeFi protocols. Time will tell if similar legislation passes, but some experts already have suggested that FTX’s fall potentially could inspire regulations that support the growth of DeFi.3

What DeFi’s Future Might Mean for Actuaries

The cryptocurrency world attracts some investors due to its lack of regulation, while other investors are shying away for the same reason. Will crypto industry self-regulation be enough to restore confidence after FTX’s bankruptcy and Bankman-Fried’s arrest? Or will this require regulatory oversight from traditional actors? In either scenario, actuaries can serve an important role in shaping crypto’s future.

To foster a better understanding of the cryptocurrency environment, the Society of Actuaries (SOA) Research Institute has released numerous DeFi reports. For example, DeFi for Actuaries provides an overview of how actuaries could affect the industry in the following areas:

- Portfolio management—As it grows more popular, DeFi could influence the traditional financial system and, thus, the performance of traditional asset classes. As a result, actuarial portfolio management involving DeFi could be one development we see in the near future.

- Insurance applications—As more investors, especially institutions, move to DeFi, demand for insurance capacity for DeFi risks will grow. Actuaries are uniquely positioned to help solve the capability gap.

- Other opportunities—Actuaries have the skills to contribute to DeFi development in product design and engineering, analysis and design of token economics, and macro analysis of the DeFi ecosystem. Actuaries also can apply their skills in data science and predictive analytics to study and simulate user behaviors and evaluate protocol performance.

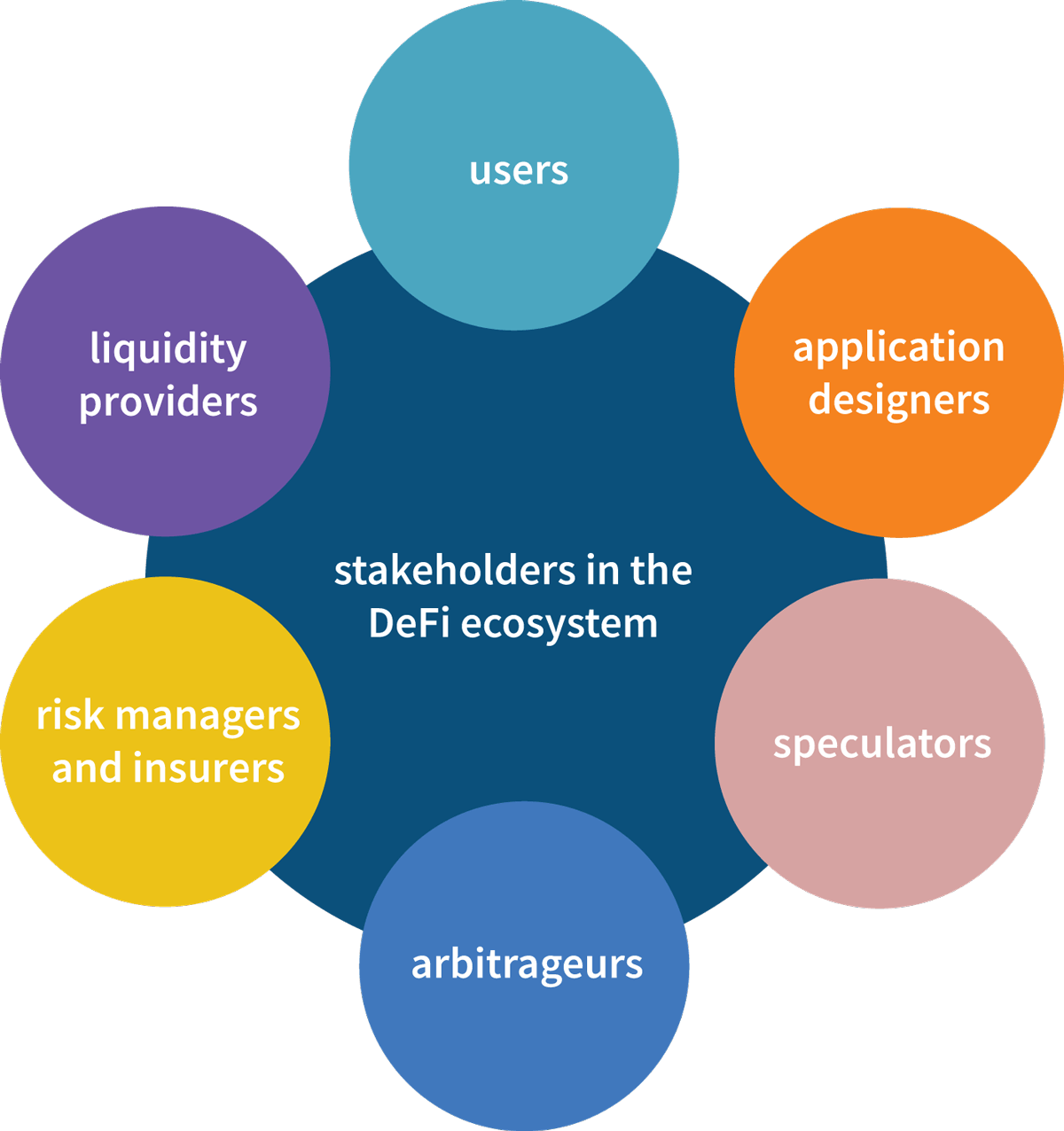

A report released by the SOA Research Institute in September 2022, A Risk Classification Framework for DeFi Protocols, responds to the expectation that insurers and reinsurers will play a growing role in the DeFi space (see Figure 1).

Figure 1: Stakeholders in the DeFi Ecosystem

Among other uses, the classification framework proposed in the report could serve as a guide for DeFi insurance, risk management product design and underwriting practices.

Additionally, decentralized insurance alternatives are a rapidly growing sector of DeFi. This could affect the traditional insurance industry, which would, in turn, affect the actuarial profession. The SOA Research Institute report, Decentralized Insurance Alternatives: Market Landscape, Opportunities and Challenges, reviews the business models and operating designs of this evolving industry to better inform its members.

Keeping Tabs on the Evolving World of Crypto

The current chaos in cryptocurrency exchanges can be compared to the early days of the insurance industry, and risk management techniques are the next step in the development and support of this new market. Keeping up to date with the latest insights and research in crypto and DeFi could be the best way to make sense of this quickly evolving industry.

Visit the SOA’s Actuarial Innovation and Technology Strategic Research page for the latest DeFi insights and other technological developments affecting the actuarial profession.

References:

- 1. Nahar, Pawan. FTX Failure Wipes Out Over $150 Billion from Crypto M-cap; Gloomy Road for the Rattled Investors. The Economic Times, November 9, 2022. ↩

- 2. Ortolani, Alex. FTX Bankruptcy Has Chilling Effect on Crypto Use in Retirement Plans. Plan Adviser, November 11, 2022. ↩

- 3. Mukherjee, Andy. FTX’s Sudden Unraveling May Allow DeFi to Grow. Bloomberg, November 8, 2022. ↩

Copyright © 2023 by the Society of Actuaries, Chicago, Illinois.