Applying Actuarial Theory to Real-Life Situations

Interview with an SOA 2022 Student Case Study Challenge finalist team

September 2022With the aim of advancing actuarial science education and research, the Society of Actuaries (SOA) holds the Student Case Study Challenge, which provides an opportunity for student teams from universities around the world to apply their actuarial skills to real-world problems. This event has encouraged active participation and exciting competition among leading universities since its inception in 2016—all while building an international exchange platform for students.

The 2022 Challenge came to a successful conclusion, and the SOA would like to congratulate the team from Renmin University of China for placing within the top six teams in the world. The team members include Wang Kaixin, Liu Hanwen, Zhou Jiarong, Jia Yaobo and Wang Rongzhen. Their adviser was Wang Yan.

Actuarial science is the science of uncertainty, and the actuary’s work is to minimize that uncertainty. Today, we live in a time of uncertainty, which means the field of actuarial application is vast, and the profession is no longer limited to life insurance.

So, how do actuaries use actuarial theory and skills to better solve real-life problems to advance society? How can theory be effectively applied to practice? How can actuaries solve the friction in the practice process?

The SOA interviewed the team from Renmin University of China and invited them to share their views on actuarial science and their knowledge of the collision and fusion of applying actuarial theory to real-life practice. Be sure to also check out “The Vast Applications of Actuarial Science,” which features an interview with another SOA Student Case Study Challenge finalist team from Nankai University.

What was your initial reason for participating in the Student Case Study Challenge, and how did you learn about it?

In our freshman year, a news release from the School of Statistics of Renmin University of China, entitled “Statistics Students Win the SOA Student Case Study Challenge 2020,” deeply touched us. We were proud of our seniors’ good results in the world-class competition, and we understood that the SOA Student Case Study Challenge was a platform where we could apply our learned actuarial knowledge to real-life problems. At the same time, the curriculum of our Applied Statistics major is highly relevant to the SOA actuarial exams and certification subjects.

Under the continuous training of our faculty professors, we have developed a deeper understanding of the actuarial profession and respect for the SOA, a world-renowned actuarial association. Therefore, with the encouragement and support of our teacher and the desire to apply our actuarial knowledge to real-world problems, we entered the Challenge.

What was your first reaction when you saw the Challenge topic, and did you consider it a relatively big challenge?

When we were tasked to “build a team to win the championship in a few years and analyze its economic impact,” our first reaction was that the directive was very voluminous. From the point of view of the national soccer team, we had to analyze the age, salary and abilities of the players on a micro level and the overall strength of the national team on a macro level, as well as put the economic development of the whole country into the field of soccer. This question was more like telling a story than questions from previous years. It required characterization and plotting, as well as environment and atmosphere, which necessitated us to grasp the main line and logic of the story to achieve accurate details.

The biggest challenge we encountered was the logic of the solution. For example, it makes sense that the country’s economy will improve, which will increase the team’s investment and strength. On the other hand, a stronger team also will contribute to a better national economy. Another example is that we may not be able to get the best players under salary limitations—strong players and high-level teams will get a higher salary cap. Both sets of opposite logic make sense in practical application. While solving the problem, we cannot blur these relationships. Therefore, this required a lot of discussion and trade-offs with the guidance of our teacher.

In addition, in the data provided, each player had many attributes and high dimensionality of data, which added difficulty to our statistical analysis. We were afraid it would be difficult to proceed without the guidance of our teacher and extensive research.

What does the topic of this Case Study Challenge have to do with actuarial techniques or actuaries, and how is the issue interpreted?

The topic, although not related to insurance actuarial science, has its basis in risk analysis, which is similar to actuarial science. Such a question not only requires our actuarial fundamentals but also our basic knowledge of statistics. It allows us to perform insurance actuarial analysis and exercise our noninsurance risk management skills in the competition, making it a challenging question that also lets us demonstrate our comprehensive abilities.

