Canadian Women in Actuarial Science

Conversations with some of the actuarial profession’s leading women who are making a big impact

March 2024

International Women’s Day, March 8, is dedicated to recognizing and honoring the achievements and contributions of women throughout history. This year, I chose to celebrate the achievements and contributions of women in STEM, specifically women actuaries. I had the opportunity to speak with three incredible female leaders and actuaries: Canada’s chief actuary, the president of a global human resources consulting firm and one of Canada’s Top 100 Most Powerful Women.

Our conversations explored the expansive journeys of each woman as she successfully navigated the challenges—and opportunities—of working in dynamic, fast-paced organizations in historically male-dominated fields. Overall, I left the conversations with powerful insights and advice. Here are three of my favorite lessons:

- Follow a two-way street. True leadership thrives on a people-centric approach. Foster a two-way street dynamic where open communication and mutual respect can pave the way for collaborative success and shared growth.

- Creativity is our superpower. In the realms of actuarial science and STEM, women leaders bring a unique blend of creativity and analytical prowess, setting a precedent for innovation and diverse problem-solving approaches in fields where linear thinking traditionally dominates.

- Disconnecting is a skill. The ability to disconnect is not just a luxury, but a necessity. It allows for mental rejuvenation, fosters creative thinking and ensures sustained engagement in demanding roles. It balances professional rigor with personal well-being.

We’ll explore these three lessons and more throughout the rest of this article.

Q&A Discussion

A pressing question around advice for young women and how we can encourage them to consider a career in the actuarial field starts this discussion. M. Teresa Palandra, FSA, FCIA, president of Mercer Canada, responds.

The actuarial profession requires a strong foundation in mathematics and statistics. How can we encourage more young women to excel in STEM subjects and consider a career in actuarial science?

Palandra: STEM professionals have the power to make a real difference whether through solving global challenges, advancing health care or ensuring financial wellness. And yet, societal expectations and gender norms still steer many women away from pursuing a career in STEM. But we can change that.

First, we need to challenge stereotypes that put forward the idea that STEM—and actuarial science—are not spaces where women can thrive. Let’s highlight the creativity and problem-solving that come with STEM and actuarial science, showcase diverse and exciting career options, and underscore the tremendous impact these professions have on the world.

It’s equally important for young women early in their education and career journeys to have mentors who can provide encouragement and guidance based on their experience. We need to spark an interest in STEM among young women, yes, but we also need to sustain that interest so they can go on to have longstanding, successful careers.

Resources for a More Diverse Actuarial Profession

The following groups support the educational growth of young women and professionals:

- Girls to the Power of Math (G^M) is a nonprofit organization based in British Columbia, Canada, that provides free after-school programming for elementary school girls to boost their confidence in math through fun games and mentorship. The mentors are high school and university girls who are proficient in math.

- The Network of Actuarial Women and Allies (NAWA) connects and empowers women of all backgrounds to be successful in the actuarial profession.

- The Actuarial Foundation’s STEM Stars is a scholarship program that supports high school students who are skilled in math and interested in the actuarial field.

- The Committee on Career Encouragement and Actuarial Diversity (CCEAD), a joint committee of the Society of Actuaries (SOA) and the Casualty Actuarial Society (CAS), promotes actuarial diversity through its Be an Actuary initiative by presenting at high schools and supporting actuarial programs for minority students.

A note on mentorship: Palandra touches on a topic near and dear to my heart. I personally have had a mentor for many years who has helped me grow immensely on a professional level. I also have had the pleasure of mentoring others as they develop in their careers. Both sides of the mentorship coin are extremely satisfying and offer opportunities for personal growth.

Monique Maynard, FSA, FCIA, executive vice president, chief actuary Canada, and president, Quebec Affairs at Canada Life, agrees with me. “Over the years, I have learned as a mentor that one receives just as much as one gives—and more,” Maynard says.

Have you had mentors or role models who have influenced your career, and how do you believe mentorships can empower more women to pursue and thrive in actuarial careers?

Maynard: I have not had an official mentor, but I have had several role models throughout my life, including family members, colleagues and other leaders at Canada Life. I have been fortunate to work in an environment where great leaders helped me learn and grow.

Now, as a senior leader, I am committed to mentoring others. I make a point of engaging in both formal and informal mentoring. I believe in sharing knowledge and experience to help others reach their full potential.

I am the executive leader of our actuarial program at Canada Life, where I oversee the recruitment and development of new actuaries, including their career progression. It is rewarding to help young actuaries grow in their careers.

