Fellowship Education Changes

New exams and modules are being rolled out sequentially through 2021

October/November 2019The Society of Actuaries (SOA) announced in October 2017 that there would be updates to the exams and modules on fellowship-level tracks beginning in late 2018. The basic structure of two five-hour exams and one two-hour exam offered twice a year was retained (with an option to take a four-hour Enterprise Risk Management (ERM) Exam instead of the two-hour exam to also earn a Chartered Enterprise Risk Analyst (CERA) credential).

Changes and enhancements to the ASA requirements necessitated these track updates. Foremost among those changes was the addition of predictive analytics and other topics that previously were in the Financial Economics Module. The considerations behind the changes to the ASA requirements are relevant when considering changes to the FSA requirements. The task force that looked into the ASA requirements was asked to consider what fundamental knowledge is required for all actuaries, what actuaries need to know now and in the future, and what the proper balance between different topics is.

Similarly, the Curriculum and Examination Committees of each track considered which topics all actuaries in their respective tracks should know, what is the proper balance of these topics in the educational process, and how these should be tested through the 5-5-2 examination structure and modules.

The revisions/new exams and modules these committees developed are being rolled out sequentially through 2021. The remainder of this article summarizes the changes by track. More detailed information about these changes, transition rules and recommended order can be found on the SOA website.

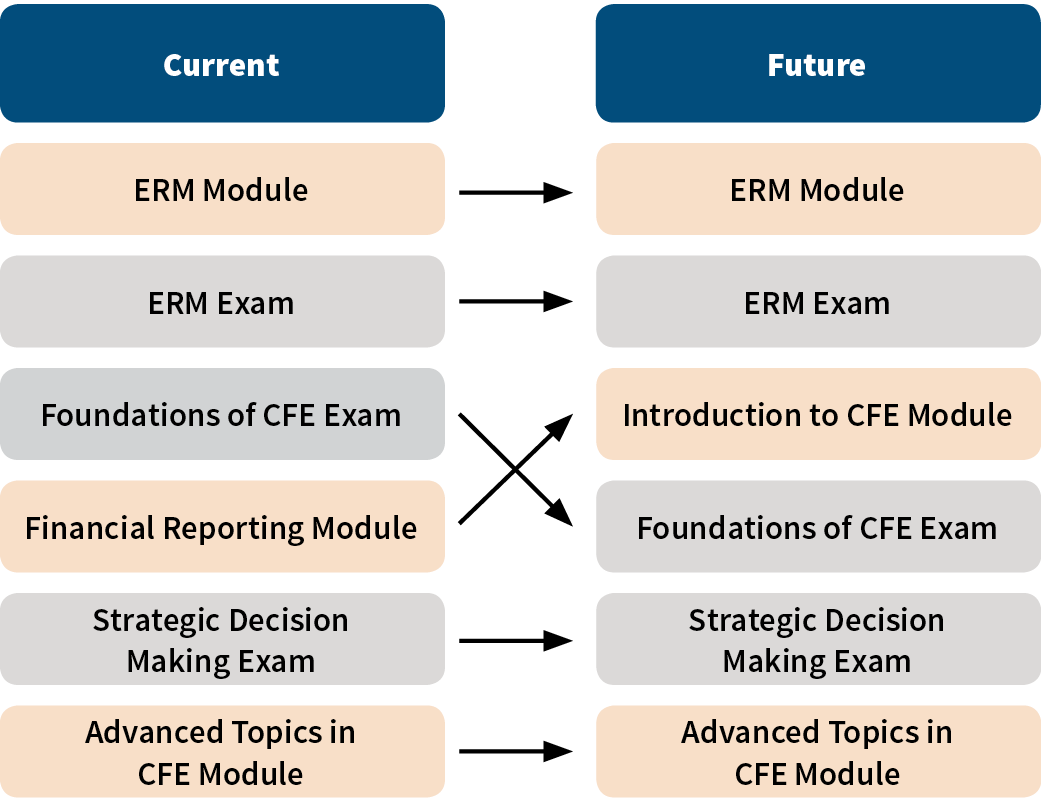

Corporate Finance and ERM (CFE) Track

No changes will be made to the CFE track exams. However, two modules are being created and/or revised (see Figure 1).

