In Pursuit of Bi-Hemispheric Happiness

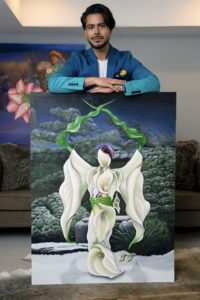

Q&A with Haris Sardar, FSA, FCIA, Canadian actuary and artist

Muskokan Dream: c. 2020; Oil on gallery-wrapped canvas; 84 x 60 x 2 inches

Images courtesy of Haris Sardar

When embarking on the arduous journey of qualifying and then practicing as an actuary, many give up on personal dreams and passions. Haris Sardar, FSA, FCIA, was one of them—until a creatively fortuitous visit to the crypt and museum of famous artist Salvador Dalí in Figueres, Spain, reignited his passion to paint again.

Now he is both a practicing actuary and a visual artist, creating mesmerizing oil-on-canvas pieces that have become part of collections worldwide. Currently, Sardar is preparing for a solo booth exhibit at “the world’s original fine art trade show,” Artexpo New York, March 30–April 2 at Pier 36 in Manhattan.

In this Q&A, Sardar shares his pursuit of bi-hemispheric happiness as well as words of encouragement to those with an actuarial and artistic frame of mind.

You went to high school in Pakistan and studied science and arts. How did that lead you to becoming an actuary?

I was born and raised in the magical city of Lahore, Pakistan, where I also completed my American high school diploma along with the British General Certificate of Secondary Education (GCSE) O-level qualification. To read how much I swoon over Lahore and my upbringing, please see my interview with Spencer Magazine.

I was very lucky to attend the International School of Choueifat (ISC), one of the finest educational institutions in Pakistan, with century-old roots in Lebanon. The story of ISC is one of perseverance, vision and determination. Established in Choueifat in 1886 as a school for girls, its founder was an Irish woman who was teaching in the area and a Lebanese educator. This was at a time when most girls were denied basic educational rights. I find it ironic that, more than 100 years later, I still find it necessary to paint about female empowerment.

At ISC, I was assigned to write 11 O-levels exams (6 is minimum and typical), which means that for the high school diploma, I studied all subjects, including advanced mathematics, chemistry, physics, fine arts, theatre, dance and more. I don’t think I’m the smartest person in the room, but you better believe I’m among the most hardworking, and I excel at most things I take a crack at.

At the time, I thought the most logical career in pursuit of bi-hemispheric happiness was becoming an architect. What better career choice to combine innate mathematical ability with a passion for creativity and the fine arts? To this day, I have a very soft spot for the likes of Zaha Hadid, Frank Lloyd Wright, Frank Gehry, Nayyar Ali Dada and others. However, my goals also included finding the fastest route to financial independence and exploring academic opportunities in the West.

Naturally (not!), like all smart and popular kids in school, the quickest way was to become the next Wolf of Wall Street—or Bay Street for me, as international tuition to American universities was exorbitant in comparison to Canadian tuition. So, that was that. I was to study my hardest and get into a Canadian university with a great business program.

Just like that, I did very well in the GCSE O-level board exams and had a stellar academic record in high school. I was accepted at various universities even before formally completing the British curriculum of A-Levels at ISC.

I ended up on the not-so-sunny shores of the University of Western Ontario (now Western University) with my best friend in tow, brother-in-waiting and the best stepper the Richard Ivey School of Business had ever seen. There it was, the building of my dreams, offering the business courses not-so-much of my dreams, only to open the school job bank website to see this “actuary” title dominating the charts. After a brief counsel from my older brother, industry research and the disappointment of the dog-eat-dog attitude of business school, it was clear that I was going to be an actuary. But what was not clear at the time was the sacrifices I would need to make to qualify and have a successful career. My heart would often drop at the thought of never being able to see a blank canvas again.

You describe your role at the Colleges of Applied Arts and Technology (CAAT) Pension Plan as nontraditional. Tell us more.

I am the director of Pension Solutions at the CAAT Pension Plan. As most Canadian pension actuaries know, CAAT is one of the larger jointly sponsored defined benefit (DB) pension plans in Canada with $18 billion in assets and 85,000 members across provinces, industries and unions.

My role is nontraditional because CAAT and our products are nontraditional. After the decline of DB pensions starting in the ’80s, there has been no new lifetime pension offering introduced in the North American market. CAAT’s award-winning and innovative DBplus pension plan is revolutionary, as it provides a secure lifetime DB pension at pre-determined employer and employee contributions. Think of it as a culmination of the best of both DB and defined contribution (DC) worlds. Given the enabling legislation and CAAT Pension Plan’s unique funding policy and benefit design, employers across Canada are now able to join the plan. In a nutshell, my goal is to increase the knowledge around CAAT and provide pension coverage to as many Canadians as possible.

Therefore, my actuarial position is nontraditional because, first, I work for the benefit of plan members and the board as opposed to shareholders of a company. Clearly, the motivation for results is different when working for a not-for-profit. Second, I am passionate about the social impact of the job and how it changes the retirement landscape of Canada. Last, it makes the best use of my technical, artistic (and gregarious) abilities to achieve these stated goals.

In my role, instead of being behind powerful actuarial software and spreadsheets, you will find me spreading the CAAT mantra at various industry conferences and thought leadership speaking engagements and by actively nurturing relationships by forming strategic partnerships and plan champions.

Where do you draw artistic inspiration from? How would you describe your art? What are your values as an artist? What do you want to convey through your artwork?

In the most secular of terms, my main inspiration comes from the ultimate creator. You will always find an element of nature in my paintings, such as flowers, water, reflections, clouds, figures and so on, though inspiration is also drawn from film, television, dance, Sufi poetry, music and fashion.

