Adjustable Rates for Long-Term Medical Insurance: Part 1

Rate-adjustable long-term medical insurance (long-term medical) has been a hot topic in the insurance industry in China, particularly in the last two years. This two-part article series attempts to analyze key risk factors and explore the direction of risk management based on the empirical trend and model prediction of long-term medical.

This first part of the series introduces the background of long-term medical, including the history, policy environment and operation status. It provides a preliminary description of the risk characteristics, targeting management and market side, respectively. Part 2, to be published next month, will focus on identifying and analyzing key risk factors from an actuary’s perspective through a loss ratio model and will discuss long-term medical management from both a product design and operational management perspective.

Development of Long-Term Medical: A Brief History

At the end of 2003, the former China Insurance Regulatory Commission issued the “Guidance on Accelerating the Development of Health Insurance” to encourage insurance companies to promote health insurance. This ushered in the first wave of commercial medical insurance development in China.

Due to a lack of risk management tools, the characteristics of medical insurance at this stage were mainly to cover the out-of-pocket portion of social insurance—with low deductibles, low limits and other low-leverage attributes—to meet the essential medical protection of customers. With a growing demand for expanded coverage, medical insurance that covered liabilities outside of social insurance gradually emerged to meet consumer needs. Compared to the initial generation of medical insurance, this period of medical insurance set higher benefit limits (from the original limit of 10,000 yuan to 100,000 yuan) while retaining low deductibles. At the same time, the annual premium rate was raised to 2,000–3,000 yuan, resulting in a significant narrowing of the clientele who could afford coverage. So the needs of most customers remained unaddressed.

In 2016, a successful product with a 10,000-yuan deductible was introduced. This million medical insurance policy came out of nowhere and in one fell swoop achieved a cost-effective, high benefit limit for customers and covered liability inside and outside of social insurance. At the same time, the risk was relatively manageable for insurance companies. So far, the domestic medical insurance market has entered the mid-level medical stage—it has gone past creation and has started to explore quality.

With the popularity of million medical insurance, consumers have raised new demands for better continuity of coverage, and the market gradually has evolved out of the guaranteed renewal versions of million medical insurance. However, it is still not enough to satisfy consumers.

In 2020, after repeated discussions and arguments, the mid-level million medical insurance market reached another milestone: the arrival of long-term medical. Long-term medical can be considered a supply-side reform to some extent. It retains the typical responsibilities of a million medical insurance policy but also extends the coverage period, with some products even guaranteeing a renewal period for life. This product has been a response to consumer demand for long-period medical coverage and has reduced the anxiety around the short duration of medical insurance coverage considerably.

Policy Environment

The introduction and development of long-term medical are inextricably linked to the guidance and regulation of regulatory policies.

- In December 2019, the “Health Insurance Management Measures” revision clarified for the first time that long-term medical insurance products could be subject to rate adjustment, creating the possibility for the birth of long-term medical insurance.

- In April 2020, the “Notice on Issues Related to Rate Adjustment of Long-term Medical Insurance Products” was issued to refine further the trigger conditions and rules for long-term medical rate adjustment, leading to the real implementation of long-term medical insurance.

- In January 2021, the “Notice on Issues Related to the Regulation of Short-term Health Insurance Business” made a clear division between long-term health insurance and short-term health insurance, requiring that “long is long and short is short,” further providing room for the development of long-term medical insurance.

Industry Situation

Because of the market base of million medical insurance, long-term medical has achieved steady growth in the past two years, with premium scale exceeding 10 billion yuan and gradually diversifying its supply. There are both medium- and long-term products of 10–20 years, as well as products that are guaranteed for life.

In terms of product type, there are both general and exclusive cancer prevention medical coverage. In terms of liability, there are both generic products and products that cover special needs as well as universal benefits. There also is a wide range of coverage for various customer groups, from children to adults and the elderly.

Business Status

Long-term medical policies mainly are concentrated in the young and middle-aged population (31–50 years old), and the age of average premium shows the typical trend of “high at both ends and low in the middle” for medical insurance. The growth of frequency incidence and average loss cost per claim are accelerated with increasing age. The overall loss ratio so far shows that the cost is moderate.