Figure 1: Corporate Finance and ERM Track

- Introduction to CFE. The focus for this module is on providing a broad understanding of business strategy with exploration into financial statements and using modeling to achieve business objectives. It is scheduled to be released in December 2019 and will replace the Financial Reporting Module.

- Advanced Topics in CFE Module. This module will be updated significantly to align with the other track material. It is scheduled to be released in December 2020.

General Insurance

The National Association of Insurance Commissioners (NAIC) has been evaluating the SOA’s general insurance curriculum for the past two years to determine if fellowship would provide an Accepted Actuarial Designation for signing its property and casualty (P&C) Statement of Actuarial Opinion. The committee thought it unwise to adjust the curriculum while this evaluation was ongoing.

With the NAIC’s approval of the curriculum in May 2019 (pending changes made for the fall 2019 exams), this process will be complete. Now that those portions of the curriculum necessary for NAIC purposes have been identified, the committee can update the remaining parts to align with the new ASA curriculum as well as cover emerging topics. Candidates should visit the website regularly for additional updates.

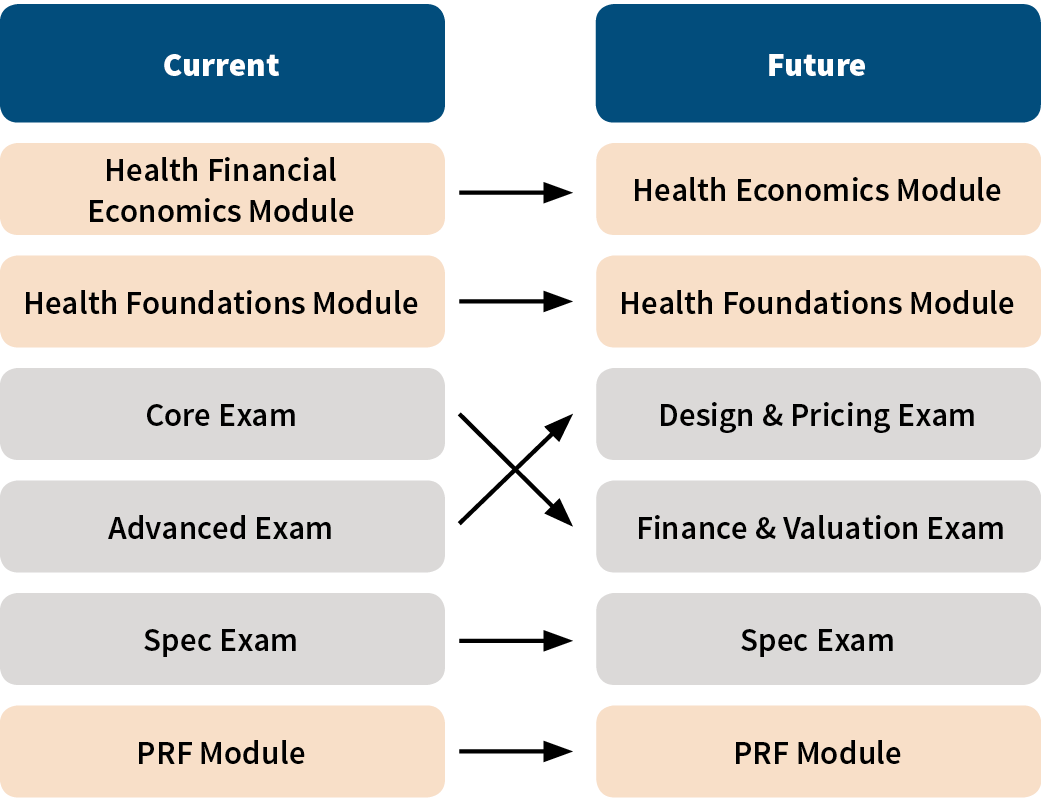

Group and Health Track

A new Health Economics Module replaced the Financial Economics Module in December 2018. Candidates currently have the option of replacing the Health Foundations Module with the Enterprise Risk Management (ERM) Module. The new requirements will have that option apply to the Pricing, Reserving and Forecasting (PRF) Module.

