Navigating the Changing Landscape

The applications of economic capital models in multinational reinsurance

December 2015/January 2016One of the greatest challenges that actuaries face is the sheer size and complexity of present day multinational insurance and reinsurance groups. Pricing, valuing and reserving for individual products and lines of business are core parts of the actuarial skill set. Planning and forecasting aggregate expectations for legal entities, business units and overall group results are also important management tools. More recently, economic capital modeling has also become an increasingly important best practice.

The aftershocks of the Great Recession, which began in 2008, are still being felt around the world. Many in the global public and regulatory community today remain skeptical of the ability of current market and regulatory frameworks to understand and monitor the larger and more complicated financial, insurance and reinsurance groups. Both the industry and regulatory communities have been working to strengthen perceived weaknesses.

At the time of writing, more than 30 states have adopted the National Association of Insurance Commissioners (NAIC) model law on Own Risk and Solvency Assessment (ORSA). Additionally, the recent Actuarial Guideline 48 now clarifies regulatory expectations for many life reserve financing captives. The Federal Reserve Board is actively developing approaches to satisfy its mandate to assess and regulate the capital adequacy of the largest systemically important insurance groups. The NAIC is moving forward with the development of a group capital standard. Internationally, Solvency II in Europe is coming into force, and the International Association of Insurance Supervisors also is pursuing a global capital standard.

This is clearly a challenging time for companies with multinational operations that are faced with navigating the changing landscape while not losing sight of their primary goal of delivering value to clients by improving the financial security of many individual lives around the world in a cost effective way. As with any change, there is a strategic advantage for those companies that have a clear view of the underlying economic risks and rewards, and those who are able to react to changing market and regulatory circumstances in a swift and flexible way.

Economic Capital

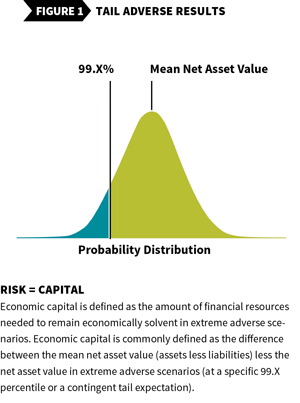

Economic capital refers to the amount of financial resources needed to remain economically solvent in extreme adverse scenarios. It usually refers to a company or firm’s own internal view as opposed to a specific regulatory or rating agency framework. Actuaries play a critical role in the assumption setting, implementation and interpretation of economic capital models.

There is currently a wide range of practice for implementing economic capital models. The following examples are illustrative of the elements a company needs to consider:

- Coverage scope: Economic capital reporting capabilities across various levels

of an organization, including legal entities, business units and the overall group perspective, are now commonly expected. Additionally, a mature economic model will consider all material quantifiable risks, including operational, biometric, property and casualty, market, etc. However, it can be appropriate to explicitly exclude certain risks to facilitate implementation, or when the additional modeling effort would not necessarily improve business decision-making. - Confidence measure: The level of confidence and the risk measure utilized are both key decision points. For example, European Solvency II compatible internal economic capital models must calculate a 99.5 percent confidence level around the net value of assets less liabilities (the value at risk or VaR). U.S. domiciled groups have greater flexibility to choose other confidence levels and metrics, such as projected long-term surplus, contingent tail expectations (CTEs), etc

- Accounting basis: A company may be able to choose its economic capital assessment valuation based on U.S. Statutory, GAAP/International Financial Accounting Standards (IFRS), Solvency II or another valuation basis. Other companies may have less choice based on the applicable regulations.

- Exit-value versus run-off value: A key consideration is whether the accounting and valuation basis used is fundamentally an exit-value approach or a run-off going concern valuation. An exit-value approach attempts to measure a company’s current market value consistent with the sale of component business and risks to a third party. Solvency II is based on an exit-value methodology. Alternatively, a run-off approach assumes a long-term horizon; U.S. cash flow testing techniques are generally consistent with a run-off approach.

There is currently no general consensus on the “best” economic capital methodology. It is likely that there is no single best methodology for all purposes.

There is currently no general consensus on the “best” economic capital methodology. It is likely that there is no single best methodology for all purposes.

Those multinational reinsurers domiciled within the European Union are now subject to Solvency II from both a Group and European entity regulatory perspective. Those companies use their Solvency II internal models in many enterprise risk management (ERM) activities. Internal economic capital models often have their roots in older pre-existing processes such as asset-liability management models or dynamic financial analysis used for aggregate exposure management. The work to expand these models into groupwide holistic economic capital models generally progressed over the last decade in preparation for Solvency II in Europe, and now ORSA and other requirements in the United States. Over time, these economic models also have become embedded in various business applications with, not surprisingly, some significant challenges along the way.

Benefits and Applications

The remainder of this article selectively overviews the range of applications in which an internal economic model has proved valuable, as well as some of the most significant challenges.

Regulatory Requirements

Around the world, economic capital work is being used to satisfy increasingly common local entity regulatory ORSA and economic balance sheet requirements in some form, including within the United States, China, Australia, South Africa and Europe. Some regulatory frameworks permit the use of an internal economic capital model as a company’s regulatory capital basis. This takes significant additional work to document and justify methodologies and assumptions, but it is particularly important for companies, such as reinsurers, where standard formulas designed for direct writers don’t apply well.

