Impact of COVID-19 on Defined Benefit Pension Plan Funding

Photo: iStock.com/Christian Lopez Walker

The global COVID-19 pandemic wreaked havoc on economies all over the world. Defined benefit (DB) pension plans, like any other financial system, have been affected by the spikes in market volatility caused by successive waves and variants of the virus, along with the steep inflation generated by government fiscal and monetary policies in response to the pandemic.

While market volatility was arguably COVID’s biggest impact on DB pension plans, economic closures and slowdowns also have had varying effects on plan sponsors’ core businesses and their ability to fund their pension plans.

By now, pension actuaries have reflected the resulting market volatility and changes in contribution levels in their work and advice to clients. However, as a profession, we should consider how the impact of COVID-19 may play out over the medium and long terms.

HIGHER INTEREST AND INFLATION RATES

While the initial investment losses resulting from COVID-19 have been recouped (albeit markets are back in flux due to the war in Ukraine, which is not within the scope of this article), the higher interest and inflation rates may very well stay with us for years, if not decades.

Higher interest rates already have translated into higher discount rates for solvency and accounting valuations, which means good news (lower liabilities) for DB pension plans. The sensitivity of a pension plan’s liabilities to the discount rate used to determine their value depends on the demographics of the plan members, the type of valuation and level of discount rates being used. Generally, the “duration” for most pension plan liabilities (defined here as the percentage decrease in liabilities for a 1% increase in discount rates) will range from 10 to 25.

In the United States, the average accounting funded ratio increased from 94.6% in July 2021 to 104.5% in July 2022, according to the Milliman 100 Pension Funding Index, despite significant decreases in plan assets during that time. This is because the average accounting discount rate (typically based on long-term, high-quality bond yields) increased from 2.59% to 4.25% during that same period, driving down accounting liabilities at a faster pace than asset losses. Figure 1 demonstrates this effect in more detail.

Figure 1: Milliman 100 Pension Funding Index (in $USD Millions)

Hover Over Image for Specific Data

Source: Wadia, Zorast, and Charles J. Clark. Pension Funding Index August 2022. Milliman, August 4, 2022.

In Canada, most private-sector pension plans are required to fund on a solvency (hypothetical windup) basis. The Canadian Institute of Actuaries (CIA) provides the solvency assumption guidance. With respect to discount rates, plan members are split into two types, and the guidance for both changes each month.

- Members who likely would be settled via the purchase of an annuity from an insurance company (usually a portion of the older active members and all retirees and pensioners). The solvency discount rates for this group are set based on an annuity proxy, meaning the CIA’s goal is to provide discount rate assumptions that generate liabilities that mimic the cost of purchasing annuities.

- Members who would be settled via the transfer of a lump sum commuted value into a personal, registered retirement vehicle (this includes all other members, such as younger active members and terminated vested members). The solvency discount rates for this group are set based on long-term government of Canada bond yields.