I would describe my art as unique, original, colorful, impactful, surrealistic, thought-provoking, large-scale and detail-oriented.

I realize that my values as an artist come from a very financially secure position, and I have the privilege of practicing on my terms without any pressure. Art is about originality, dedication to the craft and the sheer hard work that goes into producing original works. There is no gimmick, blatant plagiarism, mass production nor a quick buck that needs to be made. Art is my passion and my voice, and creating it is the closest experience to divinity for me. Therefore, the practice and its business need to be treated with the same level of respect.

There are various social, religious and philosophical attitudes my art conveys. I want to tell a visual story of a teenage Muslim-born boy’s immigration to Canada from Pakistan amid 9/11. I want to tell the story of my secular beliefs and the ideology of the oneness of humanity without the divide of manmade political borders, religions, races, sexuality or cultures. Given the mammoth-sized personalities of the leading women in my life, I want to paint about women’s empowerment.

How do your actuarial and artistic sides interact? Do you ever worry that you won’t be able to find balance and maintain both?

My actuarial and artistic sides interact with each other continuously. I can bring creative ideas to solve the most complex mathematical conundrums and at the same time bring rigorous analytical problem-solving when approaching a blank canvas, planning paintings, preparing for a show or even running the business of art. Thinking back, why would a high school student make a poster of Pascal’s triangle floating underwater with marine life as the binomial coefficients? I guess the answer is: why not!

I really do require both expressions to truly live a happy life and satisfy the need to effectively communicate with the world. Also, math brings me back to reality after being lost in the vortex of surrealistic paintings, some of which take more than 450 hours to produce. On the flip side, producing art enables me to rest the left side of my brain and refuel for the next day.

You have a show coming up at Artexpo New York with the Redwood Art Group in Manhattan, opening March 30. How are you preparing for it? What can we expect to see? How can other actuaries support you as an artist?

I am happy to report that at the time of this interview, I have just finished the last and the centerpiece of the show, Flowerin’ Riri – 2015 Met Gala. However, the organizers of the show have been very kind and extended my booth space at no additional charge, thus I potentially have the space (not sure about time) to paint one more.

Apart from that, there are still a lot of logistical items to finalize such as crating, shipping, customs, boarding and lodging—as well as the preparation of collateral marketing materials, wardrobe choices, and organizing family, friends, art advisors and collectors who want to attend. Fortunately, my spouse and sister manage the art practice, so I do have help.

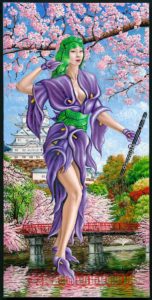

For this show, viewers can expect to see a sample of the breadth of my artistic abilities. We will be showcasing paintings from the Pre-packaged Religion series, which are architectural depictions of my personal views on the oneness of humanity. These paintings tend to be more mathematical and geometrical.

In addition, paintings from the Flores de Primavera (Spring Flowers) collection will be presented, which play a more playful note while also serving as an ode to iconic beauty and the strength of the feminine.

My main goal as an artist is to have as many eyes on the work as possible. I don’t have to tell actuaries about the power of numbers. Therefore, you all can support me in many ways, and I am grateful to those of you who are already doing so.

The show runs on the lower east side at Pier 36 NYC from March 30–April 2. I would love to have you all come if you are in the area. Bring friends and family!

What advice do you have for those who feel like they need to give up their passion in pursuit of an actuarial career?

My biggest advice would be to first know what your passion is and what you want. Once there is clarity around the absolute constructive love of your life, what you were born to do, what you wake up for even before the alarm goes off and what feels like living and not working, then you can devise a plan for your figurative unreduced immediate retirement. Somewhat like the Japanese concept of ikigai.

Don’t get me wrong, at times I felt like I was digging myself a deeper hole while going through the actuarial exam process, but I am 1,000% happy I stuck with it and completed the designations.

In any room, the word “actuary” instantaneously adds a level of respect and recognition. Being an actuary has given me the ability to secure retirement for thousands of people while providing financial freedom to approach the art practice from a position of strength. Our supportive community and actuarial societies have always provided an elevated platform, just like the spotlight provided by this article.

My actuarial career has been monumental for the maturity of my art practice, and I would never change the chronology of how the two careers have developed. I promise you, if you can get through the exam process while working full time, your bandwidth to produce is two times that of a regular person. Therefore, believe it, you can achieve anything once you know what it is and set your mind to it.

What does the future hold for you? What are some things you want to accomplish?

Oh, asking an actuary to predict the future? I might as well bring out my tarot cards and crystal ball.

On the actuarial end, the plan is to keep supporting DB pension coverage for all Canadians. It is a once-in-a-lifetime opportunity to be part of a sustainable and growing not-for-profit DB pension plan, and I want to make the greatest impact possible. As an actuary, it is my humblest duty and honor to make a difference to not only combat poverty in retirement on a national basis but also alleviate the impending pressures on our great Canadian social security systems.

To give back to our professional community, I plan on continuing to volunteer on the SOA Fellowship level exam academic committee and look for more public speaking engagements at conferences.

On the artistic end, we will see what the New York show brings, and I feel extremely positive and excited about it. From there, I plan on clearing out my commissioned work lineup and then starting to collect for the next showing, perhaps in Miami, during Art Basel week, with a blue-chip gallery or on my own.

The future objective for the art is to paint about political and social injustices with the hopes of changing hateful and rigid attitudes and beliefs, as well as normalizing mental health afflictions. I also want to raise funds for charitable causes close to my heart by donating works for auction and direct sales revenue. Eventually, the intention is to get the work displayed in public museums and other easily accessible places. I truly believe art is always owned by the public and should be displayed for the public.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Copyright © 2023 by the Society of Actuaries, Chicago, Illinois.