Assia Billig, FSA, FCIA, the chief actuary of the Office of the Superintendent of Financial Institutions (OSFI), tells me all her mentors have been men. Mine have been as well, I confess.

As a woman in a traditionally male-dominated profession, what strategies have you employed to overcome gender-related barriers and establish yourself as a respected actuary?

Billig: I started working in consulting and quickly realized I needed to get to a point where I was talking to clients without feeling butterflies in my stomach. This was no easy feat for someone who describes themself as an introvert. I had a wonderful boss who had a lot of respect for what I had to say and encouraged me to bring ideas to the table and speak up.

And so, I did. I raised my hand for opportunities and started doing things I had never done before. As you continue to do that, you realize what you have to say is worth hearing, and self-confidence is actually quite becoming. I kept pushing myself to speak up, to get out of my comfort zone.

As a leader, I decided to carve my own path. My style of leadership was not going to be one of control and command but rather a people-centric one where trust is a two-way street. And I assure you, people will trust you when they see you’re listening. It was a challenge to stick to my belief that this type of leadership style was the right approach for me. I have successfully proven that being an empathetic leader works, and it works well.

The Gender Pay Gap and Leadership Diversity

While we celebrate March 8 and all that women have accomplished, I can’t help but think about another date that follows shortly after: Canadian Equal Pay Day on April 12. On average, women have to work until April 12 of a given year to earn what a man made the prior year. That means women must work 15.5 months to earn what a man does in 12 months.

“Salaries are usually negotiated,” says Billig when I touch on this topic, “and men are often stronger negotiators. Women leaders have a role to play in closing the pay gap.” She also notes that hers is a unionized environment, so pay is equal across the board for the same job level.

While Canadian women represent nearly half of the labor force, that percentage decreases significantly at the senior levels, reports show. Mercer’s “When Women Thrive” global report, which includes 1,200 organizations worldwide, finds a concerning trend around the decline in female representation by career level, with only an average of 26% representation at the executive level in Canada and the United States, as shown in Figure 1.