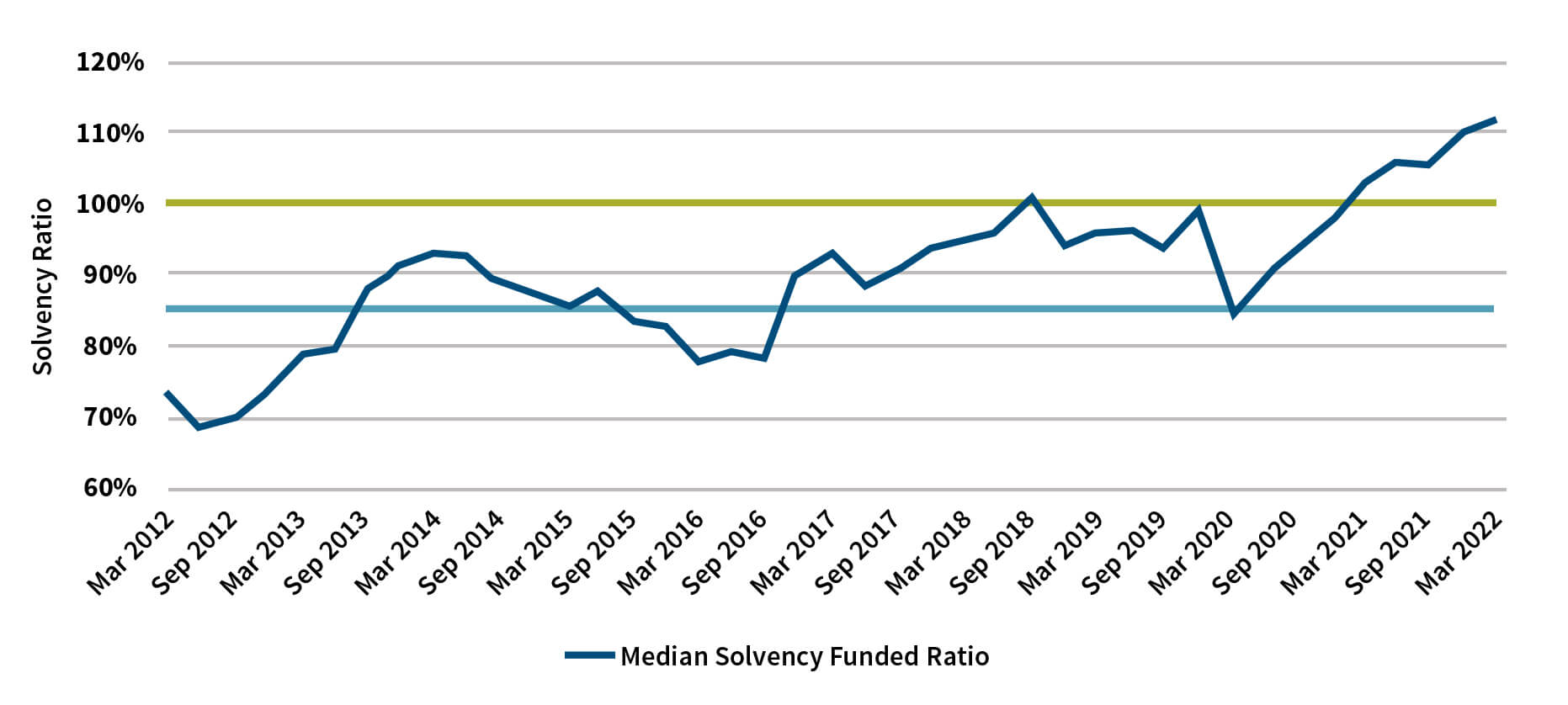

Solvency discount rates for both types of members have increased significantly over the last few months, more than offsetting any contemporaneous asset losses and sending solvency funding ratios in Canada to their highest in more than a decade.