Risk Analysis of Long-Term Medical

Long-term medical is a new type of insurance with no past experience, and the industry’s accumulated risk coverage has reached the 10 trillion-yuan level. With the accumulation of insurance policies and the aging of the population, the indemnity increases rapidly, so it is necessary to have a clear understanding of the risks involved to provide guidance and reference for product management. There are three levels of attempt (Levels 1 and 2 are discussed in this article, and Level 3 will be explored in Part 2 next month).

Level 1: Risks Articulated to Management

Compared to traditional critical illness insurance, which is the mainstay of life insurance companies, long-term medical is highly volatile and presents companies with higher-level risk management challenges.

The composition of aggregate claims can be broken down into three elements: population composition, claim amount and claims incidence. For a more intuitive understanding, compare long-term medical with traditional critical illness insurance. The three elements of traditional critical illness insurance claims are more certain: the population is relatively locked in, the claim amount is fixed and the incidence is relatively predictable.

In contrast, the three elements of long-term medical loss cost are less certain. First, the population of long-term medical is not locked in, so healthy Individuals will selectively lapse their policies and impaired individuals will continue to accumulate. Second, the nature of reimbursable medical insurance will result in variable claim amounts. Finally, the predictability of claim incidence is relatively weak due to the leverage effect of deductibles.

The comparison provides management with a clearer understanding of the risk factors and characteristics of long-term care as a new product and the need for more profound and consistent management of the long-term medical insurance business.

Level 2: Risk of Presentation to the Market Side

The fact that long-term medical has a low loss ratio at this stage does not mean the risk of claims is low. Attention should be paid to the expectation and management of the forward loss ratio.

To demonstrate the future claim situation to the market more clearly, we divided the population into healthy and impaired individuals and carried out the loss rate forecast for the two groups. Specifically, we construct a loss cost calculation framework where the overall loss cost is equal to the exposure multiplied by the average loss cost per person.

