China’s Life Insurance Industry: Part 1

A retrospective of the past 30 years

February 2023Since AIA (Asia’s largest life insurer) introduced the individual agent model to China in 1992, the Chinese life insurance market has experienced a golden age of growth in incremental term plans, prosperity and rapid growth in premium rates. As times—and people’s thinking—have changed, the industry has shifted from primarily incremental plans to both stock and incremental markets. It has entered a period of transformation and development, with the clear direction of “returning to its roots” leading high-quality development with high-quality talents and replacing sloppy management with meticulous operation.

Under the strict regulatory requirements of strong supervision, misbehavior prevention and risk prevention, the industry’s transformation is full of many real challenges. But behind the challenges are often new opportunities. To seize these opportunities, we must be practical and think carefully about some key questions:

- What direction should the inevitable transformation take?

- How has the Chinese life insurance industry developed so far, and how should we plan for the future?

- How can the life insurance business return to its roots while keeping in mind the product theory and channel theory?

Compared to countries in Europe and North America, China’s insurance industry has a relatively short history, so the public’s understanding of the industry and their recognition of what is happening in the industry are superficial to a certain extent, and there are many misconceptions.

This first part of a three-part article series focuses on how China’s life insurance industry has changed over the past 30 years. Part 2 will discuss the challenges and countermeasures the industry faces, and Part 3 will look at how insurers can plan for future development.

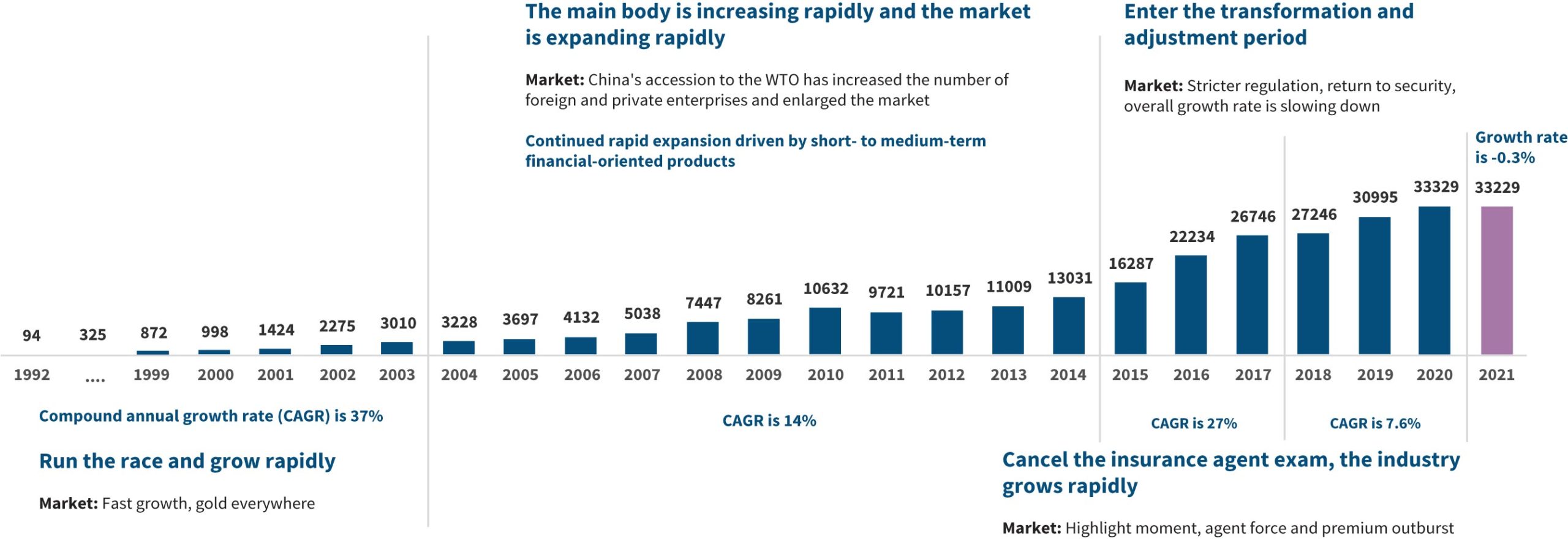

China became the world’s second-largest insurance market in 2017, following an initial trend of rapid development. However, from 2019 to 2021, the number of agents, new policy premiums and total premiums exhibited negative growth, and the industry began to face a major change, entering a period of adjustment with three overlapping components.

Slowing Growth

First is the end of the development phase. Industry growth is no longer unrelenting, and the shift from an incremental market to stock and incremental markets has become the norm. In 2021, total premiums had their first negative growth in a decade, signaling the end of the high-growth era. Most market players saw an unprecedented three-year fall in new policy premiums, a change not only in volume but also in market structure, meaning it was a long-term trend rather than a short break. See Figure 1.

Figure 1: Chinese Insurance Market Growth, 1992–2021

Source: Data from China Banking and Insurance Regulatory Commission, industry research

Increasing Challenges

The second component of the industry’s transition is that the changes that marked the end of the development period have become concentrated in three aspects of the market.

- The most-used liability model is no longer popular. In the past few years, many small and medium-sized insurance companies enjoyed the dividends of the so-called asset-driven liability model, rapidly expanding the scale of their enterprises and overtaking other companies in development. After 2017, this model—used mainly with universal life insurance—was no longer efficient, and its use contracted significantly. The sudden change meant many companies lost business, and in hindsight, both companies and the industry accumulated risk, incurred damage to their reputations, and wasted valuable time and opportunities that could have been used to develop teams and accumulate customers. Many companies became obsessed with generating short-term revenues and took on more business than they were able to handle, finally realizing neither short- nor long-term gains. The only effect was to stigmatize universal life insurance, making it a neutral type of insurance design that unfortunately became synonymous with a specific era and phenomenon.

- The companies that did not have the infrastructure to manage their operations are now going bankrupt. On one hand, the liability side governs the scale of noncompliance. On the other hand, the asset side has frequent credit risk problems. The insurance industry is not a paradise, and some companies’ problems began to surface gradually. Regulatory takeovers unseen since 2018 have become common, and a considerable number of companies have gradually stopped disclosing their quarterly earnings. Addressing these challenges is not easy and requires both time and the joint efforts of the whole industry.

- The architecture development model strongly depends on the demographic dividend, which is gradually running out. Tens of millions of people have sold insurance, decreasing the marginal utility of the huge-crowd strategy, and recruitment using a talent development model has encountered unprecedented challenges. The declining demographic dividend and the ongoing COVID-19 pandemic over the past two years have prompted the sporadic emergence of “fake assured and fake policy” problems that have affected many companies, leading to a significant decline in the industry’s input-output ratio.

Transforming Infrastructures

The third component is the many types of transition that are taking place with high-quality development, but the road is long and difficult. It basically comprises three aspects.

- Channel structure transformation from individual insurance dominance to individual insurance and bancassurance. Before 2018, bancassurance was popular. Then many companies despised bancassurance to some extent but found they couldn’t fight the inevitable. After individual insurance lost its growth momentum, bancassurance became the guest of honor again, and several large companies have restarted high-profile bancassurance business to make up for the loss of individual insurance. However, this temporary strategy has not changed the reasons companies substantially abandoned bancassurance in the past. The basic problems of bancassurance itself still exist, and pricing wars have been exacerbated by the renewed efforts of large companies to make it work. There is still a long way to go before we have a truly balanced channel strategy.

- Marketing team transformation from a huge-crowd strategy to an elite strategy. “Survival of the fittest” has become the industry’s new development rule. Total market manpower has declined significantly in the past three years, although the Million Dollar Round Table (MDRT)—which represents high-performance insurance professionals—shows there has been positive growth in China. The industry’s core manpower (for example, first-year commission = 3,000) has exhibited a quarter-by-quarter decrease, indicating that the agent as the only or main labor force is still in decline. Many grassroots agent structures have not stabilized from the widespread change from a huge-crowd strategy, which means that the insurance industry will take at least several years to achieve the transformation to an elite strategy.

- Product structure transformation from critical illness insurance to a new pillar of value that has not yet been established. After nearly a decade of rapid development, whole life critical illness insurance, which relies on the flow of customers, has covered at least a few hundred million people; the market for insurable people has become saturated, so the advantages are no longer there. The higher value long-term pension market is still in its infancy, and it is difficult to replace the value contribution of critical illness insurance quickly. Other protection and inheritance category products have a relatively narrow customer group and are more difficult to turn into mainstream products in the market as a whole, but they truly can benefit a few companies. This means the insurance product is entering a “window period” that requires more analysis over time.

The road to returning the life insurance business to profitability will be long and difficult. We have seen how the industry arrived at its present state, and Part 2 of this article will show the challenges insurers face as they make their way back.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Copyright © 2023 by the Society of Actuaries, Chicago, Illinois.