Risk Control Trends for Actuaries

Looking ahead to 2024

December 2023As we conclude 2023 and approach 2024, I believe actuaries will continue to be at the forefront of emerging trends and technologies, helping organizations adapt to changing risks. As the business landscape evolves and becomes increasingly complex, the role of actuaries in managing and mitigating risks will take on even greater significance, in my opinion.

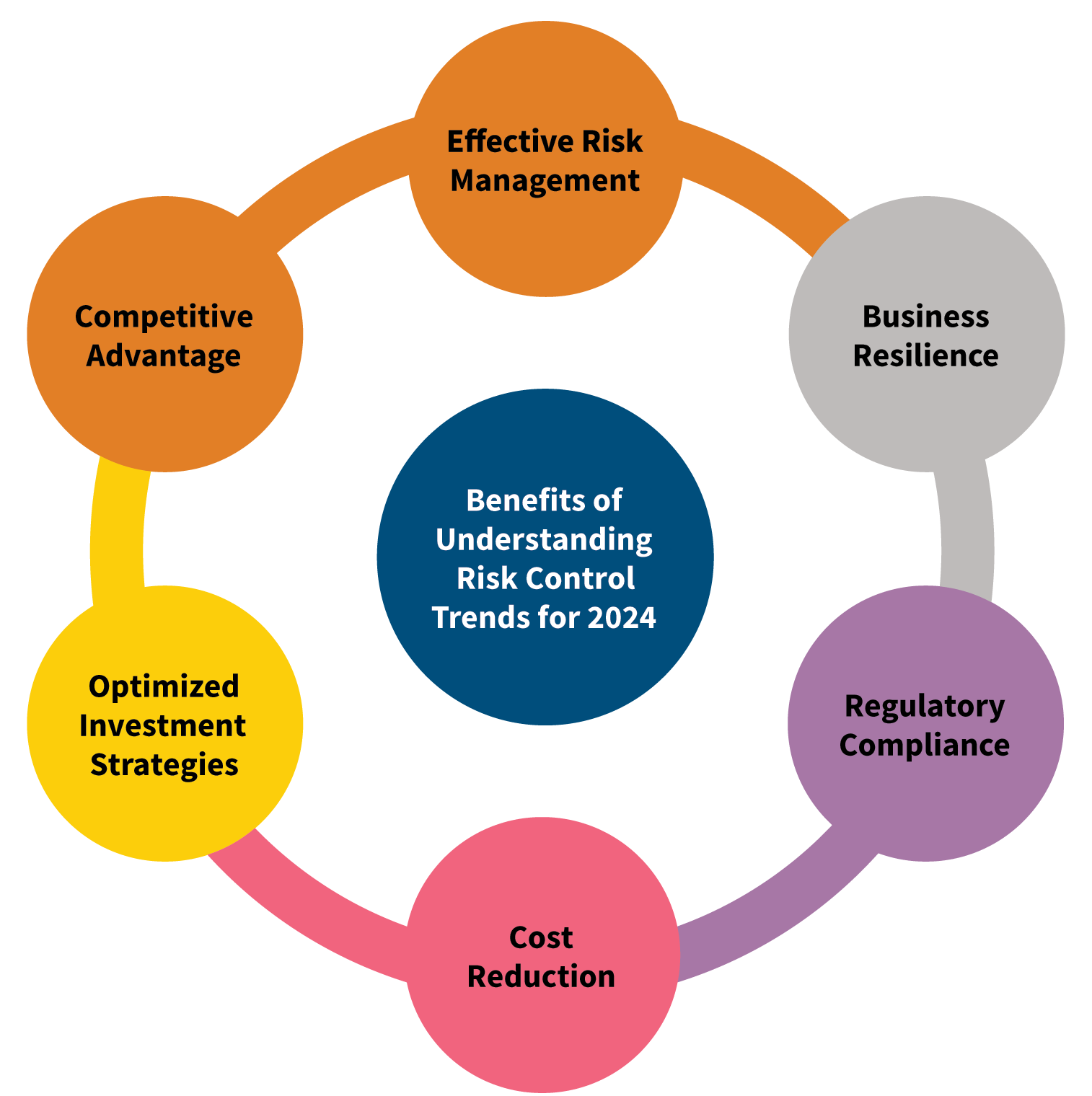

This article outlines four key risk control trends for actuaries to consider as they navigate the challenges and opportunities of the year ahead. The benefits to understanding them are highlighted in Figure 1.

Cybersecurity and Privacy

The frequency and sophistication of cyberattacks continue to grow, posing a significant threat to organizations across industries.1 As actuaries are tasked with assessing and quantifying cybersecurity risks, models to estimate potential financial losses in the event of a cyber incident include not only direct costs, like data recovery and breach notification expenses, but also indirect costs, such as reputational damage, legal liabilities and business interruption losses.

In 2024, I believe the focus will be on developing and improving robust cyber risk models, estimating potential financial losses and collaborating with cybersecurity experts to enhance risk mitigation strategies. The ability to quantify cyber risks accurately will be crucial for pricing insurance policies and setting appropriate reserves.

Climate Risk

Environmental, social and governance (ESG) factors are gaining prominence in risk control.2 Actuaries increasingly are involved in modeling and assessing climate-related risks, such as extreme weather events, supply chain disruptions and changes in regulatory landscapes.

Actuaries work to ensure insurers comply with emerging regulatory requirements related to climate risk reporting and disclosure. This involves providing data and analysis to regulatory authorities. Understanding the financial implications of climate change is becoming essential for insurers, asset managers and businesses alike.

Artificial Intelligence (AI)

Data analytics and AI already have made significant inroads in the field of actuarial science, and this trend is set to continue in 2024. At companies such as TIAA, actuaries are partnering with in-house AI teams to leverage advanced analytics to process vast data sets, identify patterns and predict future trends. AI-driven predictive models are becoming more sophisticated, helping actuaries make more accurate risk assessments and pricing decisions. As technology evolves, I believe it will benefit actuaries to stay up to date on the latest tools and techniques to harness the power of data effectively.

Pandemic Risk Management

The COVID-19 pandemic underscored the need for effective pandemic risk management. Actuaries will continue to play a crucial role in modeling and assessing pandemic-related risks through a combination of lessons learned and a forward-looking approach to prepare for future pandemics. In 2024, the focus will shift toward refining pandemic risk models, developing contingency plans and exploring insurance solutions that address pandemic-related business interruptions and liabilities. I envision actuaries collaborating with public health experts to gain a comprehensive understanding of pandemic risk and its implications and communicating their findings and recommendations to executives, underwriters and other stakeholders—including leadership—about the importance of pandemic risk management.

Conclusion

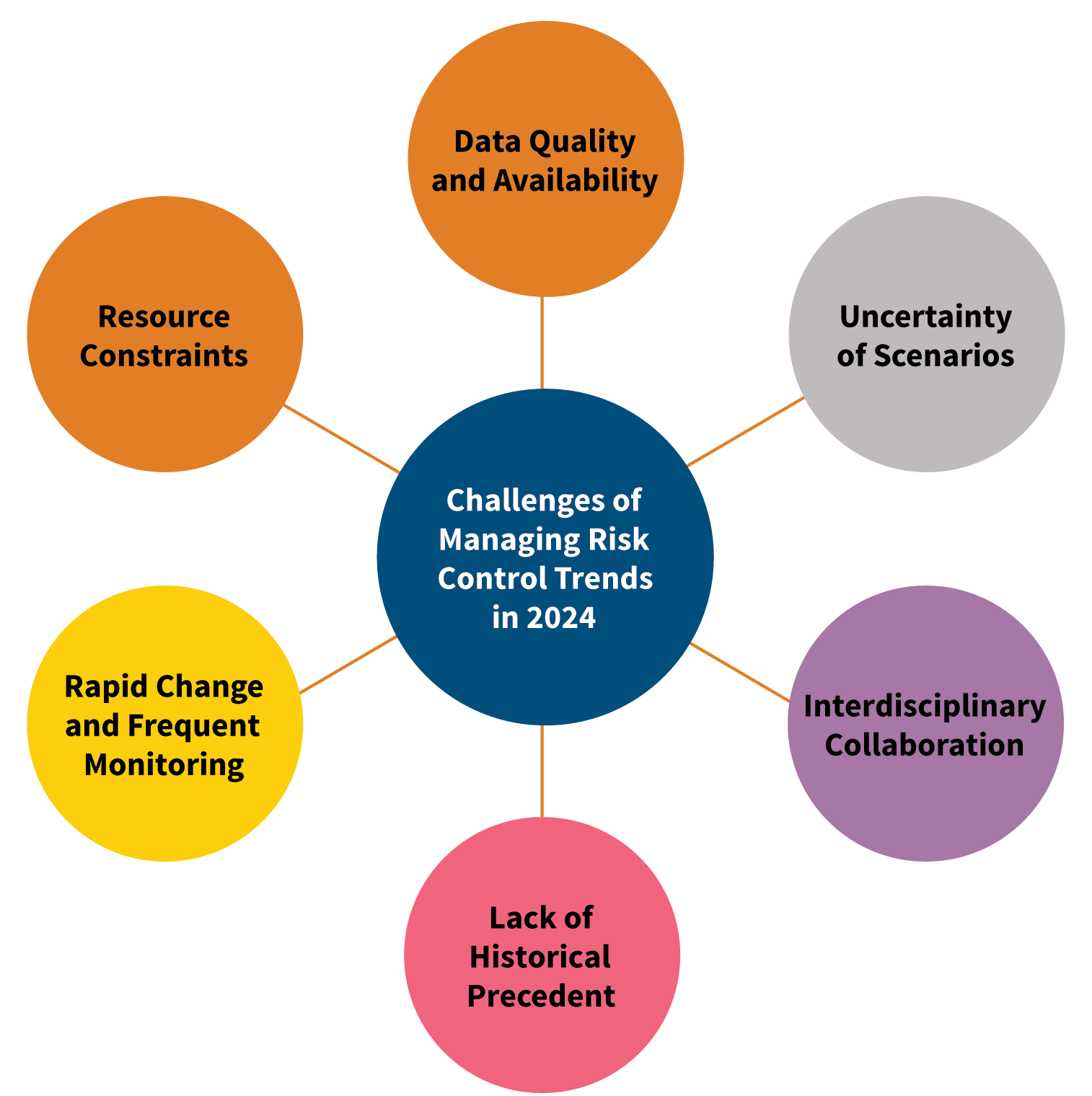

As actuaries, adapting to the evolving landscape of risk control is a continuous process. As shown in Figure 2, the actuarial profession is poised to face an array of challenges and opportunities in 2024—from harnessing advanced data analytics and AI to addressing cybersecurity threats and climate change risks.

By staying informed, embracing innovative technologies and collaborating across disciplines, I believe actuaries can continue to excel in their roles as risk control experts, helping organizations navigate the complexities of the modern world while ensuring financial security and stability.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries or the respective authors’ employers.

References:

Copyright © 2023 by the Society of Actuaries, Chicago, Illinois.