Figure 1: Average Female Representation by Career Level

Hover Over Image for Specific Data

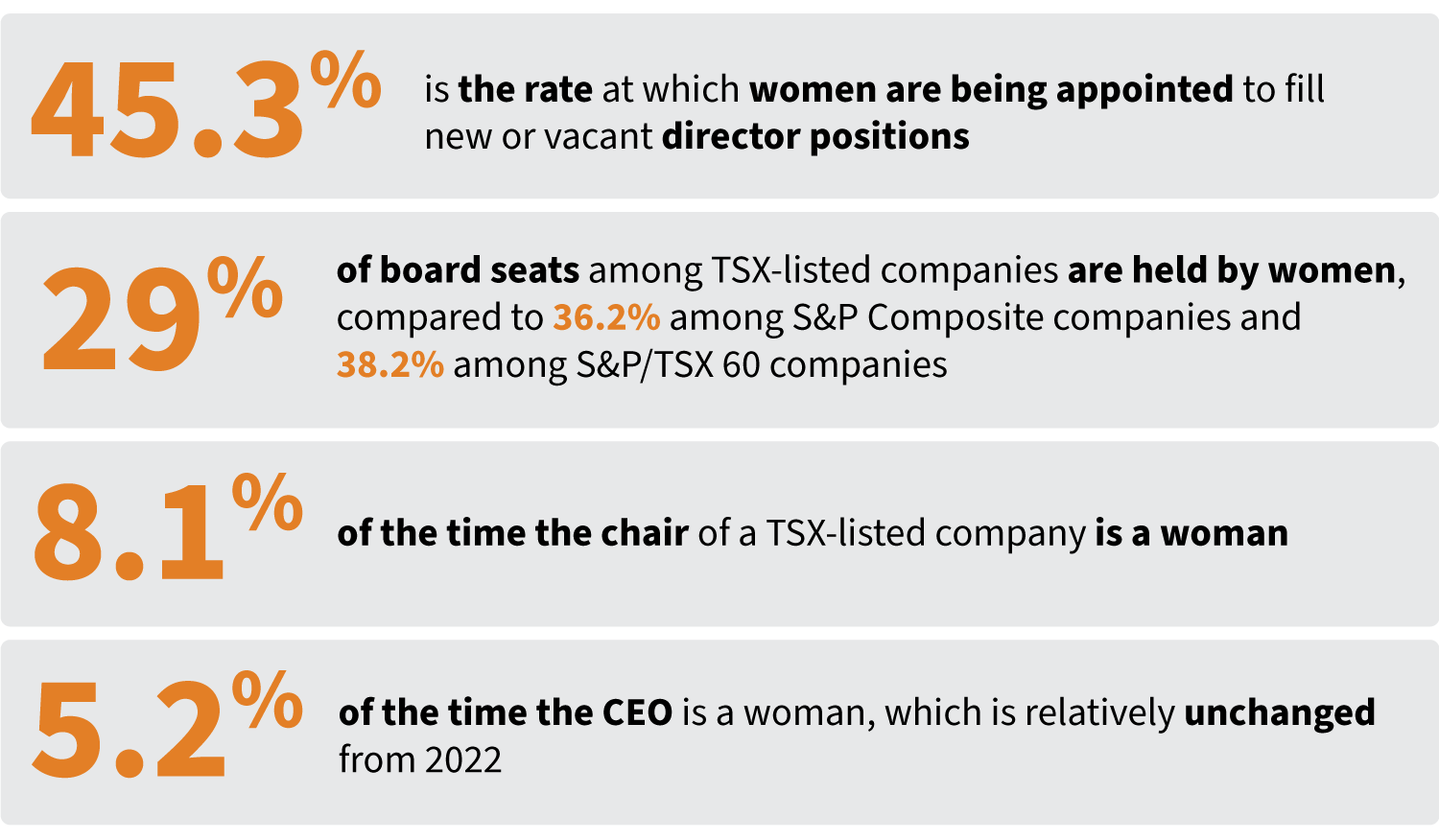

There is a similar pattern in Osler’s 2023 “Diversity Disclosure Practices” report, which analyzes diversity and leadership at Canadian public companies. The highlights are shown in Figure 2.

Figure 2: 2023 Diversity and Leadership Highlights

Success Strategies for Women in STEM

For the many women looking to break barriers and build a fulfilling career, Palandra shares strategies that helped her:

- Seek sponsorship, not just mentorship. While mentors provide valuable advice, it’s equally important to seek out sponsors. Sponsors actively push for your career growth by putting you forward for opportunities and supporting your advancement. They can make a significant difference in your professional journey.

- Know your worth. It’s not just about earning your seat at the table. It’s also recognizing when you’ve earned it and advocating for yourself. Many women struggle with imposter syndrome and find it difficult to negotiate their value. Taking calculated risks, stepping out of your comfort zone, and pursuing leadership roles and stretch opportunities can expand your skills and boost your confidence.

- Build a strong professional network. Networking is crucial for career advancement. Connect with other professionals in your field who can provide support, guidance and opportunities. Having colleagues who are committed to gender diversity can make a big difference. They can amplify your voice, challenge biases and help create a more inclusive environment.

Work-Life Balance

So, can we have it all? Balancing work and personal life is a challenge for many professionals. How can women manage work-life balance, and how can they excel in their careers while maintaining a fulfilling personal life?

“Work-life balance is personal and unique for everyone,” Maynard emphasizes. “Assessing this balance involves evaluating how well you manage your time, prioritize tasks and maintain your overall well-being. I’ve always felt I had work-life balance during the different stages of my career. For me, it’s about ensuring when I shut down my work, I’m able to go and enjoy my personal life and not worry about work. The ability to disconnect is very important for me.”

Disconnecting resonates with Billig’s strategy of protecting her weekend from work and kids’ activities, ensuring there is a respite from the week. “Having some ‘me time’ is important,” she says. “Time to unwind without guilt, without judgment.”

Palandra echoes the focus on self-care. “You can’t pour from an empty cup,” she says. “It’s important to prioritize your well-being and make choices that align with your values and goals. Take care of your physical and mental well-being, and make time for the activities and people who recharge you.”

Early in my career, a senior woman leader said to me, “You can do anything you want, just not all on Tuesday.” I took that advice to heart and tried to focus on one accomplishment at a time. Sometimes that was preparing for and delivering a successful client presentation; other times it was volunteering at my kids’ school. Recently, it was a combination of both during grade nine’s Bring Your Kids to Work day.

International Women’s Day Shout-Out

This year, on International Women’s Day, let’s take a moment to applaud women in STEM and women actuaries, with a special shout-out to the accomplished leaders and role models featured in this article. These women prioritize people-centricity by focusing on a two-way street approach with their teams. They foster creativity, even in the smallest projects. And they understand that disconnecting from work is essential to show up as their best selves for their families and careers.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Copyright © 2024 by the Society of Actuaries, Chicago, Illinois.