Identifying Emerging Risks

Early anticipation of the future risk landscape

December 2017/January 2018For public and private institutions alike, a key ingredient for success is the ability to navigate a dynamic risk landscape—one that changes ever more rapidly and often materializes in unexpected ways. These changes modify known risks, create new ones and open opportunities for the insurance industry to reduce, mitigate and transfer risk. Globalization and de-globalization trends, fragmented value chains throughout the entire world, and the growing integration and interaction of digital systems are all drivers of increasing complexity. To protect their clients and themselves against undue uncertainties, insurers and reinsurers need to monitor the evolution of the risk landscape on a continuous basis.1 So as a central part of their foresight activities, they need to scan the horizon for future risks. This entails the implementation of a broad-based enterprise risk management (ERM) framework, which includes the detection and assessment of emerging risks and thinking in scenarios.

Emerging Risks

The International Risk Governance Council (IRGC) defines emerging risks as “new risks or familiar risks that become apparent in new or unfamiliar conditions.”2 Their sources can be natural or human, and often are both. Emerging risks may include new technologies—for example, artificial intelligence (AI), nanotechnology or genetic engineering—as well as economic, societal, environmental, regulatory or political change. While some emerging trends are developing at a slow pace (like demographic changes, societal preferences or cancer research), others can be fast-changing with disruptive potential (like the development of smartphones over the past decade, alternative currencies right now or AI in the future). Slow-moving emerging trends, too, may gain momentum quickly (e.g., medical breakthroughs).

Often, emerging risks are about unclear or changing framework conditions, such as regulatory developments or litigation trends. Thus, while we may think of emerging risks as being primarily entirely new risks (as is much the case with a new technology, such as blockchain or the gene editing method CRISPR3), some are known and familiar risks, but they become new or (re)emerging, as their contextual conditions change. A field like nanotechnology qualifies as an emerging risk, because some risks have been known for quite some time, but they haven’t yet materialized fully. We therefore consider it a latent emerging risk. Some risks are changing their character dynamically. Consequently, they continue to count as emerging risks—the ever-evolving complex of cyber risks is a case in point.

Usually, emerging risks are as of yet unquantified, even though they may have a high impact potential for (re)insurers and for society. The lack of comprehensive data is one aspect of emerging risks’ general nature. That’s to say they are mostly not yet fully understood or researched, and might lead to surprises or shocks. Consequently, the early identification of potential changes to the risk landscape is important. In this context, scenario planning can be a helpful tool to discuss plausible future outcomes as a basis for risk dialogue, risk mitigation measures and business opportunities. To ensure the most encompassing risk culture for emerging risk detection and assessment, it is often necessary to conduct a broad dialogue involving different stakeholders.

Since risk perception varies across geographies, cultures, societies and educational backgrounds, it is only sensible to involve a diverse group of individuals in the emerging risk identification process.

Swiss Re’s SONAR Approach

As a risk knowledge company with many risk specialists, Swiss Re places the internal expert dialogue at the center of its emerging risk detection and assessment process. More than 10,000 employees have access to a dedicated intranet dialogue platform where they can post and discuss potential emerging risks. By posting a so-called “risk-notion,” employees discuss a certain observation, formulate a concern or raise a question to which other colleagues can react. Such “crowd-sourced” signal detection among experienced and knowledgeable employees is a powerful tool. Moreover, automated web analysis can complement it. That said, this latter method is best suited to monitoring and analyzing risk trends already known or their context already well understood.

As part of group risk management, Swiss Re has a dedicated emerging risk management team that hosts the SONAR process.4 This task entails moderating, collating and reviewing the risk notions. So the team acts as a catalyst for emerging risk identification and assessment. In concert with a broad network of experts, it clusters the SONAR posts and discussions from colleagues, enriches them with further research, and develops encompassing emerging risk themes and trends. It then folds in inputs from universities, think tanks and other relevant organizations. One of the results is the annual publication of Swiss Re SONAR: New emerging risk insights. This report is a compilation of emerging risks relevant to the (re)insurance industry.

The emerging risk process encompasses the following steps: risk identification, risk assessment, risk implementation (split into risk dialogue, risk mitigation measures and business opportunities), as well as risk monitoring and control.