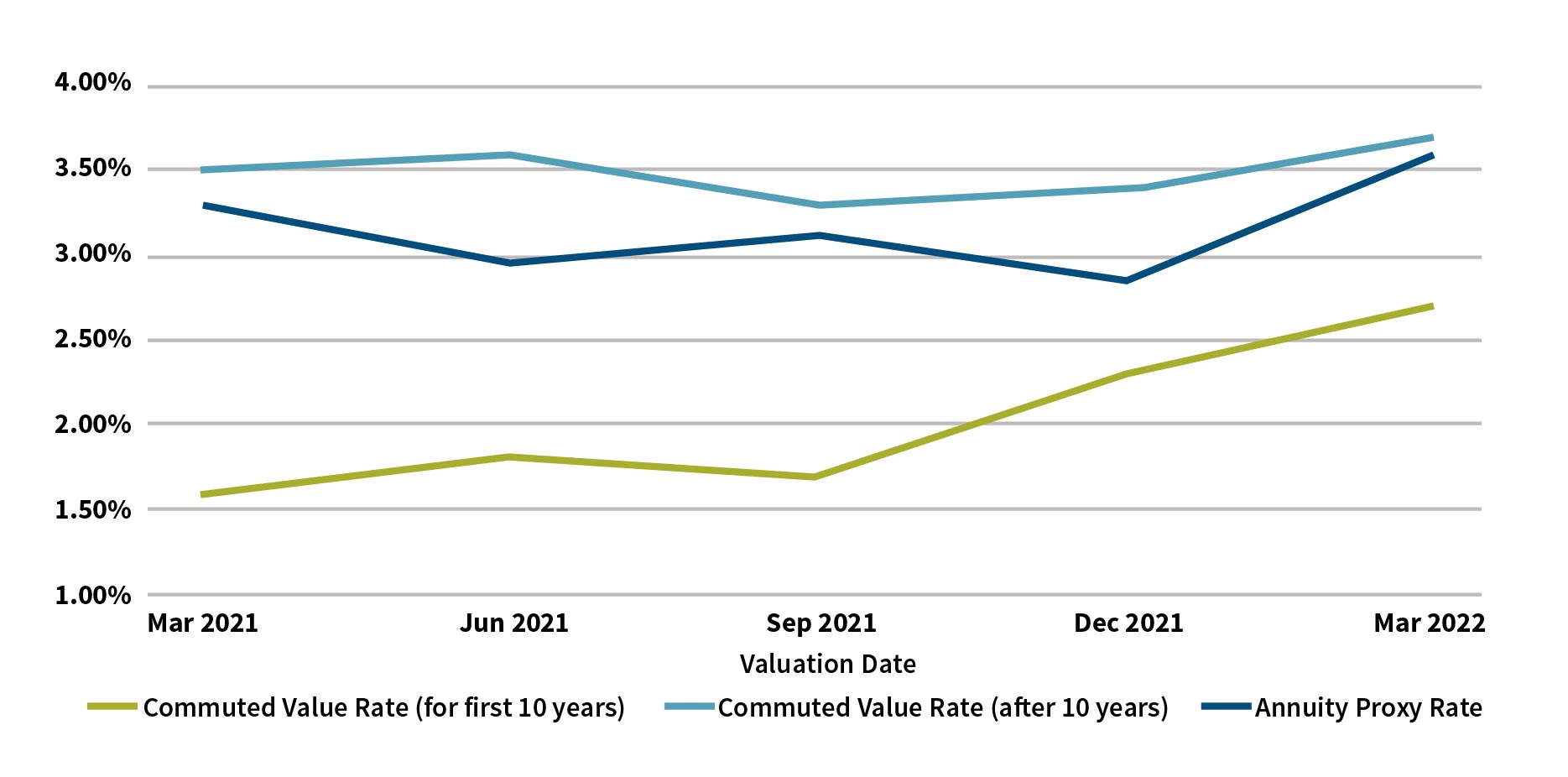

Figure 2 from the Financial Services Regulatory Authority of Ontario (FSRA) illustrates the recent increases in solvency discount rates. Note that the commuted value (CV) discount rate assumption has an initial 10-year select period followed by an ultimate rate.

Figure 2: Nonindexed Commuted Value and Annuity Proxy Rates (Based on a Medium-Duration Illustrative Block)

Since March 2022, rates have increased even further. By comparison, the August 2022 CV rate for the first 10 years is 3.80% and 4.30% thereafter. Annuity purchase rates also continue to increase.

Figure 3, also from FSRA, shows the corresponding increase in average solvency funding ratios.

Figure 3: Median Solvency Ratio

The story is similar in other Canadian provinces. Plans that may not as clearly benefit from these interest rate trends are those with inflation-based pension indexing provisions. However, even for inflation-adjusted plans, the combined impact of higher discount rates and higher inflation is still likely to reduce accounting liabilities on a net basis, given that indexation typically does not start until a plan member retires (while higher discount rate assumptions will affect valuation models immediately—as of the valuation date—for all members). While this is not true for solvency liabilities (for example, CIA fully indexed solvency discount rates reflect inflation immediately), even these inflation-adjusted solvency discount rates have increased significantly over the last few months.

Lastly, with respect to going-concern discount rate assumptions, because these rates are set based on long-term expected asset returns—typically over a period of 30 years or longer—they tend to be more “sticky,” not changing as often. Anecdotal evidence suggests that pension plans, at least in Canada, have yet to make any significant upward adjustments to their going-concern discount rates. However, inflation is a factor in most going-concern discount rate setting methodologies. If high inflation continues to the point where it becomes the norm, we also will see going-concern discount rates gradually increase over time.

In the medium term, a lot will depend on how long increased inflation and interest rates persist. In the long term, another key effect of COVID-19, which I believe may play out over the next several decades, is the impact of ongoing COVID variants on pensioner mortality. If this turns out to be true, consistent higher-than-expected pensioner mortality will drive the actuarial profession to adjust pensioner mortality tables to account for COVID-19 (and its descendants), which would translate into lower liabilities—whether they be solvency, accounting or going-concern.

