Value-Based Reimbursement for Pharmacy Financing

SOA Research Institute explores method to decrease prescription drug costs

May 2024Photo: Shutterstock/pogonici

Rising medication costs have been affecting Americans and their health care. Thirty-one percent of respondents in a Kaiser Family Foundation July 2023 survey reported not taking prescription drugs as prescribed in the last 12 months due to not being able to afford them. The discussion surrounding health care expenses tends to focus on physicians and hospitals rather than pharmacy financing. However, this has been changing as more expensive gene therapy drugs hit the market and other brand-name drugs are significantly more expensive in the United States than in other countries. In addition, changes in insurance cost-sharing have shifted more responsibility for the costs of these expensive drugs to consumers.1 Presenting actuarial solutions to drug costs, such as value-based reimbursement, could help fulfill a societal purpose by making medications more affordable for patients. In turn, this could improve medication adherence and health outcomes.

Despite the U.S. government’s policy initiatives, drug financing issues persist and are in need of new solutions. To help respond to this issue, the Society of Actuaries (SOA) Research Institute is examining an alternative to current pharmacy financing in the commercial space: using a value-based reimbursement methodology. The goals of this new methodology are to increase transparency, encourage competition, align stakeholder incentives and mitigate total cost of care (TCOC) increases related to increased use of expensive drugs. The authors of “Reimagining Pharmacy Financing” found that it’s possible to implement this value-based reimbursement methodology with the current pharmacy financing infrastructure and available data, subject to some limitations. Their report covers defining, measuring and rewarding value within the methodology and serves as a baseline for further discussion.

In 2017, the SOA collaborated with the Kaiser Family Foundation to launch Initiative 18|11: What Can We Do about the Cost of Health Care? to have a multidisciplinary discussion about health care costs in the United States. That discussion uncovered many complexities in the pharmacy ecosystem. In response, the SOA sponsored the Pharmacy Partnership Forum in early 2023. A key takeaway was the need for a new pharmacy financing methodology.

What Value Means to Each of Us

Stakeholders in pharmacy financing include consumers, payers (such as health plans and employers), providers, government entities, manufacturers and pharmacy benefit managers. Some of these stakeholders define value in terms of the International Society of Pharmacoeconomic and Outcomes Research (ISPOR) “value flower.”2 The two core “petals” of this flower are quality-adjusted life years (QALYs) and net costs. A QALY measures how a drug improves the patient’s quality and length of life. Values for other stakeholders include qualities such as the impact the drug has on caregivers and recovery time.

“Reimagining Pharmacy Financing” examines the scalability and usefulness of various methods to determine the impact a drug may have on TCOC, and it uses common drugs for diabetes and high cholesterol as case studies.

For diabetes, the study focused on insulin:

- Glucagon-like peptide-1 (GLP-1)—drugs that slow digestion and increase insulin secretion, such as Ozempic and Trulicity

- Sodium-glucose cotransporter-2 (SGLT2) inhibitors—drugs that remove glucose through urine, like Farxiga and Jardiance

The high-cholesterol drugs examined include:

- Statins that block the cholesterol-creating substance, such as Lipitor and Crestor

- Proprotein convertase subtilisin/kexin type 9 (PCSK9) inhibitors that help the liver absorb more “bad cholesterol,” including Praluent and Repatha

Testing Methods for Measuring TCOC

Analyzing 2016-2021 commercial claims data from the Health Care Cost Institute, which represents about one-third of all commercial members, “Reimagining Pharmacy Financing” examined three methodologies to evaluate the TCOC for the diabetes and high-cholesterol drug classes. Figure 1 describes and analyzes the methodologies.

Figure 1: Methodologies for Measuring Drug Impact

| Methodology | Description | Advantage | Disadvantage |

| Pre-Post Index | Comparing TCOC six months before and 12 months after a medical event, such as a hospitalization or diagnosis. | Provides a logical framework for analysis. | There might not be enough members who had an event to provide a statistically reliable analysis. |

| Propensity Matching | Comparing the TCOC of the patients taking the drug to those who aren’t. Comparable patients are matched on specific criteria, such as age and gender. | Provides a clear framework and reduces the impact of confounding factors. | The matching process may result in too few members for a statistically reliable study. |

| Risk Adjustment | Each member in the data set is assigned a score based on their risk factors, such as age and gender. Then the TCOC for each subgroup is adjusted by the sum of the risk scores. | Enables every member in the data set to be included in the analysis. Also, the method is easy to administer, and it is widely accepted and understood. | This method was developed for other purposes, so it may not adequately reflect the risk associated with specific group members. |