Common Benchmark

Multinational companies are subject to a wide variety of regulatory regimes and rating agency assessment models. These different regimes are generally not directly comparable. They also generally do not measure all risks with sufficient flexibility, granularity and transparency of underlying assumptions to use for decision-making on different products around the globe. U.S. GAAP and IFRS provide consistent accounting standards on the emergence of earnings but do not provide a common standard for evaluating relative risks.

The economic model is a primary tool in allocating capital to transactions and business lines. Risk equals capital in effective internal economic models. The economic capital model provides a common measuring stick that is used to compare and contrast risk and the risk-adjusted performance of individual transactions or entire business lines as different as property and casualty and life products.

Risk Management

Economic capital models are one of the necessary elements of a mature enterprise risk management framework for insurance and reinsurance companies. Enterprise risk management includes the identification, quantification, monitoring and steering of material risks across the organization. The common benchmark provided by a groupwide economic capital model results in a consistent approach to quantifying market, biometric, policyholder behavior, and property and casualty risks in order to consistently aggregate and demonstrate compliance with the organization’s stated risk appetite for those risks.

It may be helpful to think of risks in terms of three categories:

- Core insurance and market risks taken purposefully to make a return on capital;

- Operational risks that must be managed within an acceptable cost level; and

- Strategic market and regulatory risks that the rules of the game can change.

Economic capital models, in my experience, are best applied to the core business risks, and are less useful for managing operational and strategic risks compared to other techniques.

Diversification—Input or Output?

Insurance works fundamentally by pooling and diversifying risks. The quantification of diversification effects is simultaneously one of the most challenging and valuable elements of an economic capital model. Quantifying and demonstrating the impact of diversification to internal and external stakeholders is strategically important to a multinational reinsurer that does business in markets around the world and participates in a wide range of risks.

Less sophisticated or mature economic capital models treat diversification as an input, i.e., as the top-down assumed correlations between different aggregate risk types. The goal of more mature economic models is to quantify diversification as an output, derived from bottom-up modeling of interactions and dependencies between individual asset and liability cash flows for many specific scenarios representing many combinations of risk drivers. The use of assumptions and judgment in the bottom-up approach is still inevitable, but the resulting diversification estimates can be meaningfully more credible and useful in decision-making.

Rating Agencies

At least one of the major rating agencies now gives credit to internal economic capital models that meet its published standards in its rating assessments. For example, ultimately setting the target required capital for a given rating as a weighted average of the rating agency’s model and the company’s internal model. The cost of capital is one of the most significant costs an insurance or reinsurance company incurs, so this can be quite valuable.

Pricing Nonproportional Risks

The internal economic capital model also plays a role in evaluating remote risk financial reinsurance solutions and other nonproportional risk covers. Internal economic capital models often use many scenarios to generate a full probability distribution of results, not just the 99.5 percent confidence level required by Solvency II. This is particularly useful for pricing and evaluating the relative attractiveness and potential losses for nonproportional risk transactions. For large bespoke financial transactions, expressing the potential risks and mitigating factors in the common language of an internal model can and does facilitate the internal review and approval process, which in a large organization can involve a significant number of internal stakeholders.

Retention management is another case in which an internal economic model can and has been utilized to manage nonproportional risks. The direct insurance industry looks to reinsurers to provide capacity for large individual cases or unusual risks.

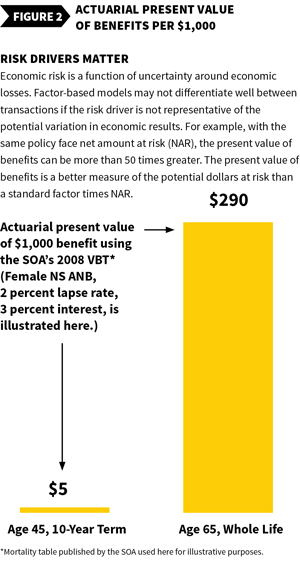

Another Pricing Example—Mortality Risks Are Not All the Same

It is relevant to note that even for more traditional pricing exercises, an internal view of the economic risk and capital is important. An example from the traditional life reinsurance space illustrates the point. The U.S. regulatory and typical rating agency models assign capital as a factor times the total amount of insurance in force or exposed. These models can be viewed as appropriate for their designated purpose. However, when evaluating a specific transaction, it is important to remember that the real risk is a function of the actual dollars that could be paid out in claims. For the same policy size, the actuarial present value of claims for a whole life product issued to a 65-year-old can easily be 50 times greater than the actuarial present value of claims for a 10-year term product issued to a 45-year-old.

Additionally, it is not unreasonable to assume there is greater uncertainty around the longer duration policy in both relative and absolute terms. For example, the eventual profitability of the whole life policy will be more dependent on future mortality improvement and long-term ultimate mortality developments than the 10-year term policy. Pricing that is based on a more dynamic economic capital basis instead of a constant factor per 1,000 can help avoid the situation where you win your losses; that is to say help avoid being the most (and/or least) competitive where you shouldn’t be.

