Changes in the East

A response to new challenges in China’s insurance market

December 2019/January 2020Photo: iStock.com/baona

In March 2012, the former China Insurance Regulatory Commission (CIRC)1 kicked off the project to establish “China’s second generation solvency regulation system.” Not only does the new regime follow the Insurance Core Principles, but more important, it takes into account local market characteristics.

In early 2015, CIRC completed the new solvency standards, known as China Risk-Oriented Solvency System (C-ROSS). With a one-year parallel running period in 2015, C-ROSS officially went into effect in January 2016. This new solvency regime was designed to strengthen capital requirements, promote risk management and corporate governance, and to ensure the healthy and sustainable development of the Chinese insurance industry.2

Achievements in C-ROSS Phase I

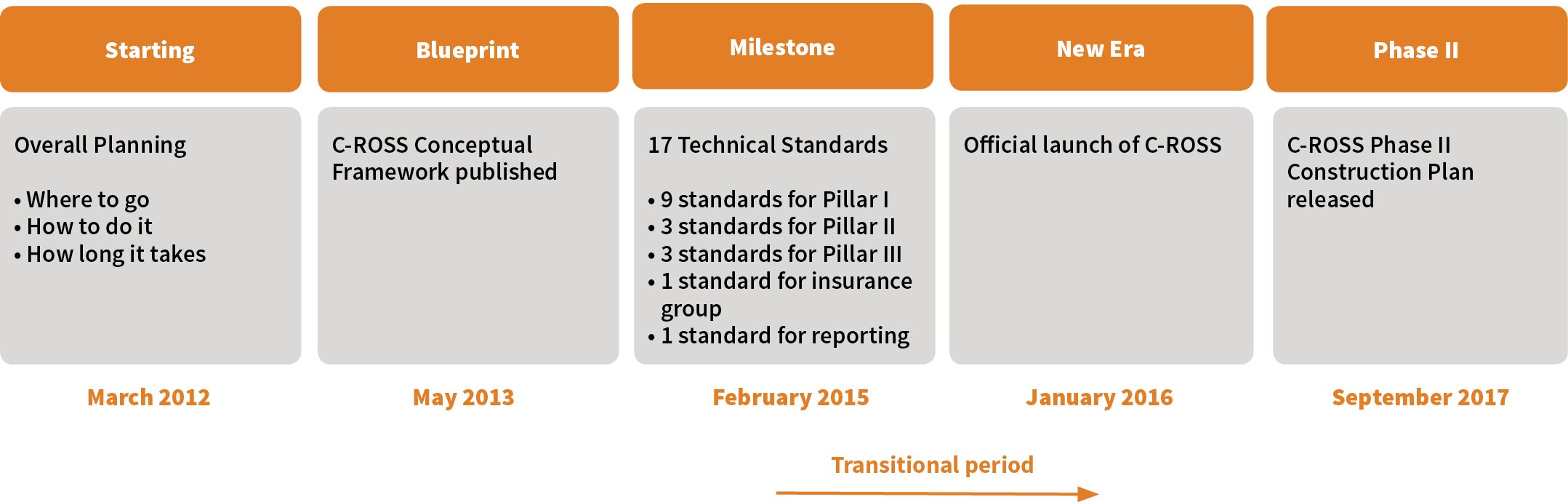

In the three years since the implementation of C-ROSS in 2016, we have noticed significant improvements in China’s insurance regulation and insurance market (see Figure 1).

Figure 1: Roadmap and Current Development of C-ROSS

Transforming the Solvency Regime From Volume-based to Risk-based

In the old solvency regime, minimum capital requirements were quantified as a percentage of the past year’s premiums or reserves, which did not properly reflect the underlying risks the insurers had undertaken. However, with the implementation of C-ROSS, moving from a volume-based to a risk-oriented construct, we noticed an apparent uptick in risk sensitivity and a broad expansion in risk coverage of regulatory approaches. Under C-ROSS, the measurement of the capital requirements more accurately and comprehensively reflects the various underlying risks, including insurance risk, market risk, credit risk and control risk. The assessment of the uncapitalized risks, which are difficult to cover by holding capital (e.g., operational risk, strategy risk, reputational risk and liquidity risk), are now evaluated under a new supervisory tool under the C-ROSS framework.

Establishing the Risk Management Capability of Insurers

As a risk managing system, C-ROSS is not merely a risk detecting or risk measuring system. C-ROSS emphasizes the risk management awareness and capabilities of insurance companies. More fundamental, C-ROSS facilitates the abilities of self-diagnosis within industry participants through a reward-penalty mechanism. To raise risk management awareness and abilities, C-ROSS introduced two regulatory tools: Integrated Risk Rating (IRR) and Solvency Aligned Risk Management Requirements and Assessment (SARMRA). The regulator assesses each insurer’s overall risks on a quarterly basis utilizing IRR, and evaluates the insurer’s risk management abilities on a yearly basis through SARMRA.

Also, through C-ROSS, China’s regulator has established a detailed list of minimum risk management standards for insurers, which are periodically evaluated against their implementation process. These standards, which assess the comprehensiveness and effectiveness of an insurer’s risk management system, also cover governance structure, internal controls, management processes and so on. These standards also provide a best practice model for the industry, especially for small and medium sized insurance companies. Since most insurers in China are small and medium sized, their risk management capabilities have been improved significantly by following these best-practice risk management standards.

Pragmatic and Valuable Experience for Emerging Markets

C-ROSS essentially has the same underlying philosophy as other international practices. Although many features are tailored specifically for China, they also are applicable for other emerging markets. From an international perspective, C-ROSS contributes a positive experience in formulating regulatory rules and promoting fair and reasonable guidance for international insurance regulation.

