Incremental Changes in U.S. Health Care Coverage

A discussion with health economics researchers Vivian Ho and Leanne Metcalfe

November 2022Photo: Shutterstock/Monkey Business Images

As actuaries, we often understand how health care works from an intuitive perspective, but examining the nuts and bolts of the United States health care economy with an academic lens is not something we usually specialize in. So, for this article in The Actuary, I turned to health economics researchers Vivian Ho, Ph.D., and Leanne Metcalfe, Ph.D., for their take on why U.S. health care works the way it does and to gain insight into health care markets and how they think markets could be improved.

What makes supply and demand relationships different in health care compared to the rest of the economy? Do consumers and policymakers need to think about health care reforms differently because of this?

Health insurance and tax policy distort demand relative to the traditional competitive market students see in introductory economics classes. Because patients with health insurance pay only a fraction of their costs once they’ve met their annual deductible, their demand for health care is more inelastic (the downward sloping demand curve is steeper) than what’s observed in conventional markets. Furthermore, the value of the health insurance coverage subsidized by employers is tax-free, unlike wages and salaries. This tax break leads workers to demand more generous coverage than they would otherwise, perpetuating the inelastic demand for health care.

The Affordable Care Act originally included a “Cadillac tax,” which would have levied a 40% excise tax on high-cost employer plans. Many economists1,2,3,4,5 favored this tax because it would have forced employers to become more cost-conscious when selecting employee health coverage, which these economists believed would ultimately have put more money back in workers’ pockets. But there was significant public backlash6,7,8 against this provision, and polling9 that indicated public perception was easily swayed by arguments for and against. It was ultimately repealed with bipartisan support.

We’re thinking hard about ways to make consumers’ demand for health care more elastic, which would limit providers’ ability to raise prices. At the same time, we want to reward high-quality care and protect consumers from additional financial burdens. That’s why we believe so strongly in promoting price transparency in health care markets, which will increase employers’ visibility into their negotiated rates as well as consumers’ ability to shop for care.

We also can make incremental changes in health plans, like tiering more expensive providers—requiring patients to pay higher copays if they seek care at a higher-cost hospital where there is no evidence that the care is better than its competitors. Some employers also have had success with reference pricing, where the health plan specifies a minimum amount it will pay for a particular procedure, which is equivalent to the amount charged by a high-quality, low-cost hospital in the market. Anyone who wants care from a higher-priced provider would need to pay out-of-pocket for the remainder.

What about the supply side—are markets with many hospital systems more competitive than those with fewer?

A study10 by Zack Cooper and colleagues that was conducted as part of the fascinating “1% Steps for Health Care Reform” project highlights that while U.S. household income has increased only 10% between 2000 and 2019, health care spending in the United States increased 87%. Revealing cost drivers and addressing cost are difficult but necessary for the sustainability of the U.S. health care system in the opinion of any informed observer.

Initial findings from studies conducted as part of the project11 showed that in highly competitive markets, high-cost hospitals had lower mortality rates for time-sensitive conditions like heart attacks. However, this is not the case for hospitals in markets with less competition. Similarly, hospitals in markets with more monopolistic pressures had 12.5% higher prices. When hospitals compete, even though some hospitals might still be very expensive, overall patient outcomes are better. This research is in line with other economic theories that show product quality is better in competitive markets.12

Overall, the “1% Steps for Health Care Reform” project highlights several initiatives that theoretically could decrease the cost of care by 9% if implemented.

A simplistic view of health care markets says that if health care costs decrease, somebody is going to get paid less. I do not see any willing volunteers. Health insurers already have regulated margins, and hospitals are reporting record losses. Where is there fat to trim?