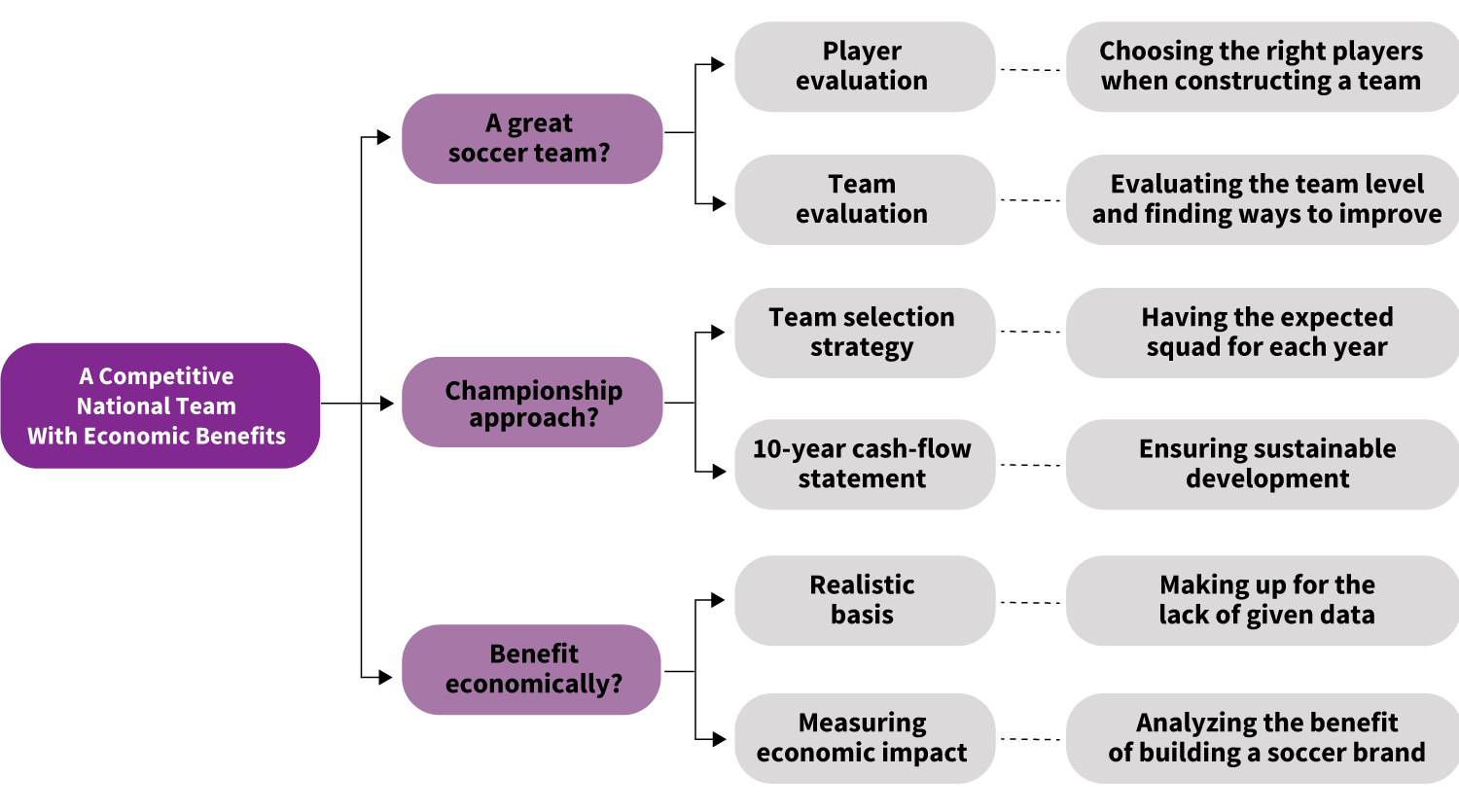

The question asked us to build a soccer team and win the championship in a few years with a limit of $900 million and analyze its economic impact. Faced with difficulties such as too many attributes per player, how to measure changes in players’ abilities and too little economic data to analyze the resulting economic impact in detail, we first split the problem into three sub-objectives (see Figure 1):

- What is a great football team?

- How do we approach the championship?

- How does soccer affect the real economy?

Figure 1: Creating a Competitive National Team With Economic Benefits

To solve the first problem, we grouped player ability into several aspects, such as age, passing, finishing and tackling, and then calculated the team score by considering various factors such as player ability, team funding investment and lineup. To solve the second problem, we took 995 million Doubloons funding as the starting point, estimated the team’s cash-flow statement over the next 10 years while selecting the annual player lineup to achieve the championship goal, and tested the results by Monte Carlo simulation. As for the third question, limited by the data, we decided to estimate it by citing the EU study on the economic impact of the soccer industry in European countries (see Figure 2).

Figure 2: The 10-Year Impact of the Soccer Economy on the Country’s GDP

Hover Over Image for Specific Data

Source: SportsEconAustria, S. E. 2012. Study on the Contribution of Sport to Economic Growth and Employment in the EU.

During the preparation process, were there any disagreements among team members about which actuarial techniques to apply? If so, how did you solve problems?

We were in general agreement on the broad ideas of problem-solving, but from time to time, there were conflicting opinions on the details of how to solve specific problems, such as which method to adopt for player evaluation, how to calculate the cash-flow statement and how to measure the risk of player teams. Disagreements do not need to be avoided, and with sufficient discussion and practice, differences of opinion can be very beneficial in solving problems. Our team adopted the strategy of first agreeing on the understanding of the problem and the goal of solving it. Then we all fully expressed our opinions. Finally, we left it up to one of the team members to implement the operation and choose the best solution in the process of practice.

Did you have any difficulties applying the actuarial knowledge you have acquired to this real-life scenario? If so, how did you solve them?

The difficulty that struck us was the data. The actuarial courses we have taken so far generally provide processed data, which means that the data itself is relatively neat and can be used directly for actuarial analysis. However, in this case, we encountered the problems of noisy and missing data, high data dimensionality and strong correlation between data, and some data not being directly accessible. Therefore, how to use the raw data to achieve reliable analysis was one of the difficulties we needed to overcome.

For the data with high latitude and large volumes, we tried various theoretically feasible ways of dimensionality reduction and finally selected the key features with good explanatory meaning. For missing and small volume data, we expanded our ideas and searched extensively for relevant literature to find realistic references on the topic for the virtual countries, and we supplemented them with real data to solve the problem.

If you plan to participate again, which aspects of the Challenge will you pay attention to? Or what advice would you give to the next class of students who participate?

For solving the case problem, we suggest that students first focus on solving the topic by decomposing it into several modules. Then, look up the literature by module to determine the applicable methods or existing supporting conclusions and discuss with their teammates and teachers in time to determine the scientificity and feasibility of the methods.

For writing the paper, we only set aside two days to do so, which led to a slight rush at the end. Therefore, we suggest that students who participate summarize the presentation and writing specifications of excellent papers from previous years in advance of the competition, form a written picture record for reference when writing the final paper, and leave enough time for final revisions and embellishment.

For the presentation defense, we suggest that the slides not contain too much content, and the presentation should focus on the big ideas and main conclusions. What’s more, it is important to fully prepare for the English defense and pay attention to the computational details in the essay. For example, we were asked why we used absolute error instead of mean square error to determine the evaluation system’s performance.

In general, we agree that an excellent teamwork atmosphere is most important and that everyone should actively express their ideas and advance the resolution of the problem.

How did you balance your daily studies with preparation for the competition?

We divided our work during winter vacation to read the best cases from previous years—to get a general idea of the direction and types of tasks of the competition, and to learn the presentation style of the best papers.

After the semester started, we held offline or online meetings once or twice a week to discuss the tasks and solutions for each phase, ensuring the efficiency and quality of task execution. Then, we used weekends or other breaks to solve problems.

Although preparing for the competition was hectic and hard work, the division of tasks and guidance from our teacher allowed us to work efficiently and with minimal disruption to our daily studies. By participating in the competition, we also applied our daily learning to practice, which gave us a deeper understanding of actuarial knowledge and consolidated our in-class knowledge.

How do you understand the concept of actuarial science?

Actuarial science, as its Chinese name implies, is what we think of as “accurate calculation”—that is, being responsible for the results of our calculations. It requires us to analyze, forecast and manage the financial risks of future economic activities using complex mathematical and statistical knowledge and various financial tools.

In this case, we needed to accurately calculate the team’s income and expenditure schedule for the next 10 years, including revenues such as broadcast fees, tickets and interest, as well as expenses including player salaries and staff expenses. These amounts are not easy to calculate, and the slightest difference can lead to an inability to make ends meet or even bankruptcy, which is the difficulty in forming a team. We have to make sure that every year we have a surplus of cash so that the team can function properly. If the team is already broke, winning the championship is just empty talk.

What kind of existence do you think being an actuary is? What expectations do you have for actuaries?

We believe actuaries are a future-oriented profession that controls risk to give a sense of security. Being an actuary requires a wide range of knowledge, including finance, mathematics and statistics, and a high level of programming skills. Actuaries in China currently are concentrated in insurance companies responsible for pricing and evaluating insurance products. We hope that with the development of China’s insurance industry and the improvement of the talent training system, the career path of actuaries can be broader in the future. Just like overseas, we hope that actuaries also can be found more often in investment companies, real estate companies and internet companies, making reasonable investment recommendations and risk assessment control through the analysis of company assets, truly showing the value of actuarial science.

For each of you, are actuarial techniques used in unexpected scenarios? How do you see it?

In our previous studies, we focused mainly on insurance-related calculations for actuarial knowledge. While learning about previous years’ cases, we realized the broad application of actuarial knowledge to various economic activities, such as designing financial derivatives for carbon emissions.

For this competition topic, the application of actuarial knowledge to determine the economic benefits of a soccer brand was equally surprising. We have made the leap from calculating the income and expenses of a soccer team to predicting the economic growth associated with an entire country. Actuarial techniques, based on the basic principles of economics and using various scientific and effective methods of modern mathematics, statistics, finance and law, can help us analyze, evaluate and manage future risks in various economic activities.

What aspects of actuarial science attracted you and made you stick to the actuarial path?

We all learned about insurance from the “school accident insurance” purchased in elementary school. Compared to insurance products, its “behind-the-scenes workers”—actuaries—are much more niche. Almost all of us started to formally learn about the actuarial profession only after we entered the university, at one time or another in the briefing sessions. It was then that we were fascinated by actuaries’ knowledge of mathematics, statistical methods and the use of financial tools, which attracted us to the actuarial path.

As mentioned, being an actuary is a future-oriented profession, which is not only reflected in actuarial predictions of future risks to protect the present but also in the demand for the position of an actuary. Actuaries are needed for insurance product pricing, evaluation, internet startups, securities companies, calculating and controlling risk, and so on. The value of actuaries is constantly being discovered.

Today, as we continue to learn about actuarial knowledge, our understanding of insurance is deepening and our love for the actuarial profession will keep us on the actuarial path.

Next, read “The Vast Applications of Actuarial Science,” in which the SOA interviewed the Student Case Study Challenge finalist team members from Nankai University.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Copyright © 2022 by the Society of Actuaries, Chicago, Illinois.