Asset-Liability Management

From a practical point of view, asset portfolio managers and actuaries do not always speak the same language. The internal economic capital model can be applied here to facilitate coordination in at least two important ways. First, the implementation of the internal model may serve as a standardized source of liability cash flows that can be used to better measure and manage asset-liability mismatches. Secondly, quantifying and aggregating both asset and liability risks using a common methodology and confidence measure improves holistic decision-making. This is essentially what the “E” in ERM is all about.

Management Goals—Alignment with Value Creation

The importance of aligning management’s goals and compensation with long-term value creation on a risk-adjusted basis is commonly understood. Regardless, to the extent there is no or little link between management goals and compensation and a company’s internal economic model, then I believe it is safe to say either the model is still immature or there is a potential gap in the company’s stated view of economic risks and management’s incentives.

External Investor Relations

It is not uncommon for insurance companies to utilize an embedded-value-reporting basis, including both new business and the change in the value of in-force business, as one element of value measurement for internal and external purposes. This is more commonly reported to external investors by international companies but may be reported externally by U.S.-based groups as well. It now appears likely in Europe that many companies will replace their current embedded value reporting with generally equivalent value measurement from their Solvency II reporting—perhaps with modifications to the prescribed Solvency II cost of capital and capital allocation requirements. It obviously is helpful to communicate a clear strategy for deploying shareholder capital to generate returns on a risk-appropriate basis.

Challenges

The potential benefits and applications of an internal economic capital model do come with significant costs and challenges, including:

Balancing Regulatory and Commercial Interests

One significant challenge is the inherent conflict between regulatory and management purposes. In any area of evolving products or markets, it is naturally in the regulators’ interest to err on the side of conservatism. For those actuaries practicing within a company’s own management, however, there is an obligation to pursue the shareholders’ commercial interest simultaneously with securing the policyholder obligations.

One way to balance this is to clearly separate within the economic capital model best estimate liability values and the capital and liability margins for risk. Then the actual dollar amounts of the provisions for risk and uncertainty are transparent. As an example, this is not transparent in current GAAP or IFRS reporting for insurance contracts, as the final dollar amount of the provisions for adverse deviations in valuation assumptions is not easily visible to internal stakeholders or external investors.

Market Volatility Versus Long-Term Nature of Insurance Contracts

One of the primary purposes of an economic capital model is to provide transparency to management and stakeholders of the current inherent net value and adequacy of assets over liabilities. However, the financial markets are notoriously volatile. One of the primary benefits that long-term insurance contracts provide to society is increased certainty and security when it is needed the most. Under immense pressure from industry, a volatility adjustment option was included in Solvency II late in the game to partially offset asset mark-to-market within liability discounting. Regardless, many would argue that significant volatility inappropriate to the long-term nature of liabilities is still likely. This is a difficult issue with vocal proponents and critics on both sides. There’s no current consensus, but one potential tool would be to clearly separate realized versus unrealized changes in value when quantifying and explaining results. By unrealized changes, I’m referring to future results that have not yet materialized or been crystalized and potentially can still be influenced by management action.

Black Box Syndrome

If the model and results are not clear, understandable and actionable, then management and other stakeholders cannot and will not rely on the conclusions for decision-making. It can take years to overcome this kind of “black box syndrome” hurdle. It is incumbent on the actuaries and other experts involved in developing and implementing an internal economic capital model to resist the urge to add unnecessary complexity. The importance of presenting and communicating the methodologies and results in a clear way to address actual business issues, provide context for existing management metrics, and support existing corporate goals and strategy cannot be overstated.

Logistics and Operational Complexity

It probably goes without saying that a groupwide internal economic capital model for a large multinational organization is a logistical and operational challenge. Inputs and computations are needed from across the organization for assets, liabilities and various interactions. The best advice that comes to mind is Albert Einstein’s admonition to “make things as simple as possible, but no simpler.” Consider ways to start with existing questions and needs, and then plan ways to grow systematically but organically from there. In the long run, the tool will be more useful and practical to the extent it is embedded and aligned with existing processes and people.

Remember What It Is Not

Especially for those closest to the economic capital model, it is important to remember what it is not. Regardless of the sophistication, it’s just a model and we must ultimately remember that no map should be confused with the actual territory. Even the best economic capital models are blunt instruments in many cases, appropriate at a block or entity level but not always appropriate for individual transactions or specific situations. Economic capital models are usually not as effective as other techniques for managing liquidity and collateral related risks. Liquidity is pass-fail; you either have it when you need it, or you don’t. Regulatory, commercial and other rating constraints are both real and critically important. Finally, techniques will continue to evolve and no model can necessarily quantify the range of all possibilities.

Conclusion

Economic capital modeling capability appears to be moving quickly from an emerging area of practice to an expected industry standard. A combination of commercial and regulatory developments is driving this trend. There is a range of applications as well as challenges that need to be carefully considered. The real opportunity to add value to the business, clients and policyholders makes this an exciting time to be practicing as an actuary in economic capital, risk management and related areas.