The Vast Applications of Actuarial Science

Interview with an SOA 2022 Student Case Study Challenge finalist team

September 2022With the aim of advancing actuarial science education and research, the Society of Actuaries (SOA) holds the Student Case Study Challenge, which provides an opportunity for student teams from universities around the world to apply their actuarial skills to real-world problems. This event has encouraged active participation and exciting competition among leading universities since its inception in 2016—all while building an international exchange platform for students.

The 2022 Challenge came to a successful conclusion, and the SOA would like to congratulate the team from Nankai University for placing within the top six teams in the world. The team members include Zhou Zheng, Cai Pingshan and Zhao Xiaowei. Their adviser was Zhang Lianzeng.

Actuarial science is the science of uncertainty, and the actuary’s work is to minimize that uncertainty. Today, we live in a time of uncertainty, which means the field of actuarial application is vast, and the profession is no longer limited to life insurance.

So, how do actuaries use actuarial theory and skills to better solve real-life problems to advance society? How can theory be effectively applied to practice? How can actuaries solve the friction in the practice process?

The SOA interviewed the team from Nankai University and invited them to share their views on actuarial science and their knowledge of the collision and fusion of applying actuarial theory to real-life practice. Be sure to also check out “Applying Actuarial Theory to Real-Life Situations,” which features an interview with another SOA Student Case Study Challenge finalist team from Renmin University of China.

What was your initial reason for participating in the Student Case Study Challenge, and how did you learn about it?

The professor forwarded the tweet to our course group via WeChat in January 2022. Most of the students were quite interested in the competition at that time. We had heard about this famous competition before and were eager to try it. So we formed a group, hoping to win honor for Nankai University and to promote our abilities.

What was your first reaction when you saw the Challenge topic, and did you consider it a relatively big challenge?

When we read the question for the first time, the first thought we had was to find how the soccer industry was relevant to actuarial science. After all, we used to believe that actuarial science was mainly used in the insurance industry and had little to do with soccer.

The main challenge we encountered was the lack of data. For example, we needed to select the best players while the rank mentioned in the data dictionary was missing. We had to use short-term data to predict the economic impact in the long term, resulting in us not being able to apply some standard methods effectively.

What does the topic of this Case Study Challenge have to do with actuarial techniques or actuaries, and how is the issue interpreted?

In our opinion, the question is about the flexible application of actuarial knowledge in the real world, involving the stochastic simulation in actuarial models, interest rate calculation in financial mathematics, factor analysis and regression analysis of statistics for risk modeling, and so on. In addition, it was difficult to find appropriate references due to data limitations, which challenged our actuarial knowledge base and thinking abilities.

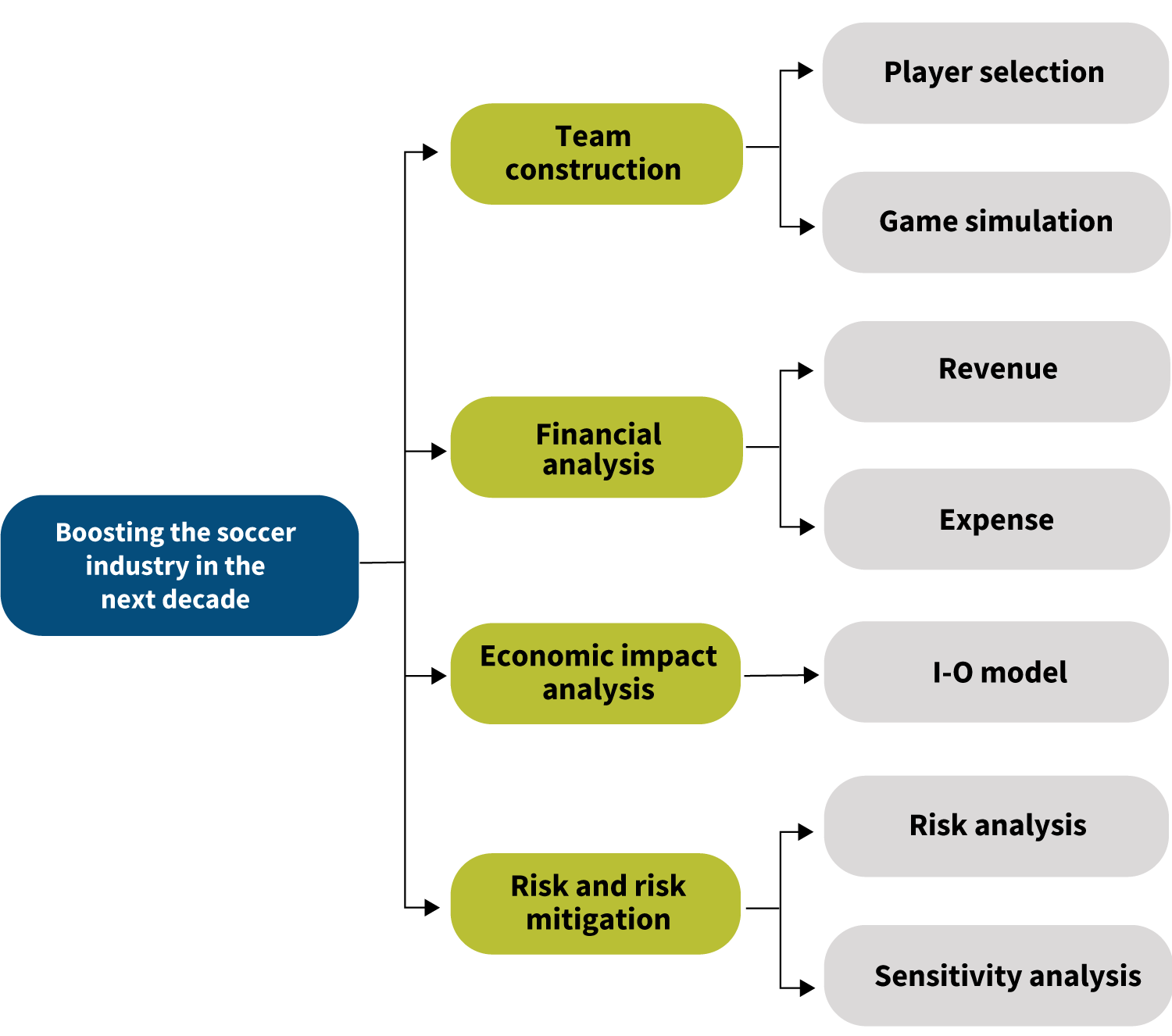

As shown in Figure 1, we divided the question into four parts:

- Team construction of how to choose players

- Financial analysis of the revenue and expenditure of the soccer industry

- The overall economic impact analysis

- Related risk analysis

Figure 1: Boosting the Soccer Industry in the Next Decade

First, we calculated the score of the team after ranking the players and used Monte Carlo simulation to predict the result of the game. Next, we utilized regression to establish the relationship between team ranking and revenue and expenditure. Third, we used the multiplier in the I-O model to calculate the impact of the soccer industry on the national economy. Finally, we discussed various risks and conducted a sensitivity analysis.

Figure 2: The Impact of the Soccer Industry on the National Economy

Hover Over Image for Specific Data

During the preparation process, were there any disagreements among team members about which actuarial techniques to apply? If so, how did you solve problems?

We determined a general framework at the beginning of each discussion and recorded the possible solution strategies for each problem. With the deepening of the problem analysis, we continued to refine the solution method, so there wasn’t much disagreement among the group members in general.

The most remarkable difference is that when we were deciding on the team’s initial capital allocation, we discussed the team’s cash flow matching method. Some team members believed that the method of duration matching should not be considered, while others believed it was necessary to consider due to the length of funds allocation. In the end, we reviewed the information on the soccer team’s capital operation and future interest rate levels. After a collective discussion, we unanimously decided not to consider the duration management method. Learning to discuss and exchange opinions was our knack for resolving our differences.

Did you have any difficulties applying the actuarial knowledge you have acquired to this real-life scenario? If so, how did you solve them?

We indeed have encountered some difficulties in adopting actuarial methods. For example, when evaluating the risks the national team may face, it was difficult for us to use the method of fitting loss distribution in property insurance to quantify risks due to the lack of data and the background of the problem. Therefore, we applied indicators commonly used in financial risk management, such as value at risk (VaR) and expected shortfall (ES), and evaluated the risk by adopting stochastic simulation methods.

The competition inspired us and allowed us to realize that actuarial science, as a discipline with rich connotations, is constantly advancing in the crossing and integration of different subjects. As actuarial students, we will continue to discover the possible applications of actuarial methods in various fields to better serve the theory in practice.

If you plan to participate again, which aspects of the Challenge will you pay attention to? Or what advice would you give to the next class of students who participate?

Regarding team division, we suggest that members learn more about each other’s tasks and distribute workload based on the question. For instance, the analysis of the latter question relies on the results of the previous query, so more members can participate in solving the previous question to improve the overall efficiency. Also, a good start is half the battle! With a good foundation laid from the start, the follow-up analysis will be carried out much more smoothly.

Regarding problem-solving, we suggest that members open their minds, brainstorm with their other team members and list as many ideas as possible to choose the best solution according to reality.

In terms of presentation and defense, we suggest that the slides be as concise as possible, showing a clear, logical argumentation process and giving examples to help the judges quickly understand the work.

How did you balance your daily studies with preparation for the competition?

We started to prepare for this competition during the winter vacation. After reading the excellent reports from previous years, we understood the competition structure and presentation plan. Through online discussions, we determined the focal point of the competition questions.

When the new semester started, we had adequate time to prepare for the competition because we had relatively few junior year courses. In the School of Finance discussion space, we regularly held group meetings one to two times a week to discuss the solutions to questions. Moreover, we would summarize the content of the meeting in time to improve the efficiency of the next discussion.

How do you understand the concept of actuarial science?

We think of actuarial science as a subject concerning quantitative assessment, modeling, analysis and decision-making of problems related to uncertainty. To achieve the goal of solving these problems, it is necessary to make comprehensive use of mathematics, statistics, informatics, economics, insurance, management and other disciplines. Today, actuarial methods and techniques are effective tools for modern insurance, finance and investment risk management.

What kind of existence do you think being an actuary is? What kind of expectations do you have for actuaries?

We suppose actuaries are professionals who apply actuarial theory and skills to analyze, evaluate and manage future risks in various economic activities in insurance, finance and other fields. Actuaries today mainly work at insurance companies and are responsible for product pricing, asset-liability management, embedded value assessment, experience analysis and so on. And they are an essential hub connecting a company’s front and back ends. Of course, with the development of actuarial science, you also can see actuaries in the marketing and sales departments of some insurance companies. It can be said that there are actuaries everywhere!

We hope that in the future, we all can become excellent actuarial scholars or actuarial practitioners.

For each of you, are actuarial techniques used in unexpected scenarios? How do you see it?

Actuarial science is mainly used in the field of insurance, but it is not limited to insurance. Actuarial science is essentially the analysis, evaluation and resolution of uncertain problems. Therefore, in any field with uncertainty and risk, actuaries will have room to show their strengths. But the questions about how we can better apply actuarial technology to these fields and where they best fit still require in-depth exploration by professionals.

At present, the application of actuarial science is increasing gradually. For example, actuaries can be found in many fields such as urban risk management, rural risk management, catastrophe risk management and population forecasting. At the same time, automakers such as Tesla and internet companies such as JD.com and Alibaba are openly recruiting actuaries. We believe actuarial science will have broader applications and brighter prospects in the future.

What aspects of actuarial science attracted you and made you stick to the actuarial path?

The greatest attraction of actuarial science to us is that it combines objective and subjective analysis, and it is the perfect combination of science and art. The increasingly excellent and developing actuarial theories and models are based on mathematics, statistics, insurance and economics, and are used to model, analyze and study uncertainty problems scientifically. Actuaries in practical work are responsible for product pricing, reserve evaluation and embedded value evaluation according to scientific methods. These are the manifestations of the profession’s scientific nature.

But actuarial science is more than numerical calculations and formulas. There is no perfect standard answer in the world of actuarial science. And that’s the beauty of it. Actuaries choose reasonable actuarial assumptions based on experience and properly balance the interests of shareholders, policyholders, marketers and regulators. This characteristic, guided by scientific rules but without a perfect paradigm, fascinates us deeply.

Of course, the high salary, stable job and decent social image attract us a lot as well.

Conclusion

With the continuous advancement of technology and ideas, society changes rapidly every day. Data has become the main development trend, and the status of actuarial science has become increasingly prominent. In such an environment, actuaries and the actuarial industry need to keep pace with the times, continuously develop professional horizons and industry boundaries, apply innovative actuarial theories to real life and resolve more uncertainties. In this process, actuarial theory and real-life practice are still a continuous process of collision and fusion, but the two complement each other, colliding and integrating, innovating in the inheritance, and jointly promoting the actuarial industry to deepen its development and help society achieve long-term, high-quality development.

The SOA will continue to improve the association’s ability to innovate as well as find talent, relying on the Student Case Study Challenge to provide a high-quality learning, practice and communication pathway to stimulate the actuarial enthusiasm of university students.

Next, read “Applying Actuarial Theory to Real-Life Situations,” in which the SOA interviewed team members from Renmin University of China.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

Copyright © 2022 by the Society of Actuaries, Chicago, Illinois.