To deepen the understanding of a particular risk, interactions with external stakeholders are most important. Discussions with clients, political authorities and non-governmental bodies are essential. Independent organizations like the IRGC are valuable partners. One platform to exchange information with industry peers is the Emerging Risk Initiative of the Chief Risk Officer’s Forum, which so far includes mainly Europe-based insurers and reinsurers. A broad, diverse and robust risk dialogue helps to overcome blind spots, fosters risk awareness, and supports adequate risk assessment and mitigation.

At the time an emerging risk theme is highlighted, it is often not yet clear how relevant it will become from an insurance standpoint. This may be due to the nature of a risk, the uncertain development of contextual conditions, or merely because the risk assessment proves inadequate in the longer term. If a risk has been highlighted early enough, timely risk mitigation is possible and business opportunities are enabled. When Swiss Re’s SONAR report was published for the first time in 2013, it featured important vulnerabilities, including supply chains or the potential for prolonged power blackouts. Today we can see the relevance of early detection of these emerging risks for effective risk mitigation. Hence, scanning the horizon to monitor the dynamic risk landscape and detecting new or (re)emerging risk trends has become a key element of ERM in the (re)insurance sector.

The 2017 SONAR report—Outlook and Analysis

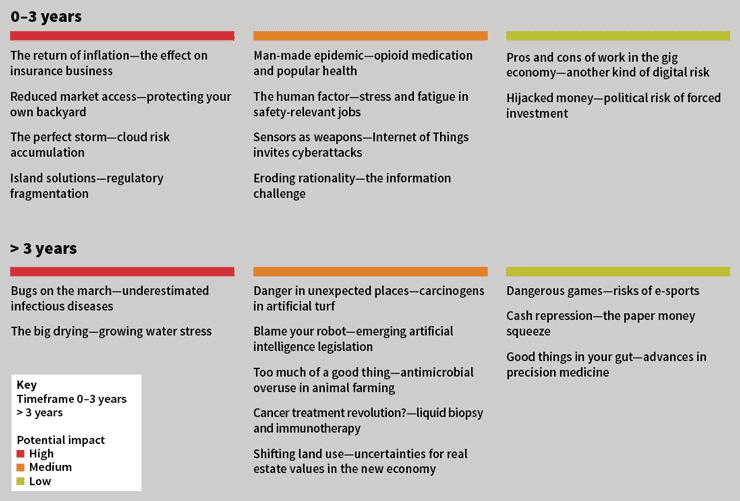

What emerging risks does this year’s SONAR report see developing on the horizon? See Figure 1.

Figure 1: Emerging Risks Themes by Potential Impact and Time Frames

Source: Swiss Re SONAR: New emerging risk insights, June 2017. This list is not a comprehensive list of emerging risks. It reflects emerging risks relevant to the insurance industry and discussed within Swiss Re during the past year.

Risks related to the business environment combine both high impacts and short timelines. These risks include financial market risks, market access restrictions, regulatory fragmentation and digital infrastructures.

The Return of Inflation—The Effect on Insurance Business

A pick-up in inflation is noticeable in important markets such as the United States or the United Kingdom, potentially reducing investment returns of insurance businesses, as well as affecting long-term liabilities in casualty and life on the claims side. Unclear development of monetary policies means there is a lot of uncertainty tied to this issue.

Reduced Market Access—Protecting Your Own Backyard

National protectionism is growing significantly—recently also in mature markets. Free trade, open markets and financial globalization are increasingly under pressure, while governments are favoring local markets and national champions. This affects operations of multinational (re)insurers, which find risk diversification, fungibility of capital and growth plans undercut.

Island Solutions—Regulatory Fragmentation

As regulatory coordination activities among G20 countries become increasingly difficult, multinational insurers increasingly are facing regulatory fragmentation, including a lack of international standards. This, in turn, increases operational costs and the compliance burden. This makes it harder to provide inexpensive insurance covers, and it becomes more difficult to close protection gaps.