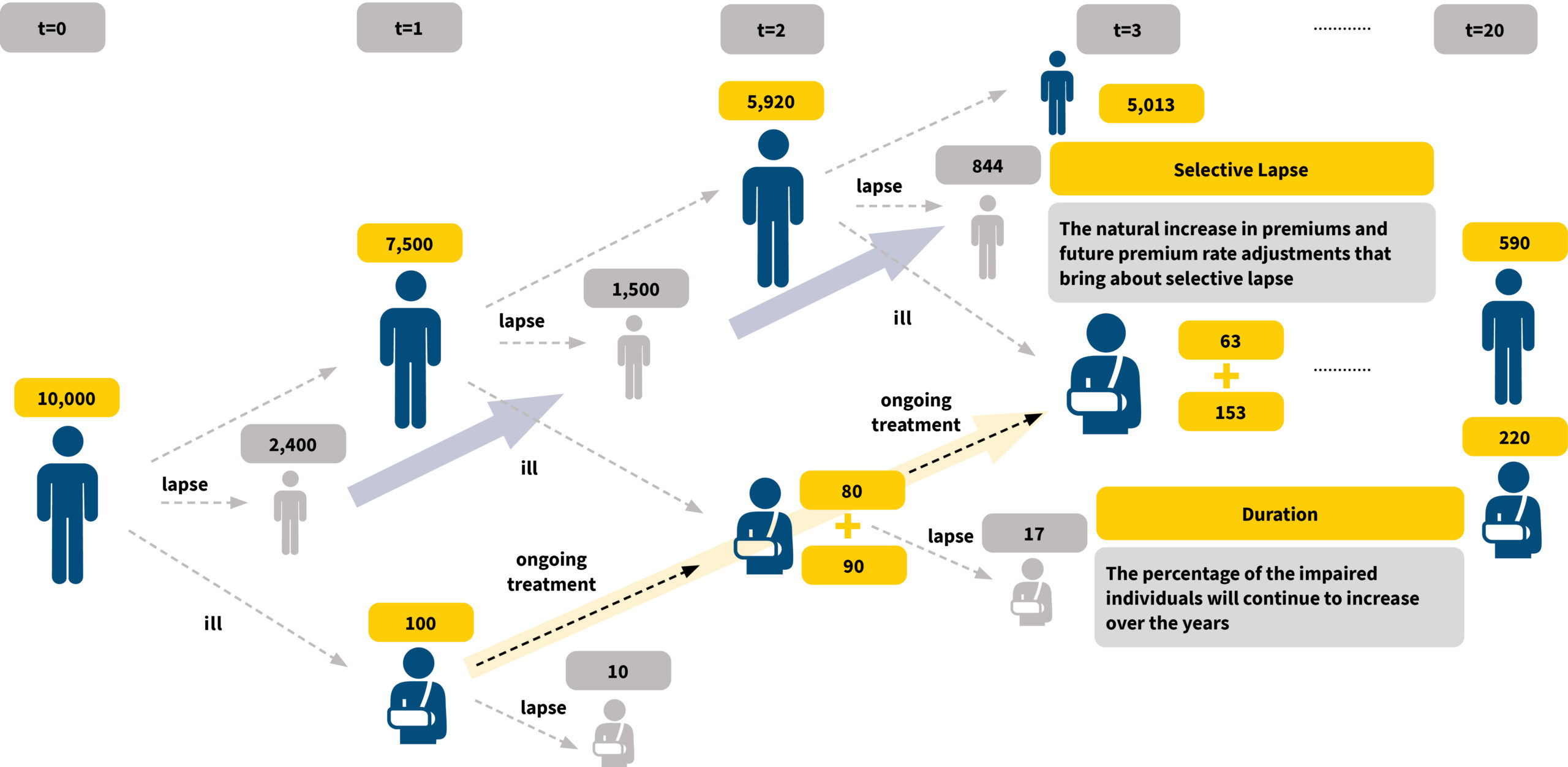

Let’s start with the analysis of exposure (see Figure 1). At the beginning of underwriting, all the policyholders are screened and are healthy individuals. However, due to the nature of long-term medical guaranteed renewals (i.e., the policyholder who made a claim is renewable), over time, the population is automatically classified into two categories: healthy and impaired. For healthy individuals, there is a tendency to gradually lapse. The main drivers of policy lapse are the shift to becoming an impaired individual and the natural increase in premium rates that bring about selective lapse. The percentage of impaired individuals will continue to increase over the years. The main driver of the increase is the high percentage who require ongoing treatment after their first illness.