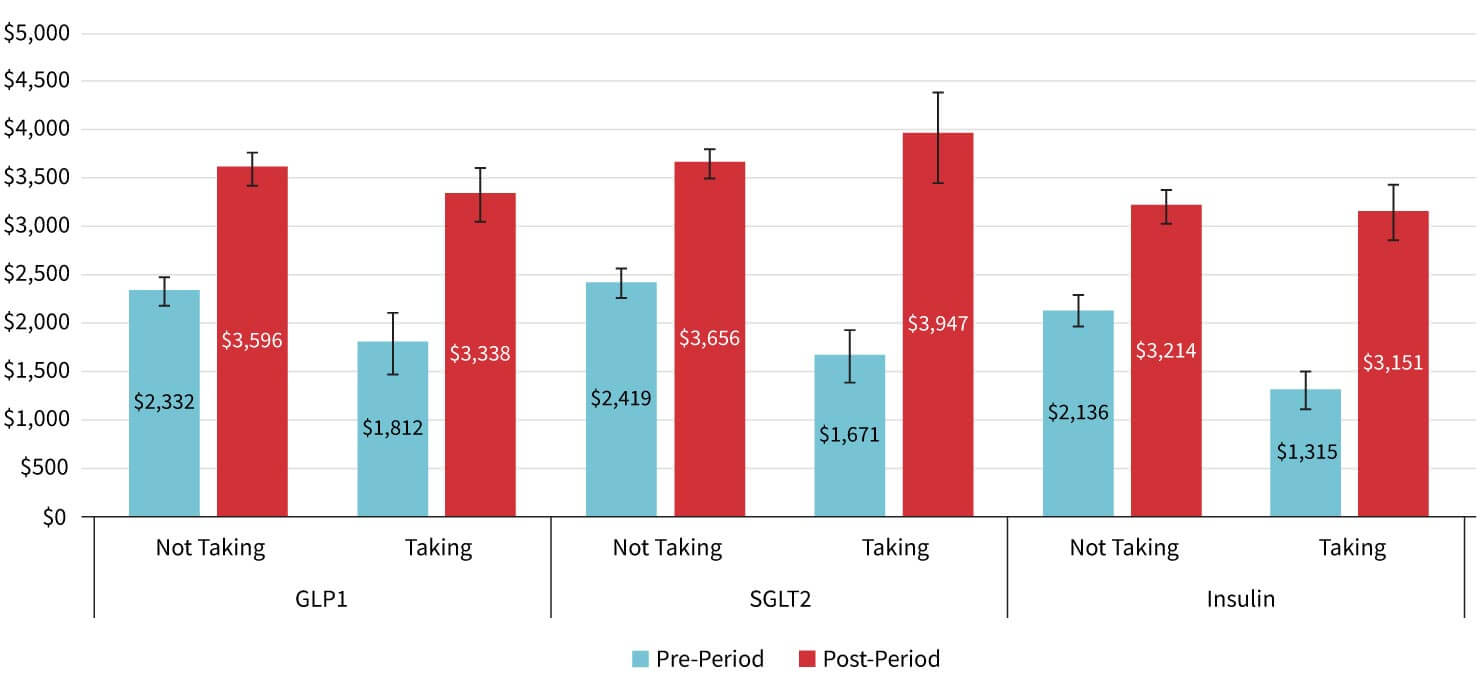

Overall, the analysis showed that TCOC was higher for newer drugs than for more established ones over one year. For example, TCOC for patients taking GLP-1s after a health event and for those taking SGLT2s were significantly higher ($3,338 and $3,947, respectively) than for patients taking insulin ($3,151) after a health event, as shown in Figure 2.

Figure 2: 2021 Index Period Allowed Cost per Member per Month (PMPM) Comparisons

See the “Reimagining Pharmacy Financing” report for further detailed analyses and lessons learned about the three methodologies used to compare TCOC for high-cholesterol and diabetes medications.

Additionally, it is important to consider not only the advantages and disadvantages of the applied methodologies but also to understand that measuring TCOC does not reflect other value elements, such as productivity and quality of life. Future studies should consider evaluating TCOC impact over periods longer than one year to better capture the full extent of the value to patients. Additional insight also could be gained by incorporating differences in adherence levels when comparing the TCOC impact of these drugs.

Value Stack and Reimbursement

A key question in developing a value-based reimbursement system is how to measure the net value. Value-based reimbursement methodologies for physicians and hospitals rely heavily on scorecards, which may include both financial elements, such as net costs, and nonfinancial, such as provider accreditation. For pharmacy financing, an alternative is a value stack. Each element of value can be monetized through proxy measures. For example, pain relief can be monetized by the reduction in costs for pain medication. With the value stack method, a drug’s incremental value elements are measured or estimated in monetary terms that can be compared to incremental costs (i.e., return on investment [ROI] ratio).

The value-based reimbursement system can be implemented today, but enhancements to the current infrastructure would make this new system more scalable. For example, in addition to measuring efficacy and safety, clinical trials can capture data that is useful for projecting real-world claim costs, such as TCOC and other measures that will help design scalable and meaningful value-based contracts between stakeholders. This could include data that enable projections for stakeholder impact (value stack) and ROI.

Additionally, the value stack enables the various stakeholders to focus on the specific types of value that matter most to them. It also can help calculate a separate ROI for each stakeholder. The value stack provides a common endpoint (ROI) for many drugs that are more comprehensible to the public. While the ROI may be broadly scalable, measurement methodologies for each drug may still require specialization.

Finally, underlying projections may be incorrect or there may be random variations in the population taking the drug. Therefore, total risk analysis is necessary to provide a framework for answering questions such as, “What is the probability we will lose more than $1 million if we go with this decision?”

There is consensus that ensuring widespread use of a new model for pharmacy financing could require the collaborative efforts of multidisciplinary experts—from policy analysts and health economists to health actuaries, consumer advocates and more. To learn more about value-based reimbursement methodology and the discussion on transforming the pharmacy ecosystem, please read the SOA Research Institute report, “Reimagining Pharmacy Financing.”

References:

- 1. Shaw, Maggie L. “High-Cost Gene Therapies Present Reimbursement, Access Challenges.” American Journal of Managed Care, November 8, 2023. ↩

- 2. Neumann, PJ, LP Garrison, and RJ Willke. 2022. The History and Future of the “ISPOR Value Flower”: Addressing Limitations of Conventional Cost-effectiveness Analysis. Value Health 25, no. 4:558-565. ↩

Copyright © 2024 by the Society of Actuaries, Chicago, Illinois.