An Irish Approach to Climate Risk

Assessing the risk associated with climate change

August 2023Photo: Shutterstock/Zeybart

There’s no denying that climate change is a global problem that requires a global solution. As (re)insurers begin to consider the impact of climate change on business, sharing approaches and best practices among territories can potentially help improve processes over time. In this article, we discuss the system that the Central Bank of Ireland (CBI) developed for Irish (re)insurers to assess the risks associated with climate change.1

One of the critical challenges to deciding the approach to take with climate change risk is the age-old question, “Where to start?” Climate change risk can develop over long timelines, historical data is rarely relevant and future climate pathways are uncertain and typically dependent on global policy changes. As a result, (re)insurers can become overwhelmed with how best to approach allowing for climate change risk in the business.

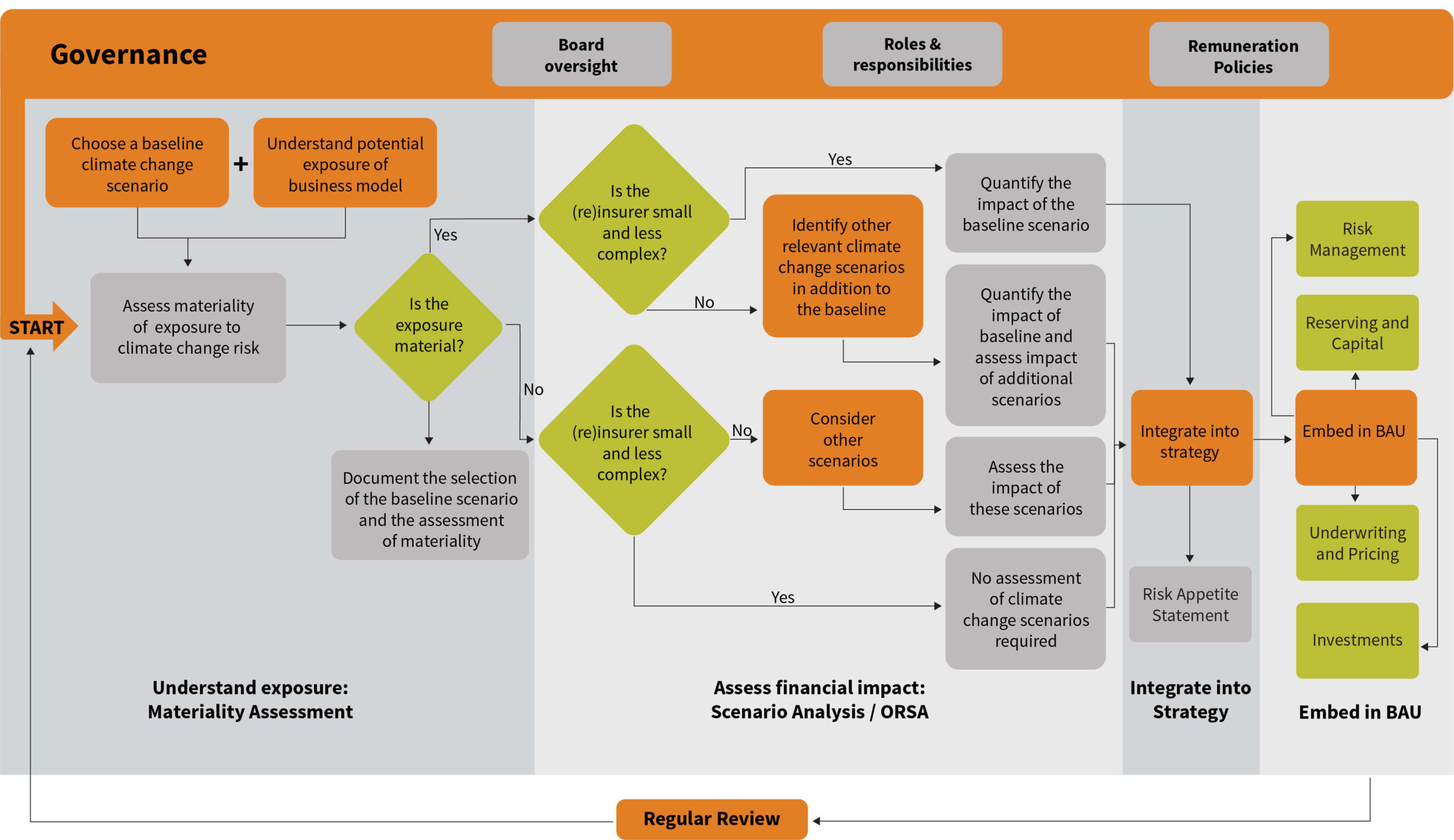

To help Irish (re)insurers navigate this journey, the CBI published guidelines to provide a framework for introducing climate change risk into the risk management process (see Figure 1). The guidelines are consistent with the European Insurance and Occupational Pensions Authority (EIOPA) requirements under Solvency II. For those struggling with where to start, the guidelines help simplify the process. This article will highlight key elements outlined in the guidelines and consider questions that may arise for (re)insurers as they move through the process.

