A Resilient Future

Managing risk in an interconnected world

May 2022At the time of this writing (early April 2022), it has been more than five weeks since the horrific events in Ukraine began. It is unclear how or when the conflict will be resolved, but it is already evident that the aftermath will be felt all over the world. As countries move to provide humanitarian support and impose sanctions, the human and economic pain will be significant.

It is also just over two years since people around the world radically changed the way they live and work in response to COVID-19 spreading rapidly from a province in China. The global pandemic required governments to intervene in economies in unprecedented ways to protect jobs and keep businesses afloat while also investing significant resources to fight the disease and save lives.

Both the war in Ukraine and the origination of COVID-19 are reminders that events “somewhere” in the world can quickly lead to local effects “everywhere” in the world.

The Challenges of Interconnectivity

The world is increasingly interconnected by virtue of rapid international travel, digital communication and a significantly integrated global economy. For those who need to make predictions about the future, such as actuaries, this poses a significant challenge. We historically have used lessons from the past to estimate what might happen in the future. Typically, we try to construct a model by looking at historical trends of a particular variable that we believe will provide a good forecast of future behavior. But inherent in this logic is an assumption that the past is a good indicator of the future. Unfortunately, this is increasingly not true.

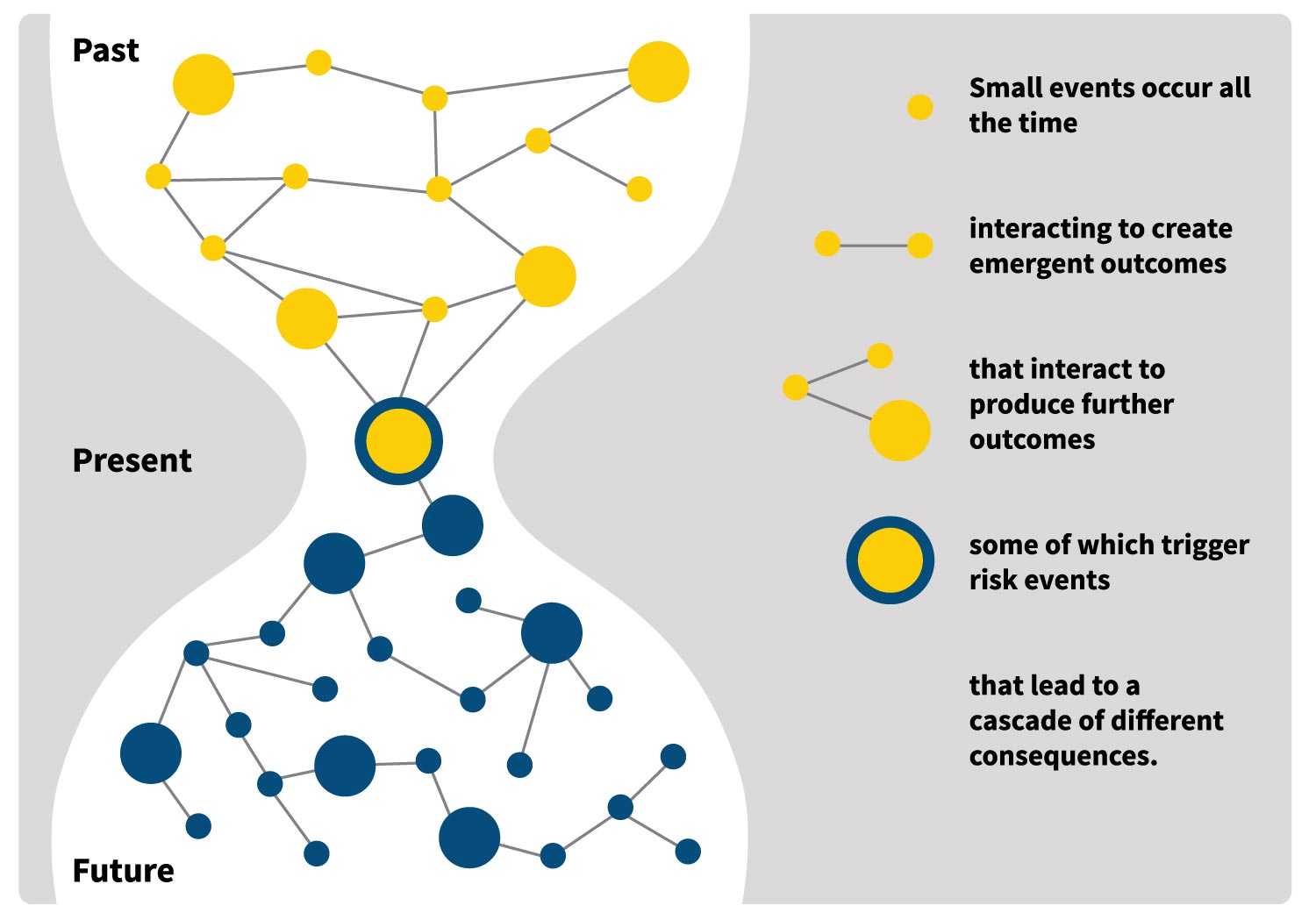

If we consider how risk events unfold in reality, they usually occur through a sequence of interacting factors (see Figure 1). For example: A control does not quite work as intended because the usual supervisor is not available, and coincidentally a staff member has unintended access to a system from which they are able to extract personal information. On any other day, those conditions might have been different and resulted in another outcome. The reality, therefore, is that risks emerge as a result of a complex series of interactions among a large number of factors, and small changes in conditions can lead to significantly different risk outcomes.