The Perfect Storm—Cloud Risk Accumulation

Tech vulnerability—the more widespread use of information technology (IT) server solutions based on cloud and cloud-of-clouds services—comes with a variety of risks: cyberattacks, technical failures, prolonged outages, data inaccessibility and significant accumulation risks (due to a small number of providers). This may affect insurers’ operations, but more important, it will affect operations of insured parties. Given the volumes of data involved, service interruption poses potentially significant and catastrophic risks.

With high impact, but a time frame of more than three years, the SONAR report identifies the spread of infectious diseases and growing water stress as significant emerging risks. These risks have increased in complexity and become more dynamic, tying environmental and social dimensions with technological and economic factors.

Bugs on the March—Underestimated Infectious Diseases

Risk factors of infectious diseases, triggered by changes in land use or agricultural practices, changes in human demographics and society, international travel and trade, poor population health, medical procedures, pathogen evolution or climate change, are altering and interacting with one another more. This development facilitates an outbreak and proliferation of infectious diseases. For insurers, life and health pricing becomes more challenging. A major epidemic or pandemic also would affect financial markets and property and casualty insurers.

The Big Drying—Growing Water Stress

Farming, industrial use and household consumption exacerbate water shortages in a growing number of regions (e.g., California, the U.S. Midwest, Southern Europe and Mediterranean, South Africa). Severe water shortages also have an adverse impact on food production and can undercut oil and gas production from hydrofracking. The insurance consequences can range from increased loss burden in agricultural and energy lines of business to a surge in property and casualty losses caused by wildfires. In extreme cases, water shortages also can destabilize the political and social fabric, leading to more civil unrest, war and migration.

There also are many relevant risk topics mentioned among medium- and low-impact risks that might become more important developments in the future. We highlight two additional emerging risks here.

Too Much of a Good Thing—Antimicrobial Overuse in Animal Farming

Already highlighted in previous years as an emerging risk of antibiotics overuse, antibiotic resistance is a well-known worldwide problem, primarily caused by excessive use of antibiotics, for both human and animal health. Extensive proliferation of antimicrobials in the production of livestock and in aquaculture is a key factor in the spread of antimicrobial resistance (AMR). AMR in livestock and aquaculture could lead to higher-than-expected losses from animal diseases.

Cancer Treatment Revolution?—Liquid Biopsy and Immunotherapy

Rapid advances in cancer screening and treatment methodologies promise benefits to cancer patients, and they also mean that more cancers are detected at an earlier stage. As such, liquid biopsy allows for much earlier detection, while immunotherapy allows for better immunization against cancer. Better screening and detection methodologies increase the risk of anti-selection for insurers, making risk pooling more challenging and increasing pricing risks.

Emerging Risk Insights More Significant for ERM

It lies in the nature of emerging risks that not all of those identified will actually materialize. By reviewing previous work on emerging risks, one can keep track of how certain risks became relevant over time or not. Looking back, cyber risks or sovereign debt crises were spotted as emerging risks almost a decade ago. And these risks are still evolving in many ways. Such “backtesting” can be useful to improve an organization’s methods to identify, assess, mitigate and monitor emerging risks.

(Re)insurers use emerging risk insights for their risk mitigation strategies within the wider risk management, underwriting and asset management departments, but also as a basis for the exploration of future risk pools and client solutions. While most such analysis is still done on a qualitative basis, the impact of certain emerging risk scenarios also can be estimated quantitatively. In many companies, emerging risks are becoming not only an integral part of a proactive risk management culture, but also an integral part of firms’ ERM capabilities.

References:

- 1. Raaflaub, Patrick. “Risk Detection by Employees.” Vontobel Portrait. 2016. ↩

- 2. IRGC Guidelines for Emerging Risk Governance. 2015. ↩

- 3. CRISPR stands for Clustered Regularly Interspaced Short Palindromic Repeats. CRISPR technology has been discovered and developed as gene scissors. This molecule is able to target and cut the genetic material of any organism in a precise and efficient way. This technology is expected to have a major impact on life sciences. ↩

- 4. SONAR stands for Systematic Observation of Notions Associated with Risk. The SONAR process facilitates the identification and assessment of emerging risk notions in order to reduce surprises, enable risk mitigation actions, seize opportunities and foster risk awareness. ↩