The revised examinations will be given for the first time in fall 2019. The two current five-hour exams, Group and Health Core (C) and Group and Health Advanced (A) will be replaced by two new exams, Design & Pricing (DP) and Finance & Valuation (FV) (see Figure 2). The FV exam will have separate Canadian and U.S. versions. To aid in the transition, the new exams will be offered in segments for four exam sessions (ending with the spring 2021 administration).

Figure 2: Group and Health Track

- DP will be divided into two segments:

- DP-C (two hours)

- DP-A (three hours)

- FV will be divided into two segments:

- FV-C (three hours, Canadian and U.S. versions)

- FV-A (two hours)

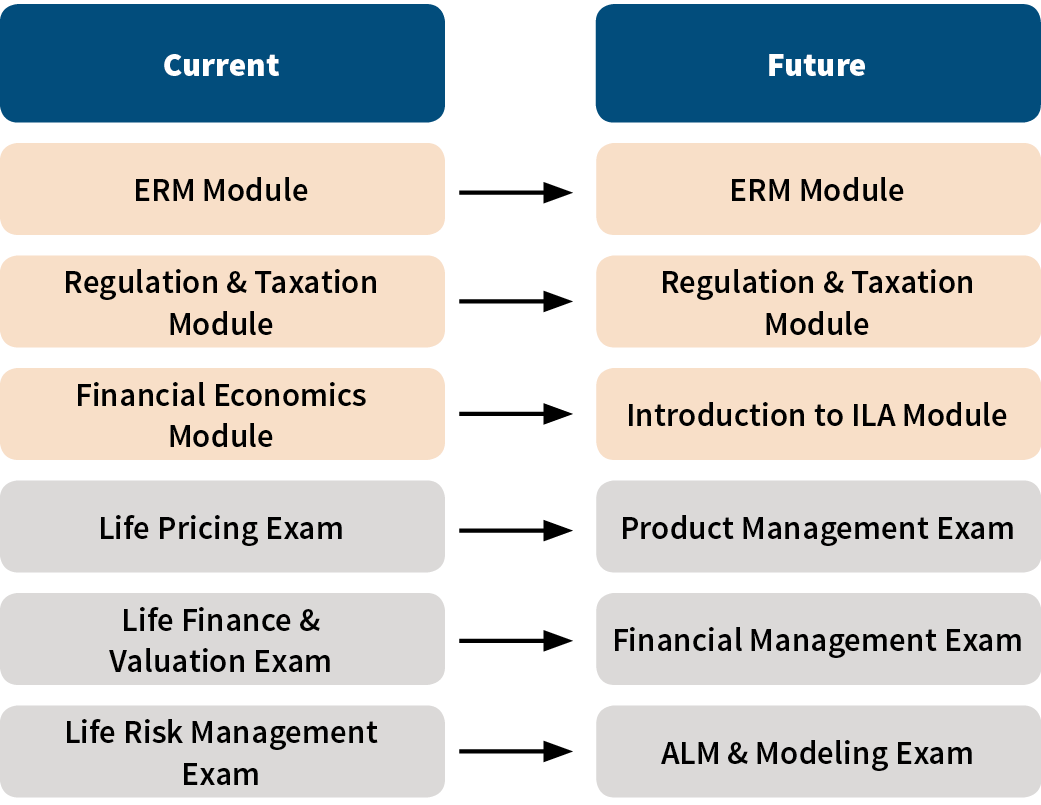

Individual Life and Annuities (ILA) Track

The three exams have been renamed and underwent some minor adjustments in content. In addition, a new Introduction to ILA Module replaced the Financial Economics Module in June 2019 (see Figure 3).