Figure 1: How to Embed Climate Change Risk Management Across an Organization

Click Image to Enlarge

Source: Central Bank of Ireland

Materiality Assessment

The key first step in the process is the materiality assessment of the company’s exposure to climate change risk. There are two important elements to this:

- Choosing a baseline scenario

- Understanding the potential exposure based on strategy and business model over short-, medium- and long-term time horizons

1. Choosing a Baseline Scenario

Companies must choose a baseline scenario that represents the climate pathway that the (re)insurer thinks is currently most plausible. This can be a baseline scenario the company has calibrated itself or a publicly available scenario. For example, the Prudential Regulation Authority (PRA) in the U.K. has used the Network for Greening Financial Services (NGFS) scenarios as the basis for climate stress tests. We consider the following two NGFS scenarios in this article to demonstrate different outcomes based on which baseline scenario is chosen.2

- Delayed transition: This scenario assumes new global climate policies are introduced in 2030, resulting in an increase in average temperatures of 1.6°C (broadly in line with the Paris Agreement on climate). This scenario would lead to more transition risk over the short term and less physical risk exposure if the temperature remained below the Paris Agreement threshold of 2°C.

- Current policies: This scenario assumes that no global government intervention is taken, resulting in a 3°C temperature increase. This scenario would result in less transition risk exposure, as the transition to a carbon-neutral economy is incomplete; that is to say, the transition action currently under way is insufficient to keep warming levels below 2°C. In this scenario, there would be a significant increase in physical risk if temperatures rise as expected and additional risks associated with the adaptation to warming of this level.3

The outcome of the materiality assessment will be influenced significantly by the baseline scenario selected, including the interactions among physical and transitional risk exposures and the company’s balance sheet. Therefore, it is important for companies to consider the impact of alternative scenarios on their business before choosing the most appropriate one.

Timelines are also important. For example, a life insurer could determine that it does not have a material exposure to climate change risk over the short term under the current policies baseline scenario, as its transition risk exposure may be low. However, higher economic uncertainty and lower growth over the long term due to increased physical risks may have a material impact.

In Ireland, where the baseline scenario results in no material exposure, the CBI has stated that companies may wish to consider alternative scenarios if appropriate given the size and complexity of the (re)insurer.

2. Consideration of the (Re)insurer’s Strategy and Business Model

The second element in the materiality assessment is considering the impact of climate change on the company’s strategy and business model, taking into account the baseline scenario chosen over the short, medium and long term.

In Figure 2, we compare the potential outcomes of the materiality assessment under the two baseline scenarios for a number of the key areas.

Figure 2: Potential Outcomes of Materiality Assessments

| Key Areas for Consideration | Delayed Transition | Current Policies |

| Claims experience and reserving Monitor impacts of climate change in the baseline scenario. Changing external factors may influence frequency or severity of claims. |

Claims may be affected by changes introduced to transition to a greener economy. For example, with increased exposure to electric and hybrid vehicles, motor insurers likely will need to consider how claims experience may evolve. | Physical risks increase as climate change causes more severe weather, which is likely to increase the frequency and severity of claims for nonlife insurers and could result in changes to morbidity and mortality rates. |

| Pricing and underwriting

Use the most relevant and up-to-date information to set premiums. (Re)insurers have been warned against waiting to see how claims experience emerges. Instead, they are encouraged to consider it in the context of business strategy to ensure they have a viable business model in the future. |

Physical risks are expected to be less severe in this scenario, so the impact on pricing may not be material. However, rating factors may need to be updated as temperatures rise. | As physical risks are expected to be greater under this scenario, claims may increase in frequency and severity and premiums may need to increase in response. This scenario also assumes higher economic uncertainty, so (re)insurers will need to consider the impact that price increases will have on sales and retention in the future. |

| Product design Companies will need to stay up to date on changes in the external environment and customer needs. |

There will be opportunities to develop new products and benefits as more focus is put on mitigating climate change. For example, life insurers may need to respond to changing consumer needs by introducing “green” life policies. | Companies may need to review product design (and innovate) to keep pricing competitive as claims increase due to climate events. For example, as extreme weather events become more frequent, this will cause an increase in claims and premiums. There will be an opportunity to develop climate-specific coverage as a stand-alone or add-on product and protect the base price of insurance. |

| Assets and investments

Consider investment strategy and its consistency with climate strategies and with regard to changing customer preferences. Companies will need to determine to what extent their assets are currently invested in industries that could have high exposures to transition risk and then consider whether there are potential reputational risks associated with this position. This assessment could include industries with high carbon emissions currently and industries that fail to innovate or transition effectively in the future. Companies also will need to consider the impact if there is a change to greener investments in the investment portfolio. How will this affect customer expectations around expected returns on savings products? |

Understanding the impact of transition risk on the asset portfolio is key under this scenario, particularly for life insurers. Insurers will need to consider how they will manage investments in carbon-intensive industries, what assets are likely to become stranded, what the expected returns for asset classes under this scenario will be and what the reputational risk from the chosen investment strategy is.