In recent years, the China Banking and Insurance Regulatory Commission (CBIRC) has been proactive in fostering dialogue and maintaining regular communication with the supervisory bodies of other jurisdictions and international organizations. As an example, in 2017, the former CIRC and the former Office of the Commissioner of Insurance of Hong Kong reached a framework agreement on mutual recognition solvency regulation. This kind of mutual recognition on an equivalent assessment authorized Hong Kong reinsurers to use a more appropriate and subsequently lower credit risk factor when accepting the reinsurance business from domestic China direct insurers.

In addition, to strengthen the exchange and cooperation of international insurance solvency regulators, CBIRC has initiated an annual Workshop on Asian Solvency Regulation & Cooperation (WASRC). Since 2016, the CBIRC has hosted four workshops, which, in aggregate, 78 officials and representatives of regulatory bodies from 18 jurisdictions have attended.

C-ROSS Phase II Kicks Off

In response to the new challenges faced by China’s insurance sector, the former CIRC announced a C-ROSS Phase II project roadmap in September 2017, which includes four aspects:

- Update current rules and recalibrate risk factors to cope with the changing market environment. With the fast growth and the rapid changes in China’s insurance market, some risk factors and correlation coefficients among various risks need to be reviewed and calibrated to better reflect the current industry environment.

- Resolve new issues that emerged in Phase I. First, despite the sufficiency of available capital across the industry, certain insurers’ available capital is not good quality. Some entities even made fake capital injections using multilayer investment products or by other complex transactions. C-ROSS Phase II will establish a new requirement of “exogenousness of capital” to ensure the capital injected comes from external sources. Second, IRR and SARMRA assessments will become more standardized by establishing Standards of Practices. Third, the solvency filings will be housed and cross-checked in response to data quality issues.

- Address new assets with businesses that cover new types of entities.

CBIRC aims to further refine regulations with intensified supervision over complex and multilayer investment products. The intention behind this is to enforce a look-through approach to identify underlying risks.Solvency regulation will cover emerging entities such as insurance groups, mutual, captives and pension insurers, and asset management companies affiliated with insurers. Current risk identification and classification for these new entities have not yet been developed.

In addition, the capital requirements of new businesses in the industry—such as credit guarantee, critical illness, catastrophe products and so on—should be studied and examined.

- Further strengthen regulatory cooperation among jurisdictions. To further promote and actively participate in prudential regulation and build mutual trust with other jurisdictions, a more comprehensive and sophisticated C-ROSS equivalent assessment system will be established.

Key Elements of C-ROSS Phase II

Three tasks are articulated in C-ROSS Phase II, including rule revision, implementation reinforcement and strengthening regulatory cooperation.

Rule revision (task one) includes review and modification of relevant standards and risk factor calibration for insurance risk, credit risk, market risk and control risk. In response to capital quality issues, the so-called exogenousness of capital requirement will be established to further regulate available capital. Meanwhile, C-ROSS Phase II will reform the IRR and SARMRA tools to ensure C-ROSS exists as a risk managing solvency system. In addition, specific rules of the market discipline mechanism will be improved.

Implementation reinforcement (task two) includes enhancement of the C-ROSS Data Bank by utilizing its automatic data verification and technology driven analysis function. In addition, C-ROSS Phase II will improve the working mechanism of the Solvency Regulatory Committee under the new unified regulatory body, the CBIRC. Actions in strengthening supervision of auditors, actuaries, rating agencies and other intermediaries will be considered to ensure the quality of implementation of C-ROSS.

Strengthening regulatory cooperation (task three) implies closer collaboration with the Central Bank, China Securities Regulatory Commission and the Ministry of Finance. Other tasks falling in this category include the establishment of a C-ROSS equivalent assessment system, the assessment of the impacts of the changes of both international and domestic accounting standards on solvency regulation, and the engagement on global regulatory policymaking.

Implications of C-ROSS Phase II

C-ROSS Phase II, serving as a timely update and a meaningful supplement to the existing system, is of great importance to China’s insurance industry. The rollout of the Phase II project would:

- Lead to more stringent capital requirements that could indicate an increase in required capital and a decline in available capital. A decrease in leverage would further enhance the financial stability and financial resilience of the insurance industry.

- Build a monitoring system with different types of risk, time frames and micro to macro analysis, as well as different monitoring objects. Establish a mechanism with the CBIRC head office and branch offices, research institutions, intermediaries and industry associations. Strengthen the risk early-warning and decision-making supportive ability of solvency information. Eventually, the authority aims to construct a multidimensional, stereoscopic and open risk analysis and monitoring system.

- Be closely tied to China’s further opening up of policies in the financial sector and proactively participate in the international insurance communities by building a regulatory mutual trust mechanism through an equivalence assessment. In the task of the Phase II project, standards that are not conducive to market opening would be revised. Under the equivalence assessment, lower counterparty risk factors for offshore reinsurers and many other rule revisions are expected to create a more friendly environment for international carriers.

- Strengthen the industry’s role in the protection of long-term assets management to enhance the core competitiveness of industry practitioners, which in turn would lead to a more prudent culture and strategies among insurers.

In summary, the Phase II project would lead to a higher regulation standard, a more stringent risk monitoring system and a more open market. What’s more, it will also promote prudence within the industry.

References:

- 1. CIRC and CBRC merged to become the China Banking and Insurance Regulatory Commission (CBIRC) in 2018. ↩

- 2. For more background on C-ROSS construction work in Phase I, please refer to Yulong, Zhao. 2014. China’s C-ROSS: A New Solvency System Down the Road. The Actuary, February/March. ↩

Copyright © 2019 by the Society of Actuaries, Chicago, Illinois.