Impact of Climate Change on Life Insurers

Insights on underwriting, pricing and investment management

September 2023Photo: iStock.com/FangXiaNuo

A decade ago, I became convinced that the change in the world’s climate represented an intermediate and long-term risk for those in economically developed countries. Recently, I have become just as convinced that it is now a current risk. This article aims to describe some of the critical elements of climate change that will affect the operation of life insurance companies.

The Underlying Problem

Learn More

For more on climate change as it relates to life insurance, read the SOA’s Projected Changes in Insurability and Affordability of Insurance Coverages due to Climate Change report.

Sam Gutterman’s “It’s Hot Outside!” essay on climate change can be read in the SOA’s Climate Change Contributions to Key Adverse Effects from Excessive Heat report.

The past seven years have been the hottest in global history,1 and 2023 is the beginning of an El Niño period, so it likely will get even warmer over the next few years.2 The May 2023 Keeling Index3 (the accepted measure for the amount of carbon dioxide in the global atmosphere) reached an all-time high of 424 parts per million, with the last annual increase one of the largest on record. This increase in carbon dioxide in the atmosphere and record-high oceanic temperature do not bode well for the effects of further climate warming and change.

Adverse Events and Conditions

Increases in greenhouse gas concentrations in the atmosphere have led to inevitable changes in all climatic factors. More adverse weather-related events and conditions have ensued, which is significant to life insurers because these factors—both alone and in combination—are leading to increases in the following morbidity and mortality risks:

- Temperature extremes and volatilities. Although increasing heat spells have attracted a great deal of recent attention, the aggregate average temperature, measured in tenths of degrees Celsius, does not sound all that large compared to our daily variations. Nevertheless, the volatility and extremes over multiple days are a primary source of most adverse health effects. But just as noteworthy is the possible reduction in cold weather morbidity and mortality—any actuary whose work is affected by seasonal experiences, such as year-end incurred but not reported (IBNR) analysis, is aware of the historical excess of winter deaths. Although many of these can be attributed to the intensity of cold weather, others relate to life indoors that won’t change much with overall warming. In some locales, the decrease in winter deaths may more than offset the increase in summer deaths, at least for a while.

- Extreme precipitation. We’ll always have rain and weeks without rain. But in the extreme, health risks such as flash flooding (that can arise within hours) and flash droughts (that can occur within weeks) can increase in likelihood, severity and duration.

- Extreme events. Wildfires, storms, insects and tropical cyclones—although this list sounds like a bunch of biblical plagues, their severity seems to be increasing, presenting numerous short- and long-term health risks.

- Air quality and pollution. Certainly not all air pollution is attributable to climate change. Still, the last several years have seen an increased risk of PM5 (small particulate matter) from wildfire risks, which have become increasingly severe over a wider geographical spread because of a combination of climate factors (heat, temperature, forest dryness and wind). Chronic exposure can lead to lung, kidney, liver, brain and heart problems.

- Slow-onset conditions. Slow-moving changes, such as ocean rise and desertification, would not dramatically affect mortality or morbidity under normal circumstances. However, these can exacerbate other sudden and unhealthy effects, such as farther-reaching flooding, increased agricultural area salination and food insecurity.

Morbidity and Mortality

As the Centers for Disease Control (CDC) reports, in addition to the immediate risks of injuries, drownings and heart attacks, climate change and extremes can be risk multipliers of human health conditions and life risks. Although public focus often has been placed on deaths immediately following a weather event, excess long-term risks may be just as great, if not more, concerning.

A lack of attribution to the underlying drivers of ill health has resulted in severe underestimates of illnesses and deaths related to climate factors. The morbidity and mortality effects are wide-ranging and can adversely affect health over a long period, in some cases leading to premature deaths from cardiovascular, respiratory, cancer and cognition risk.

These also can exacerbate food insecurity (about 10% of American households have low or very low food security4) and mental health (more than 20% of American adults now have mental illness5) in many population segments, which in turn affects long-term morbidity and mortality.

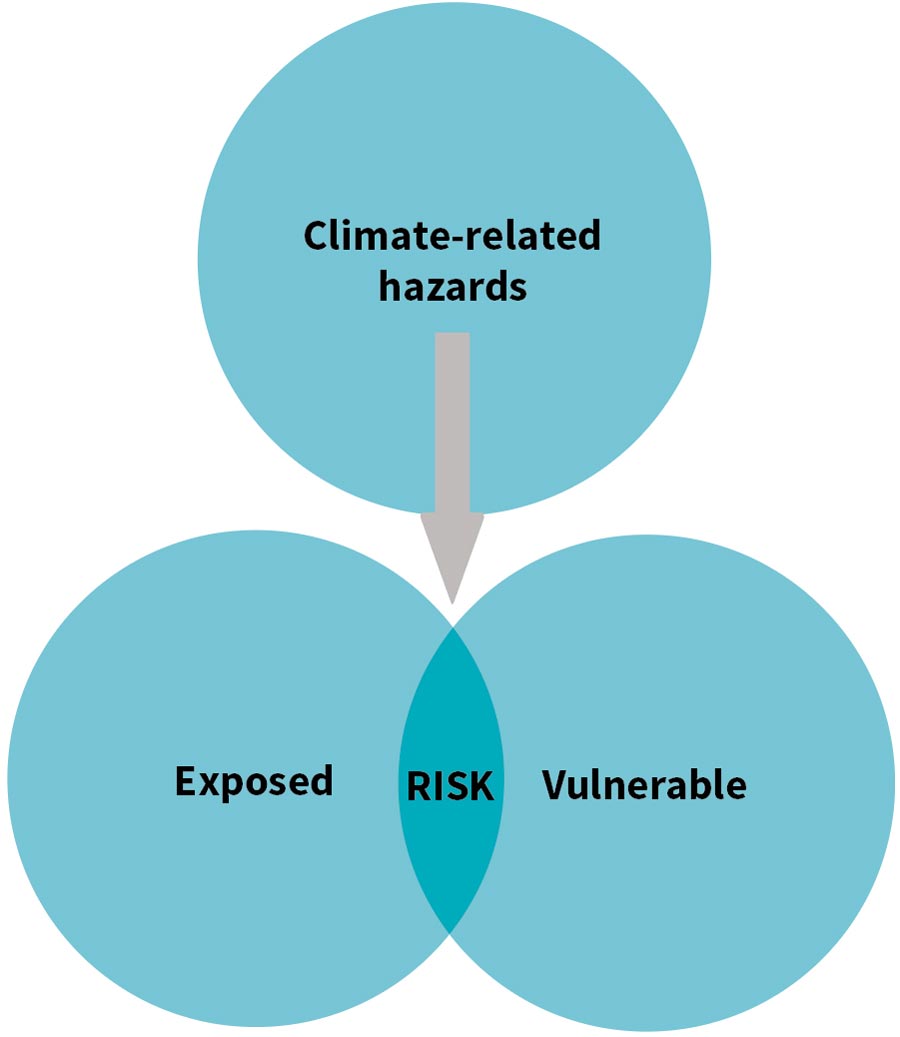

As shown in Figure 1, those affected are:

- Exposed to the effects of the applicable hazard

- Tend to be especially vulnerable and sensitive to these health risks

Figure 1: Hazard to Risk Through Exposure and Vulnerability

Exposure can differ depending on the specific climate or weather hazard. In some cases, it involves those within a particular geographic area or socioeconomic group. For example, all those downwind from a wildfire are exposed to injury and smoke hazards. With more severe wildfires, deteriorated air quality can cover a wide geographic area (in the United States, the benefits gained from the Clean Air Act of 1970 are being clawed back by recent smoke events6). In any case, it is usually the elderly, children and pregnant women who are likely to be more vulnerable and sensitive than others to respiratory and cardiovascular risks, whether due to weak immune systems or developing organs.

Regarding floods, those who can better afford to adapt, live in resilient housing and have increased mobility will avoid some of the more serious physical consequences of climate-related hazards. Other examples include a widening scope of vector or waterborne diseases.

Effects on Life Insurance Companies

According to the National Association of Insurance Commissioners (NAIC), the invested assets of an insurer and its business can be affected directly and indirectly by risks associated with climate and weather-related events and conditions. Over the past decade, most of the attention life insurers have paid to this area has focused on the selection and values of their assets. However, morbidity and mortality risks are becoming important.

As concern and disclosure requirements regarding the effects of these risks on assets, liabilities and capital continue to increase, additional expenses due to new or expanded regulatory and reporting requirements are bound to increase.

Invested Assets

Many factors are considered in selecting investable assets, including financial instruments, debt and real estate. One factor of increasing visibility is climate change and its associated risks. Attention has been placed on the dramatic effects of climate and weather and the significant efforts to control the amount of greenhouse gas emissions, a significant contributor to the changes in climate. Decarbonization and demethanization affect fossil fuel use and will increase reliance on alternative energy sources, transport and agricultural reform. This, in turn, will result in stranded assets of certain companies and countries, affecting the value of these assets.

Environmental, social and governance (ESG) investments remain popular, although pushback from certain sources has occurred partly due to ideological reasons. Like other asset portfolio risks, proper scrutiny and sound investment analysis of short- and long-term risks are necessary for effective investment management.

This also can present opportunities. For example, opportunities may arise from the financial instruments of those firms involved in effectively controlling these risks, whether in developing alternative power sources, new modes of transport or enhanced agricultural methods.

Business of Insurance

Insurance payouts by life, health and annuity policies that life insurers provide also are affected, although the number of deaths directly attributed to climate change is still quite small. Climate or weather is more often a risk multiplier or is one of several contributing factors rather than an immediate cause of ill health or death.

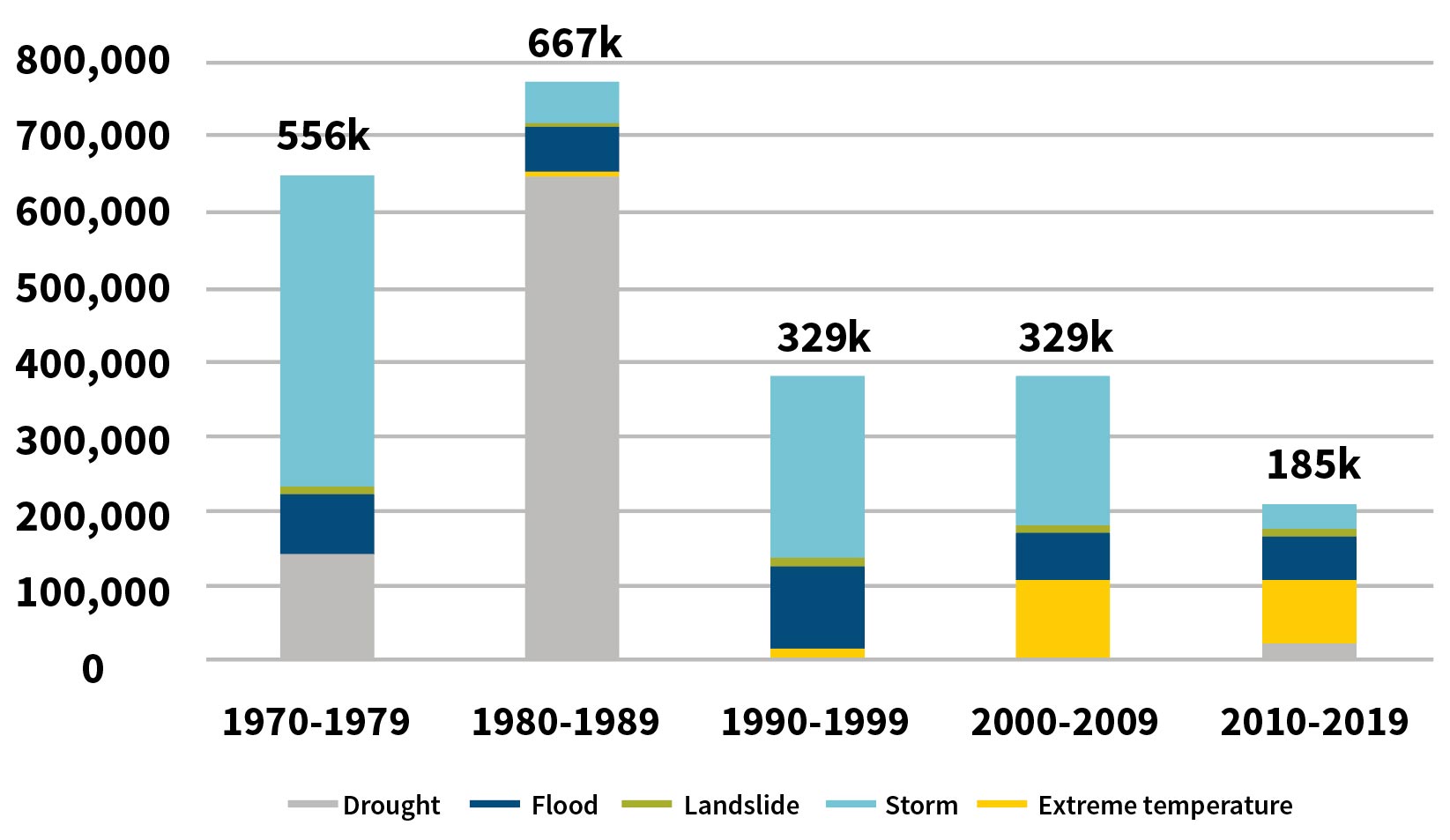

Figure 2 suggests that not only is global mortality not increasing as the climate has warmed over the past 50 years, but it has decreased. However, this trend is misleading for the following reasons, principally because conditions have changed over this period:

- Four severe droughts in the 1970s and 1980s in Ethiopia, Mozambique and Sudan resulted in 650,000 deaths. Tropical cyclone deaths were about 300,000 in Bangladesh in 1970, 139,000 in Bangladesh in 1991 and 138,000 in Myanmar in 2008. Since then, Bangladesh has instituted an extensive and effective early warning system against severe storms, which has resulted in a significant reduction in resultant mortality.7

- In the United States, there has been a significant reduction in heat-related deaths over the last half of the 20th century because of the increased use of air conditioning.8 Further progress may be more difficult to achieve because of the lack of affordability of many similar adaptation techniques. Heat stress for the elderly, for which there were 345,000 deaths globally in 2019,9 is projected to increase to 59,000 deaths in the United States in 2050 without further adaptation measures. In Phoenix in 2020, where air conditioning is common, there were 339 heat-related deaths, with the majority occurring outdoors.

Source: World Meteorological Organization. 2021. WMO Atlas of Mortality and Economic Losses from Weather, Climate and Water Extremes (1970-2019). WMO-1267.

I doubt these favorable global trends will continue based on the likely adverse trends in many climate change hazards.

The six weather-related disasters between 1992 and 2017 that had the most significant economic impact occurred in the United States. There were more than US$10 billion in health-related costs from 10 U.S. disasters in 2012, including wildfires, extreme heat and Hurricane Sandy.10 These resulted in about 900 associated deaths, 17,000 emergency room visits and 20,000 hospitalizations, including the cost of treating injuries, illnesses and mental health issues. And 2012 was still early in the climate change process. Losses are expected to grow in a nonlinear fashion over the coming decades.

What Can Be Done?

The world is past preventing what was thought just a decade ago to be the aspirational 1.5oC benchmark above the preindustrial level. Nevertheless, I assert actions to minimize greenhouse gas emissions remain important to reduce the amount and severity of climate change in the future. In addition, efforts to adapt to these hazard risks should be prioritized, including upgrading basic health care infrastructure, early warning systems and disaster recovery processes. Education and making it convenient and affordable for the population to reduce their exposure and decrease their vulnerability to these risks, especially those most sensitive to their effects, is also important.

I believe life insurers should consider the effects of climate change in their risk management processes, selection and management of invested assets, operations, and information and data gathering and analysis. In this area, actuaries should be aware that the past is not always the best indicator of the future. Yet, up-to-date, reliable data is all-important—being aware of attribution issues will be of increasing value.

As we have seen from the COVID-19 pandemic and the increase in drug overdose deaths, changed conditions can wreak havoc on a mortality improvement hypothesis. I believe alternative scenarios that allow for a sufficient margin in universal life cost of insurance charges may need to be considered. We should also pay close attention to early warning mortality indicators for other applications.

Because of the impacts of uncertain human and political behavior, the extent of volatility and severity of these risks will differ and remain uncertain across time and geographical areas. As warming continues, we likely will move into conditions for which we do not have indicative experience, which will complicate actuarial practice. These uncertainties may be assessed best through scenario analysis.

We already have seen homeowners insurance becoming costly or unavailable in certain areas, as this CNN report notes. Although unlikely to affect life insurers’ insurance products to nearly this extent, climate change should be considered in the assessment and information regarding their assets and liabilities, capital needs, the pricing of insurance products and the overall management of risks.

Management of natural insurance portfolio hedges—that is, selling both mortality and longevity risk products—might help. Management of concentration risk and exposure to the underlying risk drivers remain important. Does this mean underwriting, pricing and investment management must be overhauled? Not necessarily, though it does mean that sound risk management processes should consider environmental and climate-related risks.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

References:

- 1. Kaplan, Sarah, and John Muyskens. The Past Seven Years Have Been the Hottest in Recorded History, New Data Shows. The Washington Post, January 13, 2022. ↩

- 2. Paddison, Laura. Global Heat in ‘Uncharted Territory’ as Scientists Warn 2023 Could be the Hottest Year on Record. CNN, July 8, 2023. ↩

- 3. Trends in Atmospheric Carbon Dioxide. Earth System Research Laboratories, Global Monitoring Laboratory. ↩

- 4. Coleman-Jensen, Alisha, Matthew P. Rabbitt, Christian A. Gregory, and Anita Singh. 2021. Household Food Security in the United States in 2020, ERR-298, U.S. Department of Agriculture, Economic Research Service. ↩

- 5. Centers for Disease Control and Prevention. About Mental Health. National Center for Chronic Disease Prevention and Health Promotion, Division of Population Health, April 25, 2023. ↩

- 6. Written Testimony of David Wallace-Wells. Hearing on “The Costs of Climate Change” United States Senate Committee on the Budget. April 15, 2021. ↩

- 7. World Meteorological Organization. 2021. WMO Atlas of Mortality and Economic Losses from Weather, Climate and Water Extremes (1970-2019). WMO-1267. ↩

- 8. Barreca, Alan I., Karen Clay, Olivier Deschenes, Michael Greenstone, Joseph S. Shapiro. 2016. Adapting to Climate Change: The Remarkable Decline in the U.S. Temperature-Mortality Relationship Over the Twentieth Century. Journal of Political Economy. ↩

- 9. Atlantic Council. 2021. Extreme Heat, the Economic and Social Consequences for the United States. August 2021. ↩

- 10. Limaye, Vijay S. et al. 2018. Climate Change and Heat-Related Excess Mortality in the Eastern USA. Ecohealth 15, no. 3: 485-496. ↩

Copyright © 2023 by the Society of Actuaries, Chicago, Illinois.