Figure 1: Path to the Future

Source: Milliman

Risk events also often involve active participants who learn and adapt their behaviors accordingly. Cyber is a good example—the attacker generally is trying to outthink their adversary and stay one step ahead. All of this means that past performance is not necessarily a reliable predictor of the future. There are too many things that can be subtly different, leading to hugely different outcomes.

Key Considerations

So, how do you make sense of such apparent, complex uncertainty? A first step is to look at the world as a complex adaptive system rather than as a set of adjacent linear trends. Once you embrace the interconnectivity and nonlinear behaviors, it is possible to create more realistic theories about emerging trends and their ongoing development. All models and scenarios are only an approximation of reality—retaining the context of each factor enables a richer narrative to be built for scenarios and a more complete set of behaviors to be included in models.

Another consideration is that the world is composed of multiple interconnected systems that often move at different speeds. We generally expect things to move more slowly at a societal level, for example, than in our workplace. However, sometimes a slow-moving system can experience a tipping point, where things suddenly move rapidly and unexpectedly. This effect then is shared across all of the other systems to which it is connected.

We saw this with the COVID-19 pandemic and more recently with the invasion of Ukraine—the factors leading to those events had been building slowly and then suddenly erupted, with effects being felt all over the world. It is, therefore, important not to look too narrowly at the situation. The biggest potential drivers might be at a higher level and moving slowly.

Exploring Possibilities

It is clearly not possible for most of us to have the resources to precisely monitor the onset of events such as these. However, it is possible to consider the fact that similar situations could happen and to explore the potential consequences for your organization if they did. Each possible future emerges from the present, one step at a time. So, we are interested in pathways that lead to future states that impact (positively or negatively) at least one objective we care about—a profit target, consumer loyalty, new business growth and so on.

Based on information about how the system currently behaves, we then can build plausible pathways to those future states and ask questions about our organization’s preparedness for those situations. Which indicators should we be looking at? What actions will be available to us to recover/capture the opportunity? Is there anything we can do now to improve our performance in a given scenario? By constantly telling and re-telling rich narratives about pathways to the future—and asking, “What should we do now?”—we can learn about our strengths and weaknesses on a regular basis. This enables us to make considered, thoughtful and “no regrets” interventions before the event. Focusing only on the pathways that impact our key objectives also enables us to “bound” the problem, so we are not faced with a nearly infinite number of possible futures to consider.

The Effects of Interacting Events

Looking at the current situation—a world emerging from a pandemic and seeking to reach a conclusion to the conflict in Ukraine—it is clear there are a number of complex narratives of significance to insurers, but there is little certainty about which actually will occur. First, we have the world’s economies trying to recover from the pandemic and stimulate growth, while at the same time their economies are absorbing the impacts of significant sanctions placed on Russia. It is unclear how markets ultimately will react, but there already has been a considerable shift in global trade patterns and a significant increase in cost for freight and energy-intensive industries like manufacturing. Inflation in many western countries had been rising sharply before the conflict and is likely to accelerate. The war in Ukraine also has created significant issues for supply chains, which were only just returning to normal after the pandemic.

There is significant uncertainty for specialty insurers. In aviation, for example, there are reports of 500 foreign-owned aircraft being grounded in Russia with the real prospect of them being confiscated. And the heightened threat of cyberattacks is now firmly on people’s minds. In addition to the immediate effects, it is also clear there is the potential for many second- and third-order effects: Countries are rapidly rethinking their energy sources; corporations have changed their business strategies and operating locations; consumers are changing buying habits in response to rapidly rising inflation; and so on. It is impossible to know what the specific, combined effect of all of these emerging trends will be, but it is possible to consider the range of potential outcomes and study those that could impact your organization. And, perhaps most important, it is now clear that this combination of events could very well happen simultaneously.

In a world of such complexity and uncertainty, how can an actuary model anything? The models typically used to look at future behaviors of assets and insurance liabilities are often complicated and contain a range of variables that cover factors such as economic performance, policyholder actions and expenses. The relationships among these factors generally are created artificially using statistical methods (e.g., correlations or copulas). While these models are complicated and can take significant computing resources to run, the challenge is that the “rules” used to connect variables don’t necessarily remain true in the face of pandemics or armed conflict. Most model assumptions are only indirectly affected by the context within which they are used. A model might link policyholder actions to prevailing economic conditions, for example, but it doesn’t really know which competing priorities the customer is juggling when they decide to lapse their policy.

Despite the model’s complication, it misses the fundamental driver of outcomes—interactions. Of course, these models are useful in many situations and widely used, but it is important to appreciate the shortcoming of ignoring interactions for purposes such as risk management. You can underestimate the likelihood of bad outcomes arising from combined factors because they tend to diversify away in models where the combinations of events were not sufficiently anticipated. Or to put it another way, you get lulled into thinking that extreme outcomes are only the result of extreme events—which is not so.

Where it is important to be able to explain or understand how outcomes are achieved, an alternative approach is to build the model directly in terms of the interactions—explicitly showing how one thing leads to another and what the consequences are. This enables the outcomes to be determined by letting them emerge through the interactions of the underlying factors. Conversely, it also provides explanatory insights by showing the conditions that lead to an outcome of interest and, in particular, the combinations of events that are not extreme on their own but are devastating when combined.

When faced with a pandemic, armed conflict, climate change and myriad other things going on in the world, it can be tempting to simplify and tackle pieces of the puzzle. But risk management requires a holistic view, with everything looked at in the right context. The role of the risk manager is to connect the dots and discover the mechanisms driving an organization’s performance and then to tell compelling, rich narratives about it by engaging fellow business colleagues to answer the question, “What could we do now to make ourselves more resilient to the future?”

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Copyright © 2022 by the Society of Actuaries, Chicago, Illinois.