A Mental Health State of Mind

Global survey reveals mental health coverage challenges and opportunities

June 2024Photo: Getty Images/ipopba

Mental health conditions are among the most common health conditions globally, affecting nearly 1 billion people and accounting for nearly one-third of total Years Lived with Disability (YLD). According to World Health Organization estimates, governments worldwide spend an estimated 2% of their health budgets on mental health. This gap presents opportunities and challenges for life and health insurers globally.

In the wake of the COVID-19 pandemic and its acknowledged impact on mental well-being, Reinsurance Group of America (RGA) set out to understand global life and health insurers’ views on current mental health trends and to learn how insurers are responding.

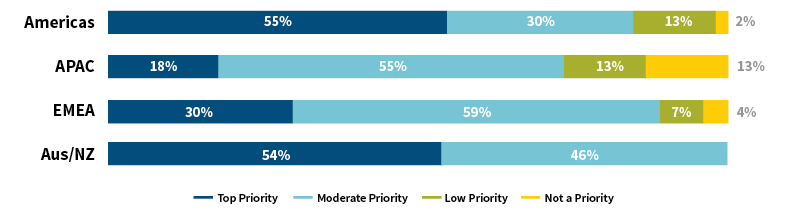

From January to April 2023, RGA conducted 17 qualitative interviews with life and health insurance companies from around the world, followed by an online quantitative survey with 137 respondents. Survey findings highlight insurers’ activities regarding mental health initiatives and provide an overview of new developments, both globally and by region. The report outlines how leading life and health insurers are currently positioning mental health within their strategic priorities, including within claims, underwriting, and product and proposition development. Globally, mental health ranked as a top or moderate priority for 85% of survey respondents, as shown in Figure 1.

Figure 1: Globally, Mental Health Is a High Priority

Source: RGA

A Growing Need

In the RGA survey, the highest-ranking mental health initiatives in terms of priority included evolving claims and underwriting management approaches and practices, providing value-added services to policyholders and claimants, and improving support or programming for employees. A majority (57%) of respondents reported additional customer demand for mental health-related products and services in the prior two years.

Half of respondents (50%) reported the use of mental health specialists (e.g., medical specialist staff to support product development, underwriting and claims, and wellness support programs), and 27% launched new products and services in the last two years.

New mental health offerings have taken various forms based on localized needs or demands, operational objectives, health care infrastructure and regulatory environments, among other factors. For example, the survey identified insurers providing counseling services attached to life insurance products, grief counseling to support life events and specific mental health-related coverage within critical illness policies.

Still, approximately half (49%) of survey respondents believe that customers are not able to purchase adequate insurance coverage for mental health conditions in their market. To us, this is a notable protection gap. Survey results revealed 40% of respondents in product development roles indicated mental health as a top or moderate priority, compared to 100% of health and wellness program management and strategy roles and 94% of those working in claims roles.

Nearly one-quarter (23%) of respondents reported future product development plans to enhance offerings, add coverage or remove exclusions for mental health conditions. The main obstacles to progress included challenges in underwriting and claims management, appropriately defining covered conditions and the availability of data for pricing.

Evolution in Underwriting Mental Health-Related Cases

Despite challenges, the life and health insurance industries are making progress in adapting underwriting approaches to widen the scope of acceptable risks. Forty-nine percent of respondents have updated underwriting philosophies or practices within the prior two years in response to mental health trends. With a growing emphasis on expanding access to insurance coverage, 48% have plans to update their philosophies or practices in the next two years. The commitment to modifying underwriting practices represents a significant shift in the risk management of mental health issues and a recognition of the important role underwriting can play in increasing access to mental health products and services.

In our experience, the risk assessment of mental health-related conditions requires specialized underwriting skills and a personalized approach to effectively evaluate and interpret individual circumstances relating to disclosures, symptoms and available health data and physician records. Survey findings revealed that 82% agree or strongly agree that existing underwriting guidelines have contributed to a conservative approach to mental health risk assessment. Top underwriting challenges included obtaining sufficient information to paint the full picture of risk, receiving appropriate disclosures from customers and acquiring adequate medical evidence to make an accurate risk assessment.