There also may be opportunities for insurers to invest in companies to help innovate and finance the transition. |

In this scenario, transition risk is expected to be lower. Over the longer term, this scenario has permanently lower growth, meaning a lower return on investments and more market volatility for the insurance company. |

| Ethical responsibility (Re)insurers have a responsibility to contribute to the fight against climate change and the power to influence change. Companies will need to decide the extent to which they will incentivize the greening of their portfolio and how they intend to do so. |

Under this scenario, (re)insurers may actively influence customers to be more sustainable (tactical sales offers, pricing, product development and investment strategy). For example, for nonlife insurers, this may mean discounting “green” risks such as electric vehicles or solar panels. Life insurers will need to consider how to manage investments in carbon-intensive industries. | This scenario assumes no change in current policies to combat climate change. However, reputational damage may still be an issue, particularly with cohorts of society that believe that the insurance or financial services industries should do more. |

Figure 2 provides an example of some areas to consider, but it is not exhaustive. The key areas for consideration will vary by company depending on its product offering, balance sheet and strategy.

The materiality assessment should look at the short term (10 years), medium term (30 years) and long term (80 years). The NFGS scenarios include transition paths over the medium term, but longer-term impacts may be more challenging to assess.

Next Steps

Where a material exposure has been identified under the selected baseline scenario, the financial impact should be estimated over the short, medium and long term using quantitative scenario analysis. For larger and more complex (re)insurers, a range of climate scenarios should be considered and quantified. It is important to remember that climate change can be a risk accelerator, so scenario analysis should look at the potential impacts holistically, including any second-order impacts. Publicly available information, such as the NGFS documentation, includes details on how to calibrate scenarios for specific climate pathways.

One of the guiding principles of the CBI’s guidance is that an iterative approach should be taken to model the impacts of climate change. The CBI accepts that companies may find the estimation of the financial impact challenging and the approaches taken may be less complex initially—at least for the long-term estimations—but this should evolve and improve in scope, depth and sophistication. This is particularly the case where there are material risk exposures and changes in modeling capabilities for climate risk.

It is important that the outcomes over the short, medium and long term of any scenarios considered are clearly communicated to the relevant stakeholders internally along with the level of uncertainty associated with the climate pathways underlying the scenario analysis.

Strategy and Business Model

It is expected that the output of the materiality assessment and scenario analysis will be used by (re)insurers to develop future strategies and consider new opportunities available over the short, medium and long term. Companies also should consider their own activities’ impact on contributing to or mitigating climate change when setting their climate strategy—so-called “double materiality.”

Climate-related commitments, such as net-zero targets, also will need to be considered and planned for under the company’s strategy. Setting a climate strategy is not a simple task and will require input from across the organization, including the board of directors and senior management.

Embed in Business as Usual (BAU)

Finally, (re)insurers need to ensure that any actions set out in the strategy and business model are integrated into the BAU activity of the (re)insurer. In particular, the CBI guidelines highlight that it is important for the risk management, pricing, underwriting, reserving, capital and investments teams to embed climate change risk into their processes and strategies. The commitment required from each of these teams will depend on the nature of the company and its climate change risk exposures. Other teams, such as procurement, vendor management and human resources (HR), also may embed climate strategies. Ultimately the CBI believes that if the materiality assessment is carried out in sufficient detail, then it should be obvious whether the company needs to take further steps to ensure its future viability.4

These guidelines have been developed for Irish (re)insurers. Still, they can be used as a road map for any (re)insurer that wants to better understand its climate risk exposure, whether the (re)insurer is based in Ireland, Europe or further afield.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

References:

- 1. Guidance for (Re)Insurance Undertakings on Climate Change Risk. Central Bank of Ireland. ↩

- 2. Note that these scenarios have been selected for illustrative purposes only. This is not an endorsement of these scenarios. (Re)insurers will need to consider which scenarios are most relevant to them based on their business model. ↩

- 3. NGFS Scenarios Portal. ↩

- 4. Supra note 1. ↩

Copyright © 2023 by the Society of Actuaries, Chicago, Illinois.