Figure 1: Example Analysis of the Exposure

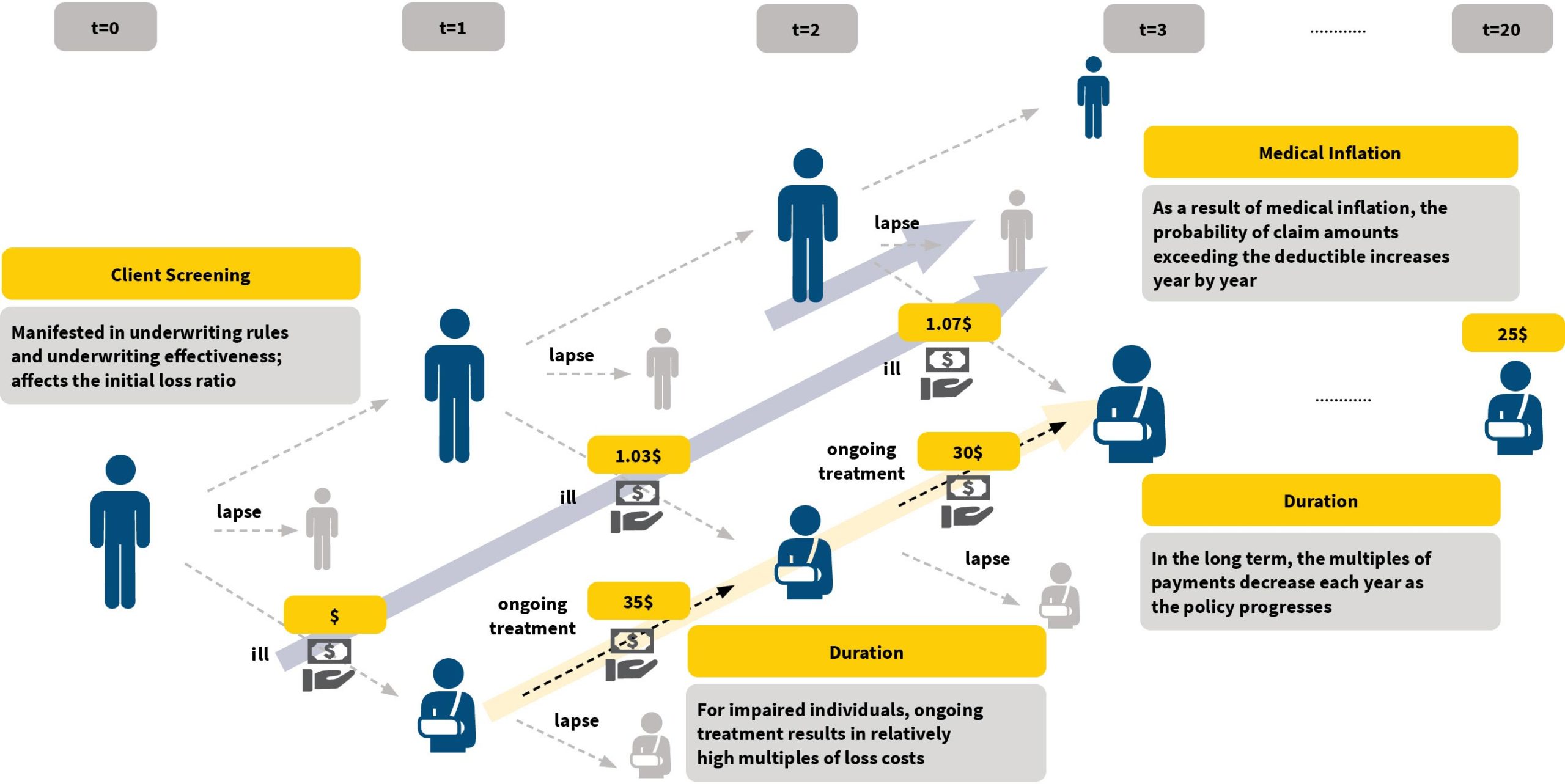

Second, in terms of average loss cost per person analysis, the average loss cost per person is relatively low based on a low probability of claims when viewed as a whole with a healthy individual (see Figure 2). If we look at impaired individuals as a whole, there is a high loss cost cycle because of ongoing treatment. Specifically, three factors affect average loss cost per person.

- Client screening—this is manifested in underwriting rules and underwriting effectiveness, affecting the initial loss ratio.

- The medical inflation effect—for healthy individuals, as the policy progresses, the probability of claim amounts exceeding the deductible increases year by year as a result of medical inflation, therefore leading to higher loss costs.

- Ongoing treatment—for impaired individuals, ongoing treatment results in relatively high multiples of loss costs, but later, the multiples of payments decrease each year as the policy progresses.

Figure 2: Example Analysis of Average Loss Cost per Person

Finally, combining exposure with the average loss cost per person of healthy individuals and impaired individuals gives an outlook on the overall loss ratio. Without considering the fact that it’s a new business, the loss ratio growth trend for long-term medical is relatively fast. Although the premium rate adjustment mechanism can hedge the growth of loss cost to some extent, it is also important to pay attention to the uncertainty of the effect of the premium rate adjustment. By conveying rational expectations of future loss costs and the effectiveness of rate adjustments to the market side through a loss ratio outlook, risks can be identified in advance during the product development stage, leading to a more rational design of product features.

Summary

We have introduced the development background and risk characteristics of long-term medical in this article. In Part 2, we will identify the key risk factors from an actuary’s perspective through a loss ratio model and provide a preliminary discussion of long-term medical risk management.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Copyright © 2022 by the Society of Actuaries, Chicago, Illinois.