We dispute the assertion that all hospitals are posting record losses. Rural hospitals and those facilities serving high numbers of uninsured patients indeed are suffering. But many large health care systems have enjoyed positive profit margins throughout the pandemic and continue to do so. These hospitals received substantial support from the CARES Act and other COVID-19-related legislation. Hospitals have gained the upper hand in the consolidation race, allowing hospital prices to increase faster than any other component of health care for the last two decades. Hospitals continually have raised prices, and patients keep coming through their doors. We believe that until the consumer becomes price-sensitive, or employers press insurers harder on negotiated rates, we will not be able to control rising costs.

You mention the consolidation race. Physician practices increasingly are owned or closely contractually aligned with hospital groups. Is there evidence that these partnerships drive higher quality and care coordination? To what degree does this market share concentration contribute to higher costs?

Studies by the Physicians Advocacy Institute (PAI) and Avalere Health13 have found that between Jan. 1, 2019, and Jan. 1, 2022, 108,700 additional physicians became employees of hospitals or other corporate entities. The trend has been ongoing for years, but the loss in income that small physician practices suffered during the early stage of the pandemic accelerated that consolidation. The PAI/Avalere study found that 83,000 of the shifts to physician employment occurred after the onset of COVID-19.

We have examined14 patient-level claims data to measure the association between vertical integration and both spending and patient outcomes for commercially insured patients. In a sample containing more than 500,000 patients covered under preferred provider organization (PPO) contracts with claims processed by Blue Cross and Blue Shield of Texas (BCBSTX) between 2014 and 2016, we found that average annual spending for patients treated by hospital-owned organizations was 5.8% higher than for physician-owned practices.

As it relates to Healthcare Effectiveness Data and Information Set (HEDIS) quality metrics, the results were mixed. In our paper,15 we saw that hospital-owned entities were less likely to screen people with diabetes for hemoglobin A1c or low-density lipoprotein (LDL) cholesterol. However, they were more likely to perform eye exams or recommended screening mammography. In terms of another measure of quality, patient outcomes, which includes fewer emergency room (ER) visits and lower admission and readmission rates, the patients fared no better or worse relative to patients treated by physician-owned practices. This result leaves us skeptical of the claims of improved care coordination under vertical integration.

I was really interested in your finding in that study16 that imaging and durable equipment services, as well as broader care in the outpatient setting, were uniquely affected by ownership—hospital-owned physician groups being more expensive than physician-owned practices. What makes those unique?

We endeavored to measure the association between physician-hospital integration and both spending and quality using patient-level data and explicit physician-hospital contracting information using retrospective review of claims data from 2014 through 2016. The largest spending differential between hospital- and physician-owned practices in our study17 was for outpatient care. Payment policies in the commercial sector often mirror what goes on in the Medicare program. MedPAC has noted18 that Medicare pays more for services when provided by on-campus hospital-owned physician practices than for services provided by independent physicians. Hospitals can add facility fees to services in both Medicare and the commercial sector, which can drive up costs relative to physician-owned practices.

We don’t have detailed data on ownership of ancillary services, but physician practices, particularly smaller ones, are probably more likely to outsource imaging services and not have durable medical equipment. A large health care system that can provide these services in-house may have an incentive to encourage its physicians to prescribe more of these services to patients at a higher price to boost revenues.

You mentioned consumer price sensitivity as a pathway to cutting costs. There has been a lot of policy activity in that regard, but perhaps more smoke than fire in terms of actual results. What are the most effective things we can do in this regard?

Like the retail industry, when customers can comparison shop, they often can find ways to save money and control costs. Being able to shop around for care and not being constrained by a larger hospital ecosystem can lead to lower costs for imaging and certain outpatient services.

In our study19 about paying patients to shop around for care, we noted an initial 1.3% overall cost savings for employers in their health care costs. This increased20 to 3.7% in the second year as more employees learned about the initiative and better leveraged the shopping tools. It will be interesting to see if the new price transparency tools coming onto the market will also encourage patients to shop around for some clinical services and continue to put downward pressure on prices.

In the meantime, as almost half of the individuals with health insurance receive coverage through their employers, companies should use those transparency tools to work with insurers to get better rates for their employees.