POTENTIAL MORTALITY RATE CHANGES

While the sensitivity of a DB pension plan’s liabilities to mortality rate changes is typically much smaller than the sensitivity to discount rate changes, the mortality rate changes resulting from COVID-19 could be longer lasting than the discount rate changes.1

Some health experts seem to agree that viruses tend to mutate to become less deadly over time.2 Still, at this point, no one can reliably predict (not even epidemiologists, and least of all pension actuaries) how long it will take COVID to become “immaterially” deadly or how effective future vaccines will be against future COVID-19 variants. As such, it might make sense to assume that pensioner mortality will stay at elevated levels for some time. The question we should keep an eye on is for how long and by how much. At some point, there will be plenty of studies that will answer this question (everything becomes clear in hindsight). Until then, pension actuaries should think about what we can do to analyze this issue for our clients.

For example, we could try to better understand the sensitivity of a DB pension plan’s liabilities with respect to certain potential changes in future expected mortality rates. Although it’s still too early to tell exactly what these changes may look like in the long run, some data has been collected over the last two years that we could use as an indication of the scenarios that might be worth considering.

Figures 4 and 5, created by Statistics Canada, illustrate total excess deaths (for all age groups, actual vs. expected) in 2021 and the first few months of 2022.

Figure 4: Weekly Adjusted Number of Deaths and Expected Number of Deaths for Canada, 2021

Hover Over Image for Specific Data

Source: Statistics Canada Provisional Deaths and Excess Mortality in Canada Dashboard.

Figure 5: Weekly Adjusted Number of Deaths and Expected Number of Deaths for Canada, 2022

Hover Over Image for Specific Data

Source: Statistics Canada Provisional Deaths and Excess Mortality in Canada Dashboard.

In Figures 4 and 5, we see noticeable spikes in actual vs. expected mortality (i.e., excess deaths) that chronologically coincide with COVID-19 infection waves in Canada. Overall, Statistics Canada indicates that between March 2020 and February 2022, Canada experienced 7.7% more deaths than expected. This may not sound like a lot, but note this is a general population statistic and does not account for the fact that the majority of these excess deaths came from people age 65 and older, which is the age group that matters to DB pension plan mortality.

For these older groups, the data so far seems to indicate even higher excess mortality. For example, Figures 6 and 7, also created by Statistics Canada, illustrate the total excess deaths for 65- to 84-year-olds and those age 85 and older during 2020, 2021 and the first few months of 2022 (using 2019 as a baseline).

Figure 6: Weekly Death Counts Reported by Canada, 65 to 84 years and both sexes

Hover Over Image for Specific Data

Source: Statistics Canada Provisional Deaths and Excess Mortality in Canada Dashboard.

Figure 7: Weekly Death Counts Reported by Canada, 85 years and older, both sexes

Hover Over Image for Specific Data

Source: Statistics Canada Provisional Deaths and Excess Mortality in Canada Dashboard.

In the first two months of 2022, excess mortality was 11.6% higher for those ages 65–84 and 12.8% higher for those 85 years and older (compared to only 9.6% higher for those ages 45–64).

In the United States, excess COVID-19 mortality differs significantly by state (due to demographics, health care policies, etc.). Some states had experiences similar to Canada, while some had considerably higher excess mortality. Overall COVID-19 deaths in the United States are roughly triple per capita compared to Canada, implying this type of analysis might be substantially more important for U.S. DB pension plans.

Considering these statistics, actuaries might start to get an idea of a range of scenarios to test, focusing on the impact of mortality rate increases for older age groups (especially for those ages 85 and older).

POSSIBLE PLAN WINDUPS SPIKE

Recently improved funding positions have benefitted plan sponsors financially. Ironically, this also is likely to cause a spike in plan windups, as some plan sponsors have been waiting many years for funding deficits to sort themselves out. They may now take advantage of this opportunity to offload their DB pension responsibilities without additional funding requirements.

In the long run, another important factor will be mortality rates. If endemic COVID-19 remains a significant new mortality risk, it would be reasonable to forecast that mortality rates (especially at higher ages) may not continue to decrease as they have over the last few decades and may even increase in comparison to current general mortality tables.

While we must be sensitive to the negative societal impacts of increased levels of illness and death that COVID-19 will continue to cause, the focus of this article is the financial impact on DB pension plans and their sponsors. In that context, pension actuaries have been advising their clients for decades that their liabilities are increasing in part due to gradually lower pensioner mortality rates. However, there may be reason to believe that at least a part of this trend will be reversed in the next few decades. For plan sponsors that have endured the social and economic turbulence of COVID-19, it is worth knowing.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

References:

Copyright © 2022 by the Society of Actuaries, Chicago, Illinois.