Survey respondents indicated it can be challenging for underwriters to find appropriate supporting medical evidence for mental health conditions. Records from treating psychologists or psychiatrists may be less standardized than those of physicians and medical testing facilities. Additionally, while psychologists and psychiatrists can provide accurate diagnoses at a given time, a diagnosis can change as the patient’s condition progresses or based on reaction to treatment.

A range of factors influence underwriting practices, including product mix (mortality/morbidity), customer mix (group/individual), operational priorities, consumer expectations and regulatory environments. These factors drive underwriting philosophy in terms of risk appetite and the level of underwriting performed. Responses from Australia and New Zealand, for example, are influenced by that market’s mix of group and disability products, while responses from APAC have a heavier focus on mortality and simplified issue retail products. In general, simplified underwriting practices and processes do not align with the relatively costly and time-consuming information-gathering needed to assess risk for individuals with mental health conditions.

Claims Management and Required Skills

The area of claims management in the survey yielded a variety of responses regarding the evolution of processes to support claimant mental health, including through specialist resources and value-added services, particularly for disability products. Forty-three percent of respondents reported the use of dedicated claims management resources for mental health cases, indicating this is an area of opportunity globally. Responses varied regionally, with resources now offered primarily in North America, Australia and New Zealand. The APAC region did not report use of dedicated claims management resources, which may be attributable to the lower prevalence of disability products and the developing mental health care infrastructure in the region.

Among insurers providing disability and income protection products, 50% of respondents currently offer counseling networks (with mental health experts), 41% offer interventions designed to support or enable claimants to return to work and 39% offer virtual medical care to support claimants’ overall well-being.

Beyond services offered, survey results also highlight challenges in disability claims assessment and management. The top-rated concern was the difficulty receiving support from attending physicians in facilitating return-to-work efforts, underscoring the importance of collaboration between insurers and health care professionals. In our experience, collaborating closely with physicians could alleviate claimant reluctance to return to work, but this requires careful planning, extensive communication and the appropriate resources to enable these conversations.

Effective claims management skills are paramount to mental health case management. Survey results confirmed that claims managers require a combination of technical and interpersonal skills. One-quarter of respondents identified communication abilities as the highest priority area for future professional development, presenting an opportunity to invest in training and development initiatives.

Additional important skill areas highlighted in the survey included analytical skills to understand the potential impact a mental health condition may have on a person’s ability to perform occupational tasks and everyday life activities, and planning skills to assist with appropriate return-to-work programming.

Behavioral science techniques can help facilitate a return to work after a temporary disability. However, insurers often find it difficult to effectively implement these techniques into a claims journey. Ideally, we believe they should be embedded throughout the process, with claims handlers playing an important role in their delivery.

While 82% of survey respondents reported they agree or strongly agree that their company has the required skill sets to adequately manage claims with a mental health diagnosis, these results contrast with feedback from claims professionals in RGA’s qualitative interviews. Claims professionals in all regions indicated it has become difficult to recruit and retain people with the breadth of necessary expertise to handle these complex types of claims and—in particular—to communicate complex claims management aspects with various stakeholders.

For More Information

- Access RGA’s Global Mental Health survey and full report.

- Read the SOA’s Health Watch newsletter article, “A Mental Health State of the Union.”

Looking Ahead

We believe the life and health insurance industries have an opportunity to increase and improve support for mental health initiatives. This includes supporting advocacy, education and research; adapting underwriting practices to expand eligibility for applicants with mental health issues; enhancing coverage for mental health conditions; and providing greater access to services. None of these steps can be taken in isolation—all are dependent on one another as part of a comprehensive solution.

Education and research lead to reduced stigma, which facilitates the evolution of claims and underwriting practices, which enables expansion of eligibility and enhanced coverage, which ultimately leads to greater access to mental health services for those who need them.

The entire industry and relevant ecosystem partners could work together to bring about transformation. The noble purpose of insurance, in our eyes, is to protect people in times of need. The industry is poised to do its part in addressing ever-evolving global mental health needs and embrace the significant impact it could have on mental health treatment.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Copyright © 2024 by the Society of Actuaries, Chicago, Illinois.