What strategies can payers and policymakers employ to educate patients on these price differences and help them make more informed health care decisions? Have high deductibles been effective in incentivizing patients to be cost-conscious consumers?

Company human resources (HR) offices, insurers and policymakers can help improve patient consumer education on where they should go for care. Information dissemination could start as young as middle and high school, connecting individuals with the medical community and teaching them where to find information. Incentivizing more primary and urgent care locations to help patients get access to nonemergent care can direct patients to the appropriate site for care and help prevent the need for an ER visit down the road. Some employers are taking this issue into their own hands and establishing on-site clinics to help improve care access for their employees. This has sometimes led to improved patient compliance and reduced negative health outcomes. Other services, such as 24/7 nurse lines and access to telemedicine, can help triage or get patients to help after-hours, which also could reduce the need for ER visits.

High-deductible health plans (HDHPs) have more cost-conscious patients who are more likely to be aware of prices and avoid unnecessary care. However, we have not seen evidence of HDHP members shopping around more than their PPO peers.

Private equity investment in health care grew twentyfold from 2000, when it was less than $5 billion, to 2018, when it surpassed $100 billion. What distinguishes private equity-owned facilities and physician practices from their nonprivate equity-owned peers?

It’s important to distinguish between various private equity investors’ motives for entering the health care market. When private equity acquired short-term acute care hospitals, financial performance improved, but staffing metrics decreased. We didn’t directly assess the implications for quality.21,22,23 Still, there’s clearly concern that the acquisition of hospitals reflects the standard private equity model of acquiring a firm, driving down costs, then exiting when the facility can be sold for a significant profit.

However, there are many private equity investors looking to disrupt the market by delivering innovative products and services. These new offerings show promise for improving the patient experience while lowering costs. The smaller entities are looking to reduce the cost of prescription drugs by bypassing pharmacy benefit managers. They also are partnering with insurance companies and providers to administer innovative care management solutions—things such as care navigation, helping people stay compliant with their medications and treatments, and helping people get required exercise. Maternity programs that incorporate doulas to improve health equity for minority mothers who face a higher rate of maternal mortality would be another helpful innovation.

The management solutions these startups are developing are also an excellent complement to the provider since they travel with the patient instead of the short conversations a patient has with a physician. It can allow the physician to get a better view of the lifestyle of the patient between visits.

I was first acquainted with your research on freestanding emergency departments (EDs). I remember visiting family in Dallas and being puzzled by the freestanding EDs that seem to be on every other block and the donut shops on the blocks in between. Are the two correlated?