Figure 3: Individual Life & Annuities Track

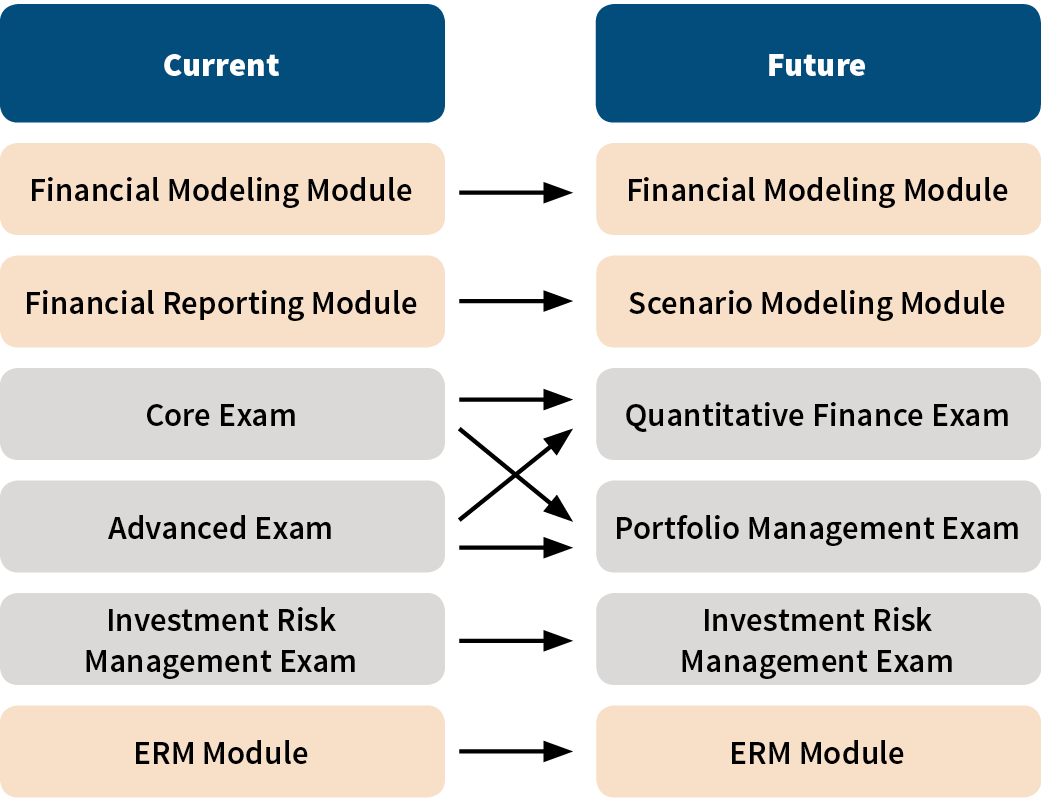

Quantitative Finance and Investment (QFI) Track

Topic coverage will be restructured among the three QFI exams, which will receive new names (see Figure 4). The modules have been created and/or revised:

Figure 4: Quantitative Finance & Investment Track

- Scenario Modeling Module. This is a new module released in June 2019 that replaces the Financial Reporting Module. The Scenario Modeling Module provides an opportunity to deploy RStudio to build simulations, apply variance reduction techniques, and calibrate and validate stochastic models.

- Financial Modeling Module. This module will be revised to cover additional quantitative modeling techniques. It is scheduled to be released in December 2019.

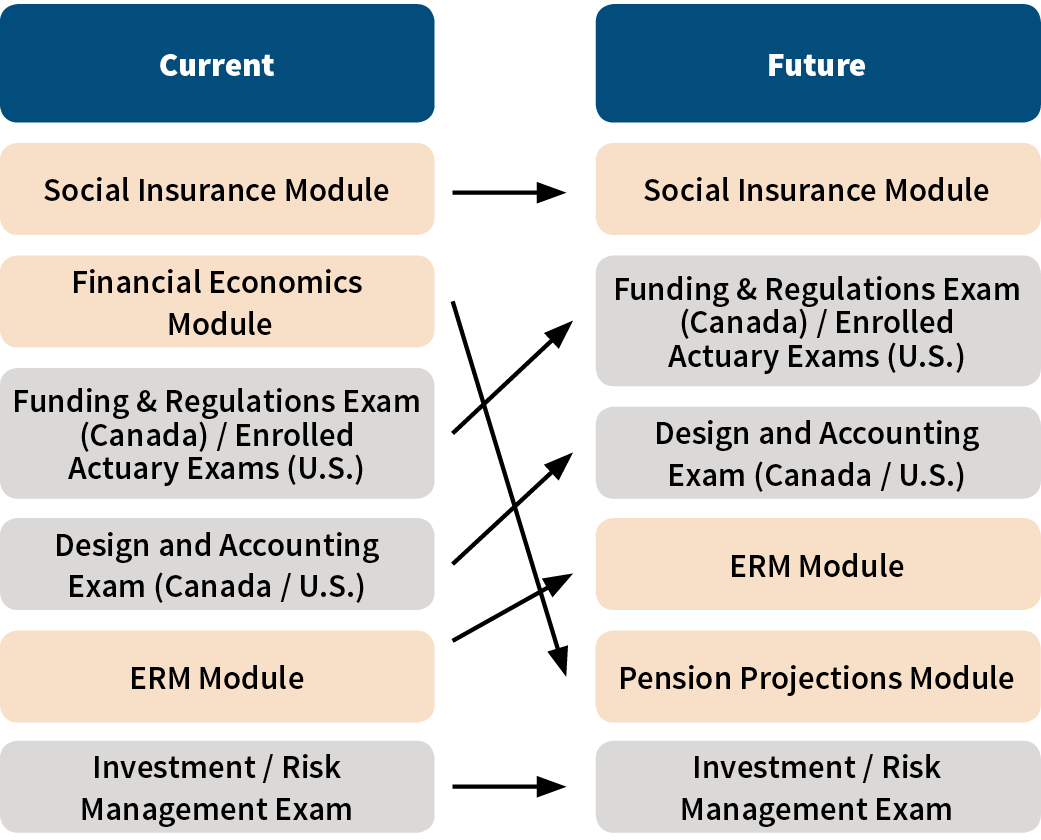

Retirement Benefits Track

A Pension Projections Module, scheduled to be released in June 2020, will replace the Financial Economics Module. Beginning with the November 2020 administration, the Retirement Benefits Track exam syllabi will be revised to reflect adjustments to the ASA syllabus and the new Pension Projections Module, but the changes are not significant enough to require any exam name changes (see Figure 5).

Figure 5: Retirement Track

Looking to the Future

These changes, to both ASA and FSA education, are important to keep the SOA’s curriculum current and ensure actuaries are experts in their areas of practice.

That said, these are not the final changes to the education of actuaries. As we experience greater competition from other professions such as data scientists, and as the profession grows internationally and actuarial subjects evolve, we need to ensure we are keeping the profession and members of the SOA relevant and competitive. This is obviously done through the content of our education. However, another important aspect of education is the “method of delivery.”

This is a particularly exciting area of change to the examination process and can be seen with the launch of the new Predictive Analytics Exam for ASAs. The exam is administered through a formal Prometric testing site that allows for the use of a computer, not the traditional room proctored by an FSA. The computer is a “closed system,” so to speak, that includes several different applications including Microsoft Word and Excel, and RStudio. Candidates use these to complete a project that tests their knowledge of the learning objectives for the Predicative Analytics Exam. This development has been well received by both the candidates and the graders. One can envision a future in which this type of approach also can be used in the FSA exams.

Thus, the closing words are: Stay tuned!

Copyright © 2019 by the Society of Actuaries, Chicago, Illinois.