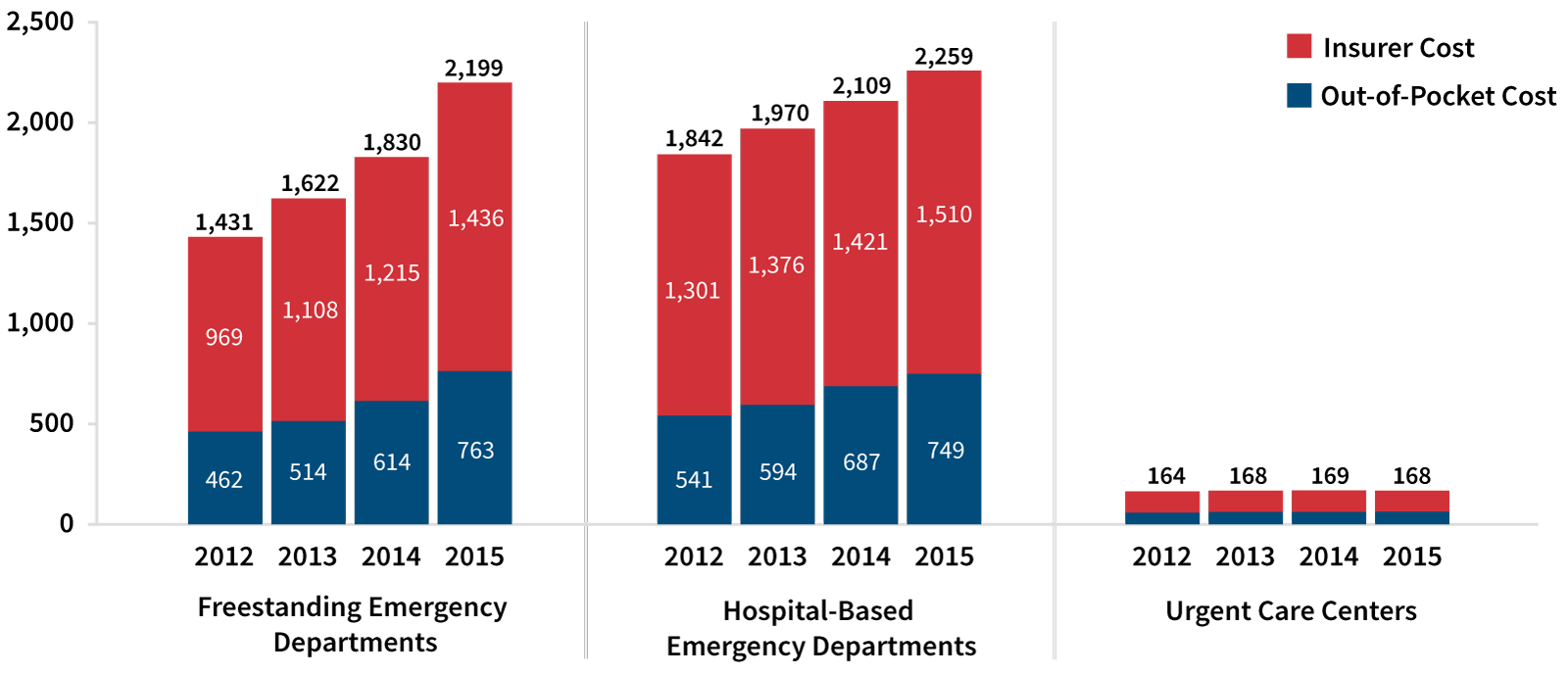

We first became interested in freestanding EDs because we both live in Texas and saw them opening in every other strip mall in Dallas and Houston. We pulled ED and urgent care claims processed by BCBSTX from 2012 to 2015 in the state’s major metropolitan statistical areas. We looked for the 20 most common diagnoses and procedures at each facility type. We found24 that most of these diagnoses overlapped at these two facility types, yet average costs were 10 times higher at freestanding EDs. The same overlap existed for procedures, yet procedures were 13 times more costly at freestanding EDs than at urgent care centers (see Figure 1).

Figure 1: Mean Total Price per Visit and Mean Amounts Paid by Insurance Versus Out of Pocket by Provider Type and Year

Part of that cost differential may be justified by the higher costs associated with running a full-scale hospital, but most of the differential can’t be justified by underlying costs. For example, patients with urinary tract infections, which do not require complex infrastructure, led to reimbursements of $1,769 at freestanding EDs but only $153 at urgent care centers. A routine urinalysis costs only $3 at an urgent care center but $51 at a freestanding ED.

Texas legislators have passed laws requiring freestanding EDs to inform patients whether their facility is in-network for their insurance plan, which would shield patients from surprise bills. However, the rules have not been strongly enforced, and stories25,26,27,28,29,30,31,32 of patients being billed more than $1,000 for COVID-19 testing at freestanding EDs were common in the press.

Insurers have been informing their customers that they will not cover claims from freestanding EDs that they do not view as emergent upon review of the records available. None of this is ideal for protecting patients from excessively high prices. We hope the federal government’s price transparency initiatives eventually will apply to freestanding EDs, so patients can see what they’re getting into cost-wise when they walk into one of these facilities.

How effective is value-based care in addressing the market inefficiencies you have studied? Are there market inefficiencies that value-based care is unable to address?

Value-based care rewards providers for the quality of care delivered rather than the quantity. It makes sense in principle but has yet to achieve its full potential. Some studies suggest that accountable care organizations (ACOs) that share savings achieved with providers can promote lower-cost, high-quality care. The oldest ACOs have been shown to lower costs, but it takes time for organizations to apply best practices.

Under the Obama administration, the Department of Health & Human Services (HHS) pushed hard to bundle payments to reduce spending on specific, common, high-cost treatments such as hip and knee replacement. The Trump administration made some of the programs voluntary,33,34 affecting the reach of the initiatives.

While we are hopeful that value-based care eventually will become more prevalent and impactful for U.S. health care, we believe that encouraging and educating employers on how to be better shoppers for health care is our best chance for slowing cost growth in the U.S. health care system. Employer-provided health insurance is the most generous coverage in the market, yet CEOs seem unaware of the significant costs that health care poses for their workers and their business.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

References:

- 1. Van De Water, Paul N. Why Congress Shouldn’t Repeal the Cadillac Tax. Center on Budget and Policy Priorities, July 11, 2019 (accessed October 28, 2022). ↩

- 2. Gleckman, Howard. The House Should Repair, Not Repeal, The ACA’s Cadillac Tax. Tax Policy Center Urban Institute & Brookings Institution, July 16, 2019 (accessed October 28, 2022). ↩

- 3. Enthoven, Alain C. Don’t Repeal the “Cadillac Tax” on High-Cost Health Plans. Health Affairs, August 5, 2015 (accessed October 28, 2022). ↩

- 4. Levitt, Larry, and Gary Claxton. How Many Employers Could be Affected by the Cadillac Plan Tax? Kaiser Family Foundation, August 25, 2015 (accessed October 28, 2022). ↩

- 5. Nowak, Sarah. Rethinking the Affordable Care Act’s “Cadillac Tax”: A More Equitable Way to Encourage “Chevy” Consumption. The Commonwealth Fund, December 18, 2015 (accessed October 28, 2022). ↩

- 6. Rovner, Julie. ‘Cadillac Tax’ on Generous Health Plans May Be Headed for Repeal. National Public Radio, August 14, 2019 (accessed October 28, 2022). ↩

- 7. Herman, Bob. Employers Hate the Cadillac Tax. Why? Modern Healthcare, September 10, 2016 (accessed October 28, 2022). ↩

- 8. Stuart, William G. Why the Cadillac Tax Had to Go. Voya Benefit Strategies, January 23, 2020 (accessed October 28, 2022). ↩

- 9. Kliff, Sarah. One Poll That Explains Why Obamacare’s Cadillac Tax Is Doomed. Vox, September 30, 2015 (accessed October 28, 2022). ↩

- 10. Cooper, Zach, and Fiona Scott Morton. 1% Steps for Health Care Reform: Implications for Health Care Policy and for Researchers. Health Services Research, April 19, 2021 (accessed October 28, 2022). ↩

- 11. Cooper, Zach, and Martin Gaynor. Addressing Hospital Concentration and Rising Consolidation in the United States. 1% Steps for Health Care Reform, November 30, 2020 (accessed October 28, 2022). ↩

- 12. Crespi, John, and Stéphan Marette. Quality and Competition: An Empirical Analysis Across Industries. March 1, 2006 (accessed October 28, 2022). ↩

- 13. Avalere Health. Physician Employment and Acquisitions of Physician Practices 2019–2021 Specialties Edition. Physician Advocacy Institute, June 1, 2022 (accessed 10/28/2022). ↩

- 14. Ho Vivian, Leanne Metcalfe, Lan Vu, Marah Short, and Robert Morrow. 2020. Annual Spending per Patient and Quality in Hospital-Owned Versus Physician-Owned Organizations: An Observational Study. Journal of General Internal Medicine 35, no. 3:649–655. ↩

- 15. Ibid. ↩

- 16. Supra note 14. ↩

- 17. Supra note 14. ↩

- 18. Medicare Payment Advisory Commission. Medicare and the Health Care Delivery System: Report to the Congress. Provider Consolidation: The Role of Medicare Policy. MedPAC, June 1, 2017 (accessed October 28, 2022). ↩

- 19. Whaley, Christopher M., Lan Vu, Neeraj Sood, Michael E. Chernew, Leanne Metcalfe, and Ateev Mehrotra. 2019. Paying Patients to Switch: Impact of a Rewards Program on Choice of Providers, Prices, and Utilization. Health Affairs 38, no. 3:440–447. ↩

- 20. Whaley, Christopher, Neeraj Sood, Michael Chernew, Leanne Metcalfe, and Ateev Mehrota 2022. Paying Patients to Use Lower-Priced Providers. Health Services Research 57, no. 1:37–46. ↩

- 21. Erickson, Kevin F., Wolfgang C. Winkelmayer, Vivian Ho, Jay Bhattacharya, and Glenn M. Chertow. 2019. Market Consolidation and Mortality in Patients Initiating Hemodialysis. Value Health 22, no. 1:69–76. ↩

- 22. Offodile II, Anaeze C., Marcelo Cerullo, Mohini Bindal, Jose Alejandro Rauh-Hain, and Vivian Ho. 2021. Private Equity Investments in Health Care: An Overview of Hospital and Health System Leveraged Buyouts, 2003-17. Health Affairs 40, no. 5:719–726. ↩

- 23. Cerullo, Marcelo, Yu-Li Lin, Jose Alegandro Rauh-Hain, Vivian Ho, and Anaeze C. Offodile II. 2022. Financial Impacts and Operational Implications of Private Equity Acquisition of U.S. Hospitals. Health Affairs 41, no. 4:523–530. ↩

- 24. Ho, Vivian, Leanne Metcalfe, Cedric Dark, and Lan Vu. 2017. Comparing Utilization and Costs of Care in Freestanding Emergency Departments, Hospital Emergency Departments and Urgent Care Centers. Annals of Emergency Medicine 70, no. 6:846–857. ↩

- 25. Kliff, Sarah. This Lab Charges $380 for a Covid Test. Is That What Congress Had in Mind? The New York Times, September 26, 2021. ↩

- 26. Pattani, Aneri. The Bill for His COVID Test in Texas Was a Whopping $54,000. NPR, September 30, 2021. ↩

- 27. Kliff, Sarah. These Towns Trusted a Doctor to Set Up Covid Testing. Sample Patient Fee: $1,944.The New York Times, November 10, 2020. ↩

- 28. Blakkarly, Jarni. Price Gouging: COVID-19 Rapid Antigen Test Prices Soar. CHOICE, January 5, 2022. ↩

- 29. Gutierrez, Melody. California Will Crack Down on Surprise Coronavirus Testing Fees Under New Law. Los Angeles Times, October 8, 2021. ↩

- 30. Davis, Amy, and Andrea Slaydon. KPRC 2 Investigates: Why Are Free COVID Tests Costing People Thousands of Dollars? Click 2 Houston, October 7, 2021. ↩

- 31. Kenney, Tanasia. Watch Out for COVID Testing Scams and Price Gouging as Demand Surges, Officials Warn. The Sacramento Bee, December 29, 2021. ↩

- 32. Allen, Marshal. How a $175 COVID-19 Test Led to $2,479 in Charges. The Texas Tribune, August 1, 2020. ↩

- 33. ACO Participation Hit Low During Trump Administration. National Association of ACOs, January 21, 2021 (accessed October 28, 2022). ↩

- 34. Galewitz, Phil. Trump Administration to Overhaul a Program Designed to Save Medicare Money. National Public Radio, August 9, 2018 (accessed October 28, 2022). ↩

Copyright © 2022 by the Society of Actuaries